Suncoke Energy dividend yield – SunCoke Energy Declares 0.08 Cash Dividend

February 6, 2023

Dividends Yield

Suncoke Energy dividend yield – On February 3 2023, SunCoke Energy Inc. declared a 0.08 cash dividend for its investors. SUNCOKE ENERGY ($NYSE:SXC) has been issuing an annual dividend of 0.28 USD per share for the past three years, giving investors a dividend yield of 3.8% each year. This is a very attractive yield in comparison to the average dividend yield of 3.8%, making SUNCOKE ENERGY an attractive investment for those interested in stocks with a dividend. It also produces coal and other related products. SUNCOKE ENERGY’s customers include some of the largest steel and iron producers in the US and Canada. The ex-dividend date for this dividend is February 15th 2023.

This means that any investors who purchase the stock before this date will qualify for the dividend, and those who purchase after will not receive it. So if you are interested in SUNCOKE ENERGY for the dividend, make sure to purchase the stock before this date. In conclusion, SUNCOKE ENERGY is an attractive stock option for investors looking for a dividend yield of 3.8%. The company is well-established and has many large customers in the steel and iron industries. The ex-dividend date for the 0.08 cash dividend is February 15th 2023, so make sure to purchase the stock before then if you want to qualify for the dividend.

Stock Price

On Friday, SunCoke Energy’s stock opened at $9.2 and closed at $9.2, up by 1.9% from its prior closing price of 9.1. This dividend represents the company’s commitment to creating value for its shareholders and is a strong sign of their confidence in the future of the company. SunCoke Energy Inc. is one of the leading independent producers of metallurgical coke in the world, with operations in the United States, India, and Brazil. The company produces metallurgical coke for the global steel industry, which is a key component in the production of steel. The company also produces and sells coal and coke by-products, including coal briquettes, coal tar and sulfuric acid.

The company has been providing strong returns to its shareholders over the years through dividends and share repurchases. This declaration of a cash dividend is another indication of SunCoke Energy’s commitment to delivering long-term value to its shareholders. The company is also committed to increasing shareholder value through strategic initiatives, such as mergers and acquisitions, expanding operations, and investing in new technologies. Shareholders should expect more great things from SunCoke Energy in the future as the company continues to focus on its long-term growth strategy. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Suncoke Energy. More…

| Total Revenues | Net Income | Net Margin |

| 1.97k | 100.7 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Suncoke Energy. More…

| Operations | Investing | Financing |

| 208.9 | -70.2 | -112.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Suncoke Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.65k | 1.03k | 7.02 |

Key Ratios Snapshot

Some of the financial key ratios for Suncoke Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.2% | 14.2% | 7.8% |

| FCF Margin | ROE | ROA |

| 6.8% | 16.5% | 5.8% |

Analysis

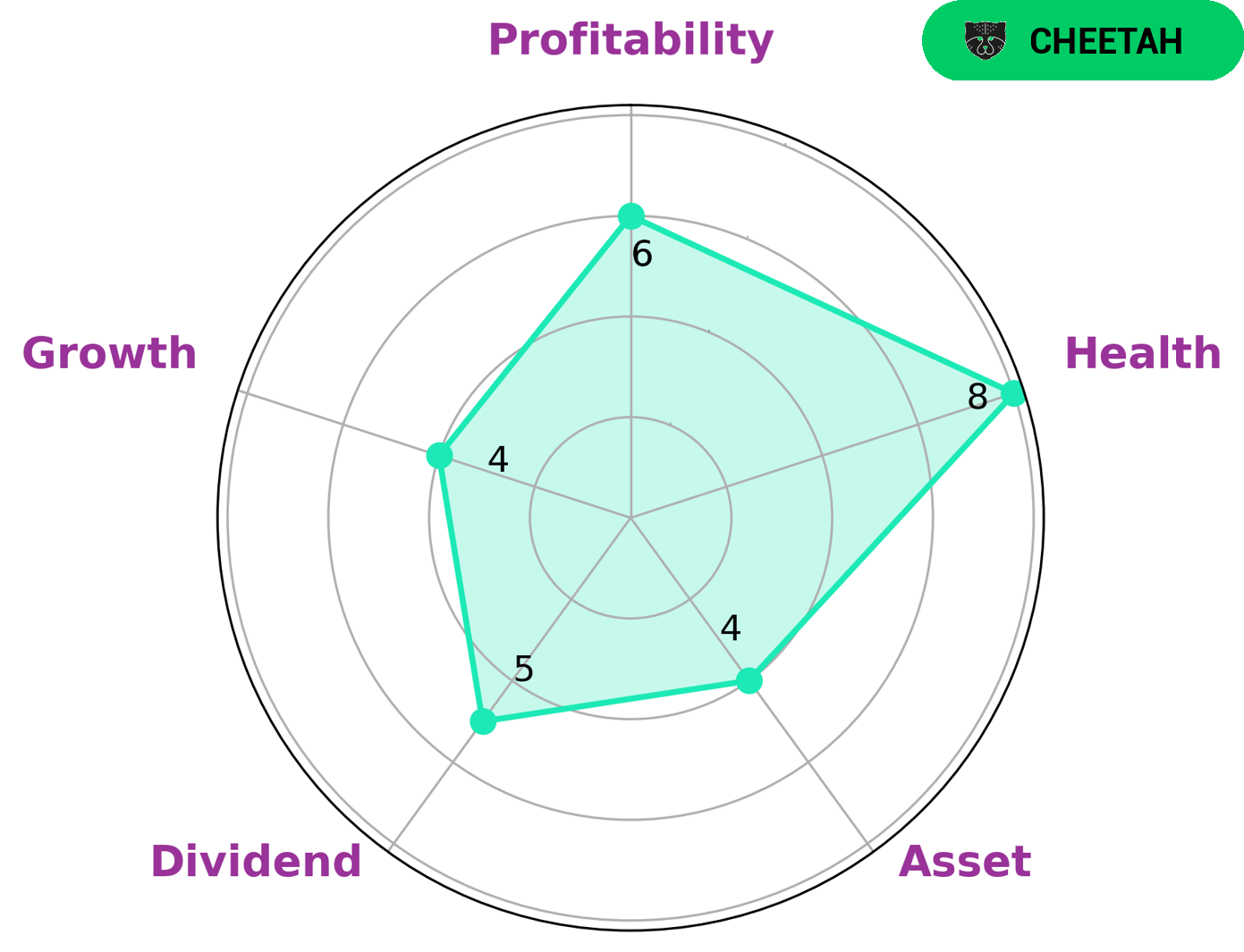

GoodWhale has conducted an analysis of SUNCOKE ENERGY‘s wellbeing, with the results being presented in its Star Chart. The health score of SUNCOKE ENERGY is 8/10, which reflects its strong cashflows and debt and its ability to ride out any crisis without the risk of bankruptcy. According to GoodWhale, SUNCOKE ENERGY is classified as a “cheetah” type of company, that is it is a company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Given its strong cashflows and debt, SUNCOKE ENERGY is likely to be attractive to investors who are looking for stable investments as well as those who are looking for growth. However, it should be noted that SUNCOKE ENERGY is strong in cashflows and debt, and medium in asset, dividend, growth, and profitability. Consequently, investors should consider all aspects of SUNCOKE ENERGY’s wellbeing before making an investment decision. Overall, SUNCOKE ENERGY has a high health score and is capable of riding out any crisis without the risk of bankruptcy. Its classification as a “cheetah” type of company indicates that it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Investors should take all aspects of SUNCOKE ENERGY’s wellbeing into consideration before investing. More…

Peers

The company has a long history dating back to 1828 and has been a major player in the coke industry for over a century. The company’s main competitors are Alpha Metallurgical Resources Inc, Corsa Coal Corp, and Jastrzebska Spolka Weglowa SA.

– Alpha Metallurgical Resources Inc ($NYSE:AMR)

Metallurgical Resources Inc is a Canadian company that operates mines and metals processing facilities. The company has a market capitalization of 2.88 billion as of 2022 and a return on equity of 82.18%. Metallurgical Resources is engaged in the business of extraction, beneficiation, and processing of metals and minerals. The company’s primary products are copper, zinc, lead, and gold.

– Corsa Coal Corp ($TSXV:CSO)

Corsa Coal Corp is a coal mining company with a market cap of 27.88M as of 2022. The company has a Return on Equity of 1.34%. Corsa Coal Corp operates in the United States and Canada. The company produces and supplies metallurgical coal, coke, and anthracite.

– Jastrzebska Spolka Weglowa SA ($LTS:0Q45)

Jastrzebska Spolka Weglowa SA is a coal mining company with operations in Poland, the Czech Republic, and Germany. The company has a market capitalization of 4.43 billion as of 2022 and a return on equity of 39.6%. The company produces a variety of coal products including coking coal, thermal coal, and metallurgical coal. Jastrzebska Spolka Weglowa SA is one of the largest coal producers in Europe and is a major supplier of coal to the steel industry.

Summary

SUNCOKE ENERGY is an attractive stock for income-seeking investors, offering a dividend yield of 3.8%. The company has maintained a consistent dividend of 0.28 USD per share for the past three years, making it a reliable income source. The ex-dividend date is February 15th 2023, so investors need to act quickly if they want to receive the dividend. Investors may also find SUNCOKE ENERGY to be an attractive option due to its potential for capital appreciation.

The stock has seen a steady increase in price over the past year, and analysts are bullish on the company’s growth prospects going forward. With its reliable dividend and potential for price appreciation, SUNCOKE ENERGY is an appealing investment opportunity for those looking for an income-producing stock.

Recent Posts