Ramaco Resources Stock Prices Plummet 6.90% to Close at $8.90

May 23, 2023

Trending News 🌥️

Ramaco Resources ($NASDAQ:METC) Inc. is a coal mining and development company that produces metallurgical and thermal coal and provides consulting services. It operates in the United States, with headquarters in Lexington, Kentucky. The stock of Ramaco Resources Inc. went down significantly at the end of the trading day, closing at $8.90, a decrease of -6.90% from its previous day’s closing price of $9.56. This is a significant dip in the stock price, raising concern among investors as to what has caused this sudden drop. The company has not released any official statement regarding the plunge in stock prices.

As of now, the cause of this steep decline remains unknown. Ramaco Resources Inc. is one of the few publicly-traded coal companies in the United States and its stock prices have been rather volatile over the past few months. Investors are keeping a close eye on the developments in this situation and will likely be watching for any announcements from the company in the near future.

Analysis

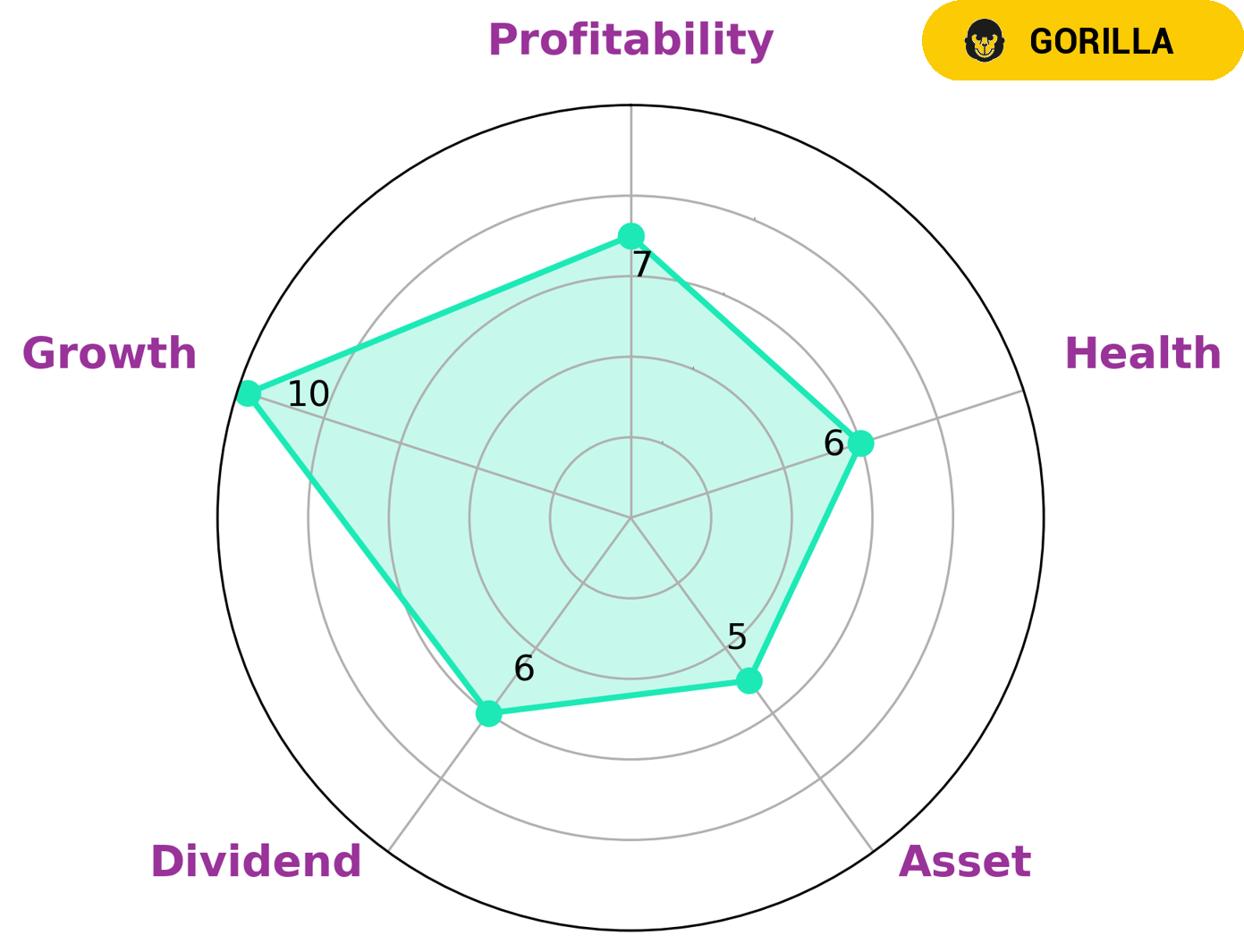

GoodWhale has performed an analysis of RAMACO RESOURCES‘s financials and based on the Star Chart, we have classified the company as a ‘gorilla’. This means that RAMACO RESOURCES has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are seeking stable and profitable returns are likely to be interested in such a company. According to our analysis, RAMACO RESOURCES is strong in growth, profitability, and medium in assets and dividend. In addition, the company has an intermediate health score of 6/10 when considering its cashflows and debt, which indicates that it might be able to safely ride out any crisis without the risk of bankruptcy. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ramaco Resources. More…

| Total Revenues | Net Income | Net Margin |

| 577.17 | 99.83 | 17.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ramaco Resources. More…

| Operations | Investing | Financing |

| 131.86 | -148.33 | -18.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ramaco Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 641.32 | 304.39 | 7.58 |

Key Ratios Snapshot

Some of the financial key ratios for Ramaco Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 39.0% | 79.4% | 23.0% |

| FCF Margin | ROE | ROA |

| 0.9% | 25.7% | 13.0% |

Peers

The company’s competitors include Alpha Metallurgical Resources Inc, Corsa Coal Corp, and Bowen Coking Coal Ltd.

– Alpha Metallurgical Resources Inc ($NYSE:AMR)

Metallurgical Resources Inc is a Canadian company that operates in the mining industry. The company has a market capitalization of $3.09 billion as of 2022 and a return on equity of 82.18%. The company’s primary business is the development and extraction of metals and minerals. The company’s products include copper, gold, silver, and zinc. The company has operations in Canada, the United States, Mexico, and Peru.

– Corsa Coal Corp ($TSXV:CSO)

Corsa Coal Corp is a coal mining company with a market cap of 25.82M as of 2022. The company has a Return on Equity of 1.34%. Corsa Coal Corp produces and exports metallurgical and thermal coal. The company operates mines in Pennsylvania and West Virginia. Corsa Coal Corp was founded in 2004 and is headquartered in Canonsburg, Pennsylvania.

– Bowen Coking Coal Ltd ($ASX:BCB)

Bowen Coking Coal Ltd is an Australian company that produces and exports coking coal. The company has a market capitalization of $522.31 million as of 2022 and a return on equity of -17.6%. Bowen Coking Coal is one of the largest coking coal producers in Australia and exports its coal to customers in Asia, Europe, and North America.

Summary

Ramaco Resources Inc. ended the day with a significant decrease in stock, closing at $8.90. This marks a 6.90% decrease from the previous closing price of $9.56. This downward decline in stock likely reflects investors’ views on the company and its current operations. Analysts suggest that this could be a sign of a weakening financial position, which could make investing in the company a risky endeavor.

Market sentiment may also be influenced by any concerns around the company’s growth prospects, cash flow, and profit margins. Investors should take a careful look at available data before deciding whether to invest in Ramaco Resources Inc., as a loss of capital is a potential outcome.

Recent Posts