Teacher Retirement System of Texas Invests $912,000 in Ramaco Resources in 2023

February 7, 2023

Trending News 🌥️

The company has operations across the United States and is known for its high-quality coal products. The company’s focus is on producing metallurgical coal for the steel industry and other metals such as iron ore, manganese, and copper. Ramaco ($NASDAQ:METC) also has an enterprise-level software system that helps manage the mining operations and increase efficiency. The investment from TRS will help Ramaco expand its operations and increase its production capacity. This will allow the company to meet the growing demand for metallurgical coal in the steel industry.

It will also help Ramaco to produce more coal at a faster rate, allowing them to become more competitive in the global market. The company has a strong track record of producing high-quality coal and other metals. This will allow them to meet the growing demand for metallurgical coal and other metals, while also increasing their competitiveness in the global market.

Market Price

This investment comes after Ramaco Resources stock opened at $10.4 and closed at $10.1, down by 2.9% from the previous closing price of 10.4. This investment is a vote of confidence for the company, despite the current market conditions. Ramaco Resources is an energy and metallurgical coal producer based in Knoxville, Tennessee. The company has operations in the United States, Australia, and South Africa. They specialize in the production and sale of metallurgical and thermal coal, as well as developing and securing resources for future operations.

The company has a strong balance sheet and cash flow, allowing them to be well-positioned to capitalize on future opportunities. Their experienced management team and strategic partnerships have been integral in Ramaco’s success and growth in the past few years. The investment will provide Ramaco with additional capital to pursue new projects, as well as help them secure resources for the future. With a strong portfolio of projects, Ramaco is well-positioned to capitalize on future opportunities and become an industry leader in the energy and metallurgical coal industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ramaco Resources. More…

| Total Revenues | Net Income | Net Margin |

| 517.97 | 120.3 | 23.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ramaco Resources. More…

| Operations | Investing | Financing |

| 174.38 | -153.81 | -20.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ramaco Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 562.13 | 263.46 | 6.35 |

Key Ratios Snapshot

Some of the financial key ratios for Ramaco Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.3% | 73.5% | 30.3% |

| FCF Margin | ROE | ROA |

| 13.7% | 33.9% | 17.4% |

Analysis

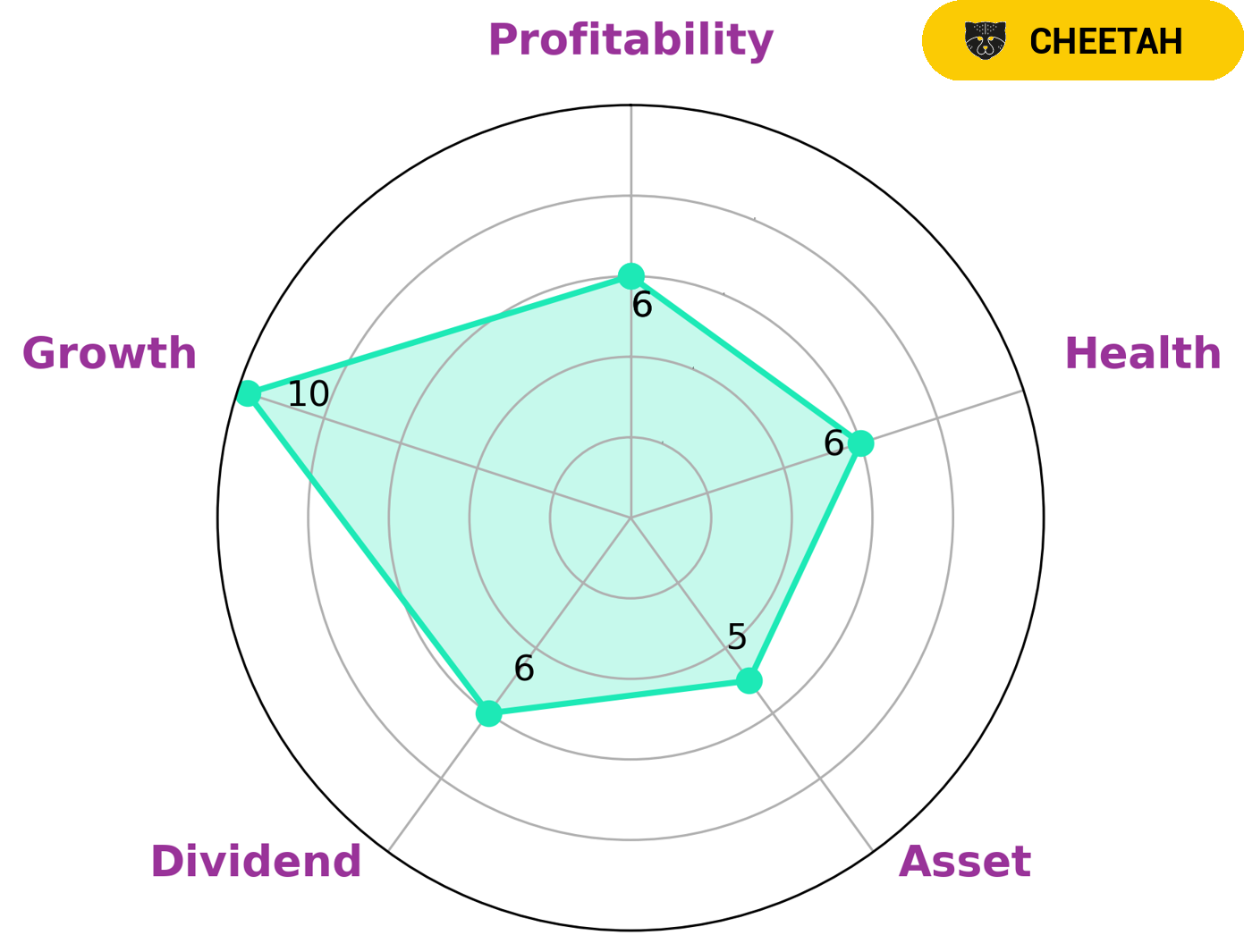

RAMACO RESOURCES has been assessed by GoodWhale and given strong marks in terms of growth, but medium marks when it comes to asset, dividend, and profitability. Their intermediate health score of 6/10 means that they are likely to sustain future operations in times of crisis. RAMACO RESOURCES is classified as a ‘cheetah’, meaning they have achieved a high rate of revenue or earnings growth but at the cost of lower profitability. Investors who are looking for potential opportunities with high growth rates and are willing to take on the risk of lower profitability may be interested in RAMACO RESOURCES. They should also consider the company’s fundamentals, such as its cashflows and debt, before investing. Investors with a long-term outlook who are comfortable with risks may find RAMACO RESOURCES an interesting opportunity. The stock market can be volatile, and investors should understand the risks associated with investing in RAMACO RESOURCES before making a decision. The company’s balance sheet should be carefully examined to ensure that it can sustain future operations in times of crisis. Additionally, investors should take into consideration the company’s prospects for the future and whether they align with their investment goals. RAMACO RESOURCES may offer an interesting opportunity for those investors who are willing to take on the associated risks. By understanding the potential rewards and risks of investing in RAMACO RESOURCES, investors can make an educated decision and potentially benefit from the company’s growth potential. More…

Peers

The company’s competitors include Alpha Metallurgical Resources Inc, Corsa Coal Corp, and Bowen Coking Coal Ltd.

– Alpha Metallurgical Resources Inc ($NYSE:AMR)

Metallurgical Resources Inc is a Canadian company that operates in the mining industry. The company has a market capitalization of $3.09 billion as of 2022 and a return on equity of 82.18%. The company’s primary business is the development and extraction of metals and minerals. The company’s products include copper, gold, silver, and zinc. The company has operations in Canada, the United States, Mexico, and Peru.

– Corsa Coal Corp ($TSXV:CSO)

Corsa Coal Corp is a coal mining company with a market cap of 25.82M as of 2022. The company has a Return on Equity of 1.34%. Corsa Coal Corp produces and exports metallurgical and thermal coal. The company operates mines in Pennsylvania and West Virginia. Corsa Coal Corp was founded in 2004 and is headquartered in Canonsburg, Pennsylvania.

– Bowen Coking Coal Ltd ($ASX:BCB)

Bowen Coking Coal Ltd is an Australian company that produces and exports coking coal. The company has a market capitalization of $522.31 million as of 2022 and a return on equity of -17.6%. Bowen Coking Coal is one of the largest coking coal producers in Australia and exports its coal to customers in Asia, Europe, and North America.

Summary

This investment is a sign that TRS has confidence in Ramaco Resources and their potential for growth. The company has an extensive portfolio of metallurgical and thermal coal assets, as well as an exploration portfolio. It has a long-term goal to become a leading supplier of metallurgical coal to the global steelmaking industry. With the investment from TRS, Ramaco Resources is in a strong position to achieve its goals and drive growth in the years to come.

Recent Posts