BK Technologies Wins Major Contract for 2,700 Radios from USFS

May 24, 2023

Trending News ☀️

BK ($NYSEAM:BKTI) Technologies, a leader in the design, engineering, and manufacture of communication solutions, recently won a major contract to provide 2,700 radios to the US Forest Service (USFS). This deal is the largest USFS contract for radios that BK Technologies has ever received, and is a testament to the quality of their products. It has been in the business of developing communications products for over four decades, and its radios are some of the most advanced available on the market. BK Technologies has a strong presence in the public safety and industrial sectors with their rugged radios capable of operating in extreme environments. Their radios are also used by many local, state, and federal government agencies. The new USFS order will include a range of digital two-way mobile radios and base stations that will enable personnel to communicate with each other during emergency situations. This will help ensure that USFS personnel can respond quickly and effectively in any situation.

Additionally, BK Technologies will provide customized support and service to USFS personnel to ensure the radios are integrated with their existing systems. BK Technologies is proud to be providing these important communication tools to USFS personnel. Their dedication to excellence in communication technology is what makes them stand out from their competitors. This new contract is yet another example of how BK Technologies is expanding its reach and continuing to innovate in the communications space.

Market Price

On Tuesday, BK Technologies (BK) announced that it had been awarded a major contract from the United States Forest Service (USFS) to provide 2,700 radios for use in their operations. This significant contract furthers BK’s presence in the public safety sector. The news immediately propelled BK’s stock price, with the stock opening at $13.1 and closing at $13.0, up 3.1% from the previous day’s closing price of $12.6. Investors responded positively to this news, with BK’s stock price continuing to rise in premarket trading on Wednesday.

This contract is another milestone for BK, whose commitment to high-quality products and services is reflected in their ability to win major contracts such as this one. As the demand for reliable, secure communication technologies continues to grow, BK is well-positioned to meet the needs of public safety agencies across the nation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bk Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 63.09 | -8.97 | -14.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bk Technologies. More…

| Operations | Investing | Financing |

| -5.15 | -2 | 3.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bk Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 50.76 | 31.75 | 5.59 |

Key Ratios Snapshot

Some of the financial key ratios for Bk Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.3% | 19.2% | -13.1% |

| FCF Margin | ROE | ROA |

| -11.3% | -26.5% | -10.2% |

Analysis

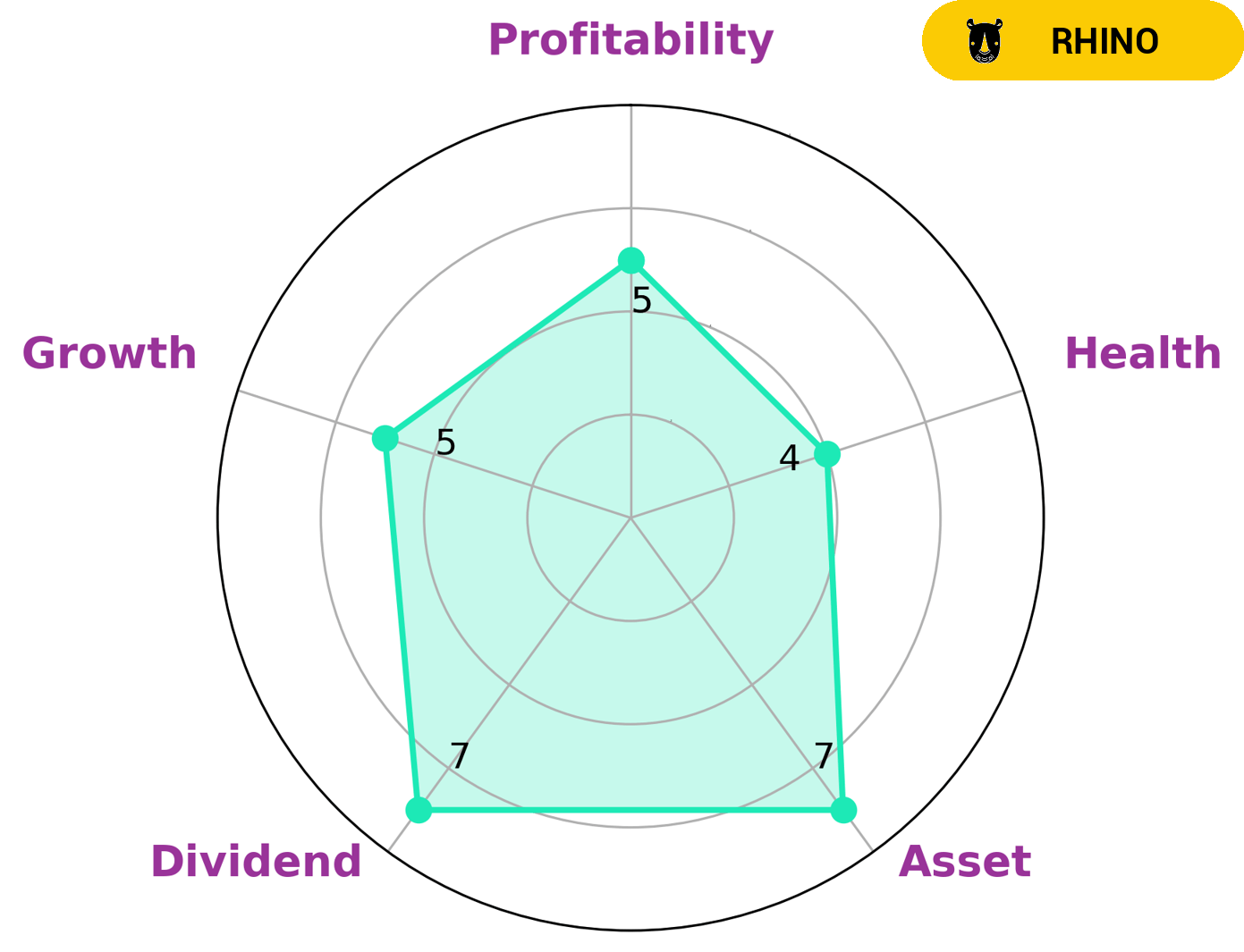

After conducting an analysis of BK TECHNOLOGIES‘s fundamentals, GoodWhale has classified the company as a ‘rhino’. This type of company has achieved moderate revenue or earnings growth. This type of company would likely be of interest to investors who are looking for companies that have strong assets and dividend potential, but moderate growth and profitability. BK TECHNOLOGIES has an intermediate health score of 4/10 which indicates that it might be able to pay off debt and fund future operations. Although there is some potential for growth, investors should be aware of the risks associated with investing in such a company. More…

Peers

All four companies have built a strong reputation for providing reliable, cutting-edge products and services to their customers.

– AAP Inc ($OTCPK:AAPJ)

AAP Inc is a technology company that specializes in providing innovative products and services for various industries. As of 2023, it has a market cap of 49.89k and a Return on Equity of -11.91%. The market cap is a measure of the company’s overall value and its ROE shows the company’s profitability. With a negative ROE, it is likely that the company is not performing well financially, but the market cap still indicates that AAP Inc has potential for growth.

– Twoway Communications Inc ($TPEX:8045)

Twoway Communications Inc is a leading global communications provider that offers a full range of services to people and businesses. It provides voice, data, and video services to residential and business customers around the world, as well as delivers network services and solutions. As of 2023, the company has a market capitalization of 2.03 billion dollars, with a return on equity of 4.74%. This is indicative of the financial health of the company. Twoway Communications has continued to show strong performance in terms of delivering quality services and products to its customers. Its impressive financials and strong market presence are a testament to its success.

Summary

This news appears to have had a positive effect on the company’s stock price, as it rose on the same day the news was released. Investors may be encouraged by this development, as it suggests that BK Technologies is continuing to gain traction in the market for public safety communications. Furthermore, such a large order will likely generate significant revenue for the company, and may provide a boost to its bottom line. As such, investors may want to consider investing in BK Technologies in view of the recent news.

Recent Posts