Bank of Chengdu Announces 28.2% Increase in 2023 Profit, Shares Up 8%

March 29, 2023

Trending News ☀️

The Bank of Chengdu ($SZSE:300101) Co., Ltd. (601838) has reported a 28.2% increase in profits for the year 2022, leading to an 8% surge in its share prices. This is the biggest rise in profits the Bank of Chengdu has seen since 2023 and is a sign of ongoing financial stability and strength. The company’s increased profits are due to their focus on top-notch customer service and innovative products, which have kept them ahead of the competition.

In addition, their strong lending practices and low risk strategy have contributed to their profitability. The Bank of Chengdu’s announcement of a 28.2% increase in profits has come as a surprise to many investors, who had expected the company’s profits to remain stagnant. The 8% surge in shares is also unexpected, given the current economic environment. This clearly shows that the Bank of Chengdu is a profitable and reliable business which is well-placed to take advantage of any economic opportunities that arise in the future. The Bank of Chengdu’s success is likely to have a positive impact on other financial institutions in China, as well as on the entire Chinese economy. It is also likely to boost investor confidence in the Chinese banking sector, which could lead to new investments and further growth. This can only be good news for the Bank of Chengdu and its stakeholders.

Share Price

On Wednesday, the Bank of Chengdu announced that its profit for 2023 had increased by 28.2%, causing a surge in its stock price of 8%. This news was met with positive media coverage as the increased profits promise a bright future for the company. Despite this, the CHENGDU CORP stock opened at CNY30.5 and closed at CNY29.2, indicating a 2.3% drop from the previous closing price of 29.9. It is unclear whether the market’s reaction to the news was due to a lack of confidence in the Chengdu’s profitability, or if it was simply a reflection of the current market trends. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chengdu Corp. More…

| Total Revenues | Net Income | Net Margin |

| 998.03 | 240.06 | 31.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chengdu Corp. More…

| Operations | Investing | Financing |

| 201.32 | -191.99 | 41.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chengdu Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.52k | 912.68 | 2.43 |

Key Ratios Snapshot

Some of the financial key ratios for Chengdu Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.4% | 160.2% | 27.4% |

| FCF Margin | ROE | ROA |

| 1.8% | 12.3% | 6.8% |

Analysis

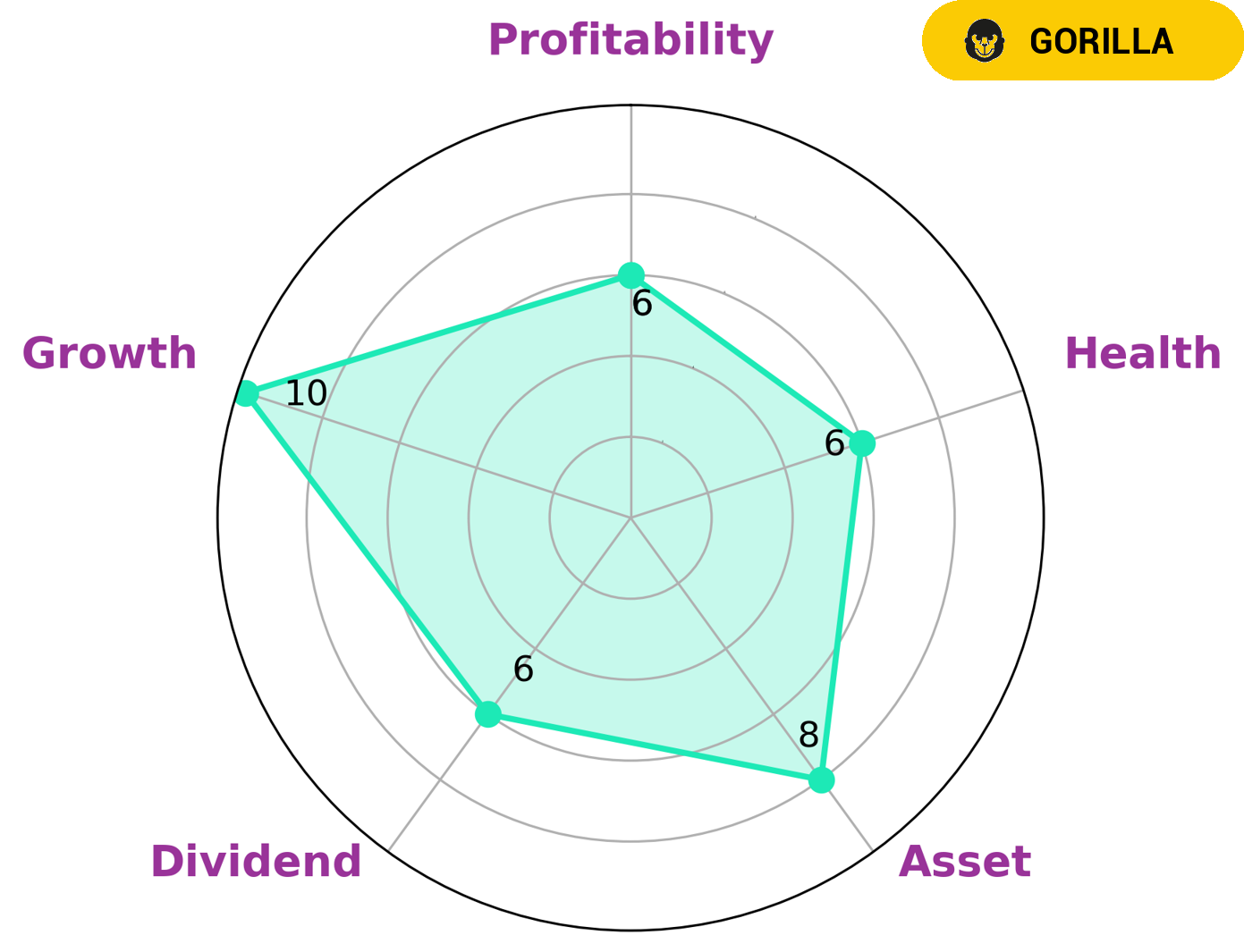

At GoodWhale, we conducted an analysis of CHENGDU CORP‘s wellbeing. According to our Star Chart, CHENGDU CORP’s health score was 6/10, indicating that it is in an intermediate state. Our analysis showed that CHENGDU CORP might be able to pay off debt and fund future operations through its cashflows and debt. We classified CHENGDU CORP as a “gorilla” company, which we believe has achieved stable and high revenue or earning growth due to its strong competitive advantage. As a result, investors looking for long-term, consistent returns may be interested in this type of company. Our analysis also revealed that CHENGDU CORP is strong in asset, growth, and medium in dividend and profitability, making it an attractive option for investors. Interested parties should do their own due diligence to ensure that CHENGDU CORP is the right fit for their portfolio. More…

Peers

It faces stiff competition from Chengdu M&S Electronics Technology Co Ltd, Max Echo Technology Corp, and Tai-Tech Advanced Electronics Co Ltd, in a highly competitive and ever-evolving technological environment.

– Chengdu M&S Electronics Technology Co Ltd ($SHSE:688311)

Chengdu M&S Electronics Technology Co Ltd is a leading electronics technology firm based in Chengdu, China. The company specializes in making computer hardware, communication equipment, and consumer electronics. As of 2023, the company has a market cap of 8.12B, making it one of the largest companies in the industry. Additionally, the company’s Return on Equity (ROE) is 3.65%, which shows that the firm is able to generate a large return on their investments. This is a testament to the success of their products and services in the market.

– Max Echo Technology Corp ($TPEX:5228)

Echo Technology Corp is a technology company that specializes in providing innovative solutions to enable customers to improve their operations. The company has a market cap of 869.58M as of 2023, placing it among the most valuable companies in the world. Its Return on Equity (ROE) of 6.51% indicates that it is well-managed and profitable. The company’s products and services are highly sought after in various industries due to its innovation and excellence in customer service.

– Tai-Tech Advanced Electronics Co Ltd ($TPEX:3357)

Tai-Tech Advanced Electronics Co Ltd is an electronics company that specializes in the research, development and production of advanced electronic technologies for a range of industries. Its market cap of 11.58 billion indicates a strong position in the electronics market and its Return on Equity of 12.05% reflects the company’s efficient use of resources and its ability to generate profits from its operations. Tai-Tech’s commitment to delivering quality products and services has enabled the company to maintain its competitive edge and remain a leader in the industry.

Summary

Chengdu Corp has reported a 28.2% increase in profit for 2023, which has sent shares up 8%. This has been positively received by investors, with most media coverage being positive. Looking forward, Chengdu Corp has the potential to generate very good returns for investors due to its strong financial performance and successful track record. With a highly diversified portfolio, the company has a wide range of products and services that can be used to increase its profitability.

Furthermore, its robust cash flow and high dividend payments make it an attractive target for long-term investments. All in all, Chengdu Corp appears to be a solid investment prospects for investors looking to capitalize on China’s economic growth.

Recent Posts