SUNCOKE ENERGY Reports Positive Financial Results for FY2022 Q4 on February 2 2023

February 17, 2023

Earnings report

On February 2 2023, SUNCOKE ENERGY ($NYSE:SXC) reported positive financial results for their fiscal year 2022 fourth quarter ending on December 31 2022. Total revenue for the quarter came to USD 11.8 million, a 7.1% decrease compared to the same period the previous year. These results show that SUNCOKE ENERGY is taking strategic steps to maximize their profits and ensure their shareholders receive an attractive return. Looking ahead, SUNCOKE ENERGY is well-positioned to remain profitable and deliver strong returns for their investors in the upcoming fiscal year.

Price History

On this day, the company’s shares opened at $9.0 and closed at a slightly higher rate of $9.1, indicating a 0.3% appreciation from the previous closing price. This increase in stock prices reflects the confidence that investors have in the company and its potential for further growth. Despite uncertainties in the global economy due to the ongoing pandemic, SUNCOKE ENERGY is overcoming obstacles to deliver strong returns for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Suncoke Energy. More…

| Total Revenues | Net Income | Net Margin |

| 1.97k | 100.7 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Suncoke Energy. More…

| Operations | Investing | Financing |

| 208.9 | -70.2 | -112.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Suncoke Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.65k | 1.03k | 7.02 |

Key Ratios Snapshot

Some of the financial key ratios for Suncoke Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.2% | 14.2% | 7.8% |

| FCF Margin | ROE | ROA |

| 6.8% | 16.5% | 5.8% |

Analysis

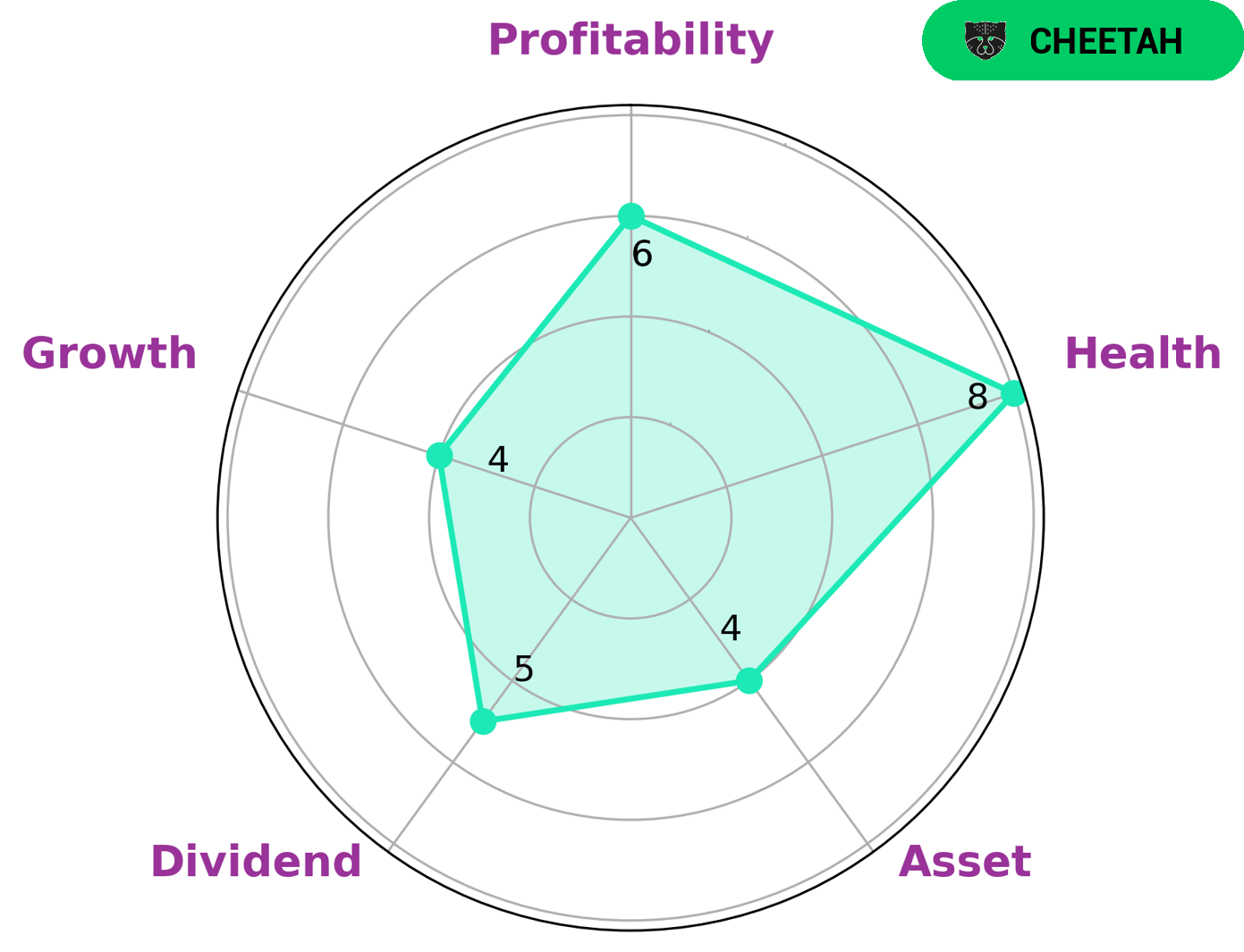

At GoodWhale, we conducted an analysis of SUNCOKE ENERGY‘s wellbeing. The Star Chart classified the company as ‘cheetah’, a type of company that achieved strong revenue or earnings growth, but is considered less stable due to lower profitability. This type of company may be attractive to investors who are more focused on growth rather than stability. Despite the lower stability, SUNCOKE ENERGY scored a solid 8/10 for health in terms of its cashflows and debt, which suggested that the company will be able to safely ride out any crisis without the risk of bankruptcy. Further, SUNCOKE ENERGY is strong in asset health, medium in dividend health, growth, and profitability. This suggests that SUNCOKE ENERGY is well positioned for a higher stability and growth. More…

Peers

The company has a long history dating back to 1828 and has been a major player in the coke industry for over a century. The company’s main competitors are Alpha Metallurgical Resources Inc, Corsa Coal Corp, and Jastrzebska Spolka Weglowa SA.

– Alpha Metallurgical Resources Inc ($NYSE:AMR)

Metallurgical Resources Inc is a Canadian company that operates mines and metals processing facilities. The company has a market capitalization of 2.88 billion as of 2022 and a return on equity of 82.18%. Metallurgical Resources is engaged in the business of extraction, beneficiation, and processing of metals and minerals. The company’s primary products are copper, zinc, lead, and gold.

– Corsa Coal Corp ($TSXV:CSO)

Corsa Coal Corp is a coal mining company with a market cap of 27.88M as of 2022. The company has a Return on Equity of 1.34%. Corsa Coal Corp operates in the United States and Canada. The company produces and supplies metallurgical coal, coke, and anthracite.

– Jastrzebska Spolka Weglowa SA ($LTS:0Q45)

Jastrzebska Spolka Weglowa SA is a coal mining company with operations in Poland, the Czech Republic, and Germany. The company has a market capitalization of 4.43 billion as of 2022 and a return on equity of 39.6%. The company produces a variety of coal products including coking coal, thermal coal, and metallurgical coal. Jastrzebska Spolka Weglowa SA is one of the largest coal producers in Europe and is a major supplier of coal to the steel industry.

Summary

This marks an impressive year-over-year performance for SunCoke Energy and is indicative of the company’s profitability and strength.

Recent Posts