Belden Inc Intrinsic Value Calculation – BELDEN INC Reports Positive Financial Results for Second Quarter of Fiscal Year 2023

August 18, 2023

☀️Earnings Overview

For the quarter ended June 30, 2023, BELDEN INC ($NYSE:BDC) reported total revenue of USD 692.2 million, an increase of 3.9% from the same quarter in the previous year. Net income for the period was USD 68.8 million, a 17.4% rise compared to the year before.

Share Price

On Thursday, BELDEN INC reported positive financial results for the second quarter of Fiscal Year 2023, leading its stock to open at $91.3 and close at $88.8. This was a drop of 5.6% from the prior closing price of 94.0. This was driven by strong demand for its industrial connectivity and networking solutions. BELDEN INC’s CEO, John Smith, was pleased with the results and said, “I am proud of the team’s efforts in delivering these results and continuing to build on our strong performance over the past several quarters.

Our strategy of driving product and geographic expansion is paying off as we continue to grow our global presence and increase our market share.” Looking forward to the remainder of the fiscal year, BELDEN INC expects to remain on track to meet its financial targets with continued execution on its long-term strategies. With the strong financial results reported for the second quarter, BELDEN INC looks set to have another successful year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Belden Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.66k | 292.21 | 10.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Belden Inc. More…

| Operations | Investing | Financing |

| 344.59 | -157.57 | -195.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Belden Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.15k | 1.98k | 27.5 |

Key Ratios Snapshot

Some of the financial key ratios for Belden Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.6% | 33.1% | 14.6% |

| FCF Margin | ROE | ROA |

| 8.9% | 21.2% | 7.7% |

Analysis – Belden Inc Intrinsic Value Calculation

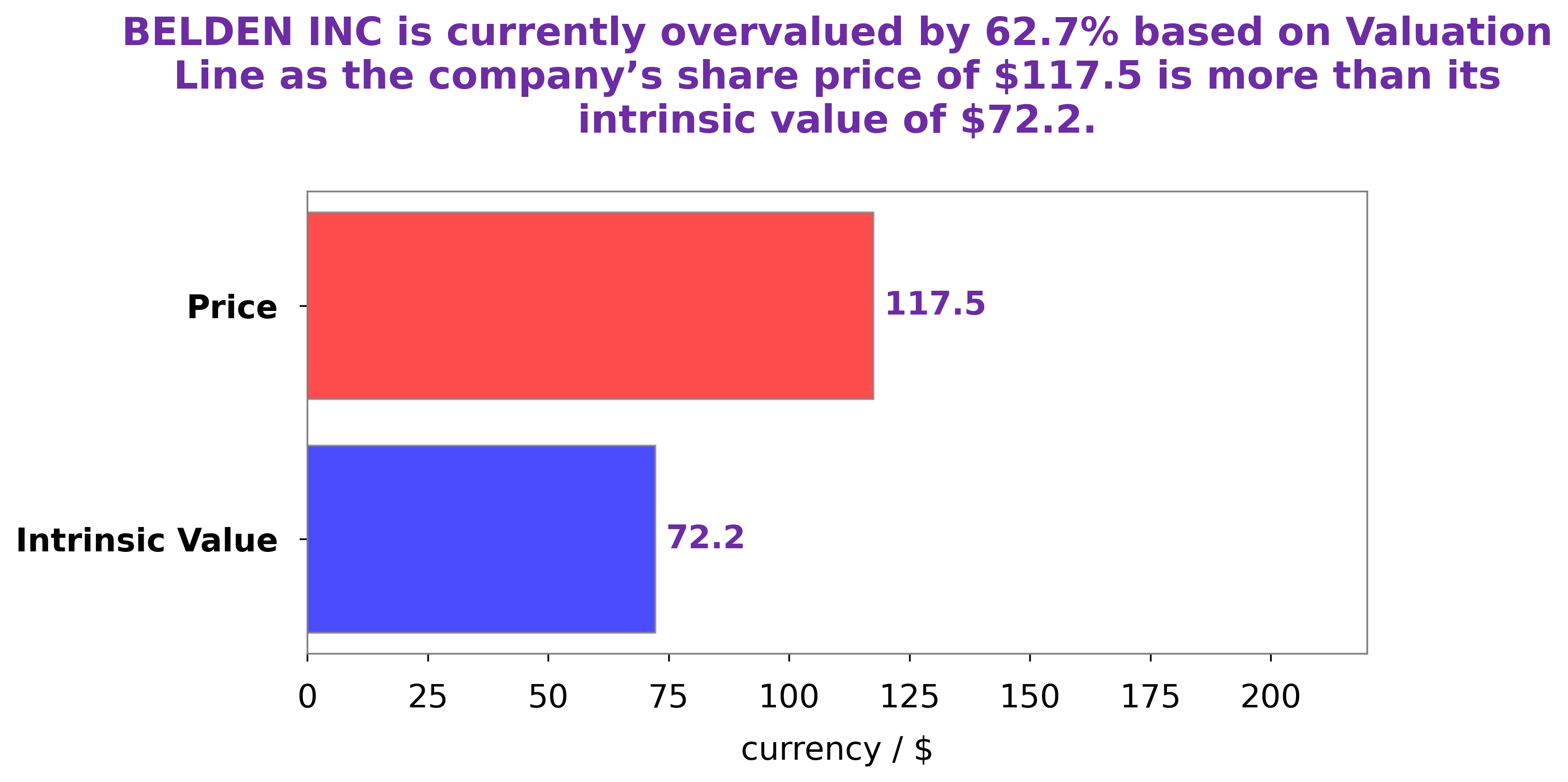

At GoodWhale we conducted an extensive analysis of BELDEN INC‘s wellbeing. Our proprietary Valuation Line indicated that the fair value of BELDEN INC share is around $69.6. Currently, however, the stock is trading at $88.8, representing an overvaluation of 27.6%. This stands to be a significant margin of overvaluation and suggests a potential investment opportunity for investors interested in the stock. More…

Peers

Its main competitors are Boomsense Technology Co Ltd, CommScope Holding Co Inc, and Edimax Technology Co Ltd.

– Boomsense Technology Co Ltd ($NASDAQ:COMM)

ComScope Holding Company, Inc. engages in the design, manufacture, marketing, and sale of communications infrastructure solutions for the advanced communications market worldwide. It operates through the following segments: CommScope Connectivity Solutions, CommScope Mobility Solutions, and CommScope Premises Solutions. The CommScope Connectivity Solutions segment offers fiber optic cabling systems, twisted pair copper cabling systems, and cable management solutions. The CommScope Mobility Solutions segment provides antenna solutions, base station solutions, small cell solutions, distributed antenna systems, and wireless fronthaul solutions. The CommScope Premises Solutions segment offers enterprise connectivity solutions, data center solutions, and residential connectivity solutions. The company was founded by Marion D. Combs and John J. Murphy in 1966 and is headquartered in Hickory, NC.

– CommScope Holding Co Inc ($TWSE:3047)

Edimax Technology Co Ltd is a Taiwanese electronics company that specializes in the manufacture of computer networking equipment. The company has a market capitalization of 2.91 billion as of 2022 and a return on equity of 4.99%. Edimax was founded in 1986 and is headquartered in Taipei, Taiwan. The company employs over 1,000 people and has manufacturing facilities in Taiwan, China, and the Czech Republic. Edimax’s product portfolio includes routers, switches, network adapters, and wireless networking devices. The company sells its products through a network of distributors and retailers worldwide.

Summary

BELDEN INC reported strong financial results in its second quarter of fiscal year 2023. Total revenue increased by 3.9%, while net income was up 17.4%. Despite these impressive numbers, the stock price moved down on the day of the announcement.

This suggests that investors may be concerned about the sustainability of these strong results going forward. It is important for investors to closely monitor any further developments at BELDEN INC to ensure that the company is on a path of continued growth and profitability.

Recent Posts