Perennial Energy Intrinsic Value Calculation – Perennial Energy Holdings Limited: Fair Value Is Projected at HK$1.33 and Currently Trading at a Discount

April 27, 2023

Trending News ☀️

Perennial Energy ($SEHK:02798) Holdings Limited (PERENNIAL ENERGY) is an independent energy company primarily operating in Singapore and China, with assets located in China, Singapore, the United States, Indonesia, India, and Thailand. By examining the Intrinsic Value of PERENNIAL ENERGY, a Dividend Discount Model suggests that the fair value for the company’s shares should be HK$1.33, which is higher than their current price of HK$1.24. This suggests that there is potential value to be gained by investing in the company’s shares. Given the current market conditions and the potential of the company’s assets, it is likely that the current discount undervalues PERENNIAL ENERGY’s stock.

In order to further assess their long-term potential, investors are encouraged to assess their financials to better understand their business operations and gain insight into the stock’s long-term prospects. Analyzing PERENNIAL ENERGY’s financials may reveal whether or not the stock is worth investing in at its current price.

Dividends

Perennial Energy Holdings Limited (PERENNIAL ENERGY) is a company that is worth considering for investors who are looking for a dividend stock. PERENNIAL ENERGY has paid dividends of 0.03 CNY per share for the last three years. At the current share price, this equates to a dividend yield of 2.22%, which is expected to remain at the same level for the 2022 to 2022 period.

The fair value of PERENNIAL ENERGY’s shares is currently projected at HK$1.33 and the company is trading at a discount compared to this price. This makes it an attractive option for those looking for a steady income with the potential of some capital appreciation down the road.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Perennial Energy. More…

| Total Revenues | Net Income | Net Margin |

| 1.78k | 743.96 | 42.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Perennial Energy. More…

| Operations | Investing | Financing |

| 180.74 | -734.56 | 575.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Perennial Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.08k | 1.62k | 1.54 |

Key Ratios Snapshot

Some of the financial key ratios for Perennial Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.0% | 47.8% | 49.6% |

| FCF Margin | ROE | ROA |

| -30.9% | 24.1% | 13.5% |

Stock Price

On Friday, Perennial Energy Holdings Limited (PERENNIAL ENERGY) opened at HK$1.3 and closed at HK$1.2, a decrease of 6.5% from its last closing price of HK$1.2. This provides investors with an opportunity to purchase shares of the company at a lower price. It has been suggested that the company’s current undervaluation could be attributed to the volatile nature of the stock market, and that the company may experience a price increase in the near future. As such, investors should consider taking advantage of this opportunity. Live Quote…

Analysis – Perennial Energy Intrinsic Value Calculation

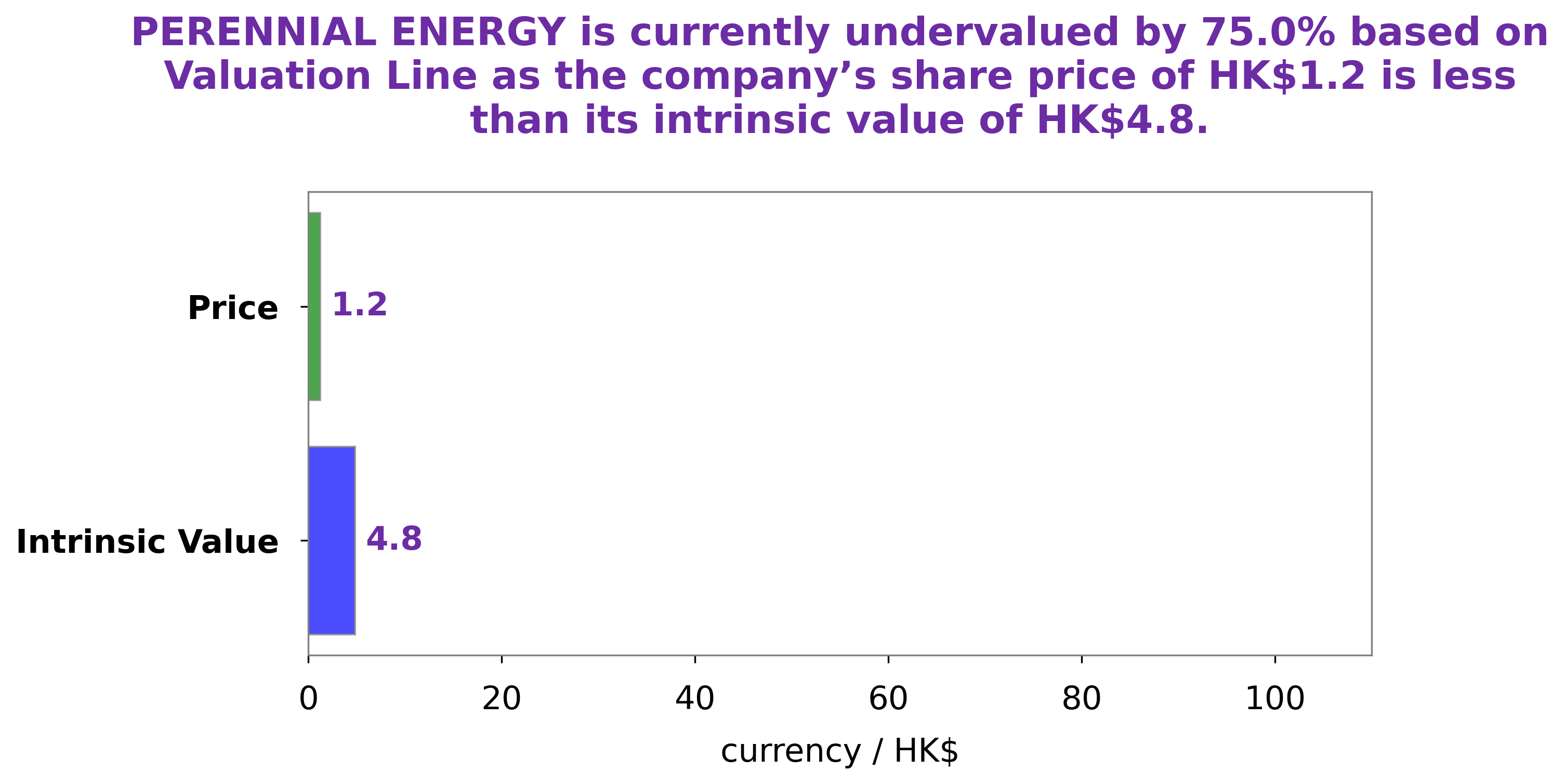

As a start, GoodWhale has conducted an analysis of PERENNIAL ENERGY‘s wellbeing. After careful consideration, our proprietary Valuation Line has established that the fair value of PERENNIAL ENERGY shares is around HK$4.8. In comparison, the current market price for the PERENNIAL ENERGY stock is at HK$1.2 – which represents a whopping 74.9% discount to the fair value. This presents a great opportunity for investors to take advantage of the stock’s undervaluation. More…

Peers

Perennial Energy Holdings Ltd is engaged in an intense competition with its competitors, Mongolian Mining Corp, Shougang Fushan Resources Group Ltd, and Tigers Realm Coal Ltd, for the control of the energy resources market. All four companies are striving to reach the top spot in the industry by providing efficient and cost-effective solutions for their customers. In this fiercely contested environment, Perennial Energy Holdings Ltd will need to rely on its strong financial position, as well as its innovative approach to business, in order to achieve success.

– Mongolian Mining Corp ($SEHK:00975)

Mongolian Mining Corporation is a Mongolian-based mining company that specializes in the exploration, extraction, and production of coal and other minerals. The company has a market capitalization of 3B as of 2023, which reflects its size and importance in the industry. Its Return on Equity (ROE) is -3.82%, indicating that the company’s shareholders are losing money. This could be due to a number of factors, such as mismanagement or high levels of debt. Despite this, Mongolian Mining Corporation remains one of the largest and most successful mining companies in Mongolia.

– Shougang Fushan Resources Group Ltd ($SEHK:00639)

Shougang Fushan Resources Group Limited is a Hong Kong-based company that is engaged in the production and sale of iron ore, steel, and other related products. The company has a market cap of 14.04 billion as of 2023 and a Return on Equity of 21.21%. This indicates that the company is performing well as it is able to generate strong returns for its shareholders. Shougang Fushan is one of the largest iron ore producers in the world and operates four mines in mainland China. In addition, it produces and sells various steel products, including hot-rolled coils, cold-rolled coils, galvanized sheets, and billets.

– Tigers Realm Coal Ltd ($ASX:TIG)

Tigers Realm Coal Ltd is an Australian based coal exploration and development company. The company’s primary focus is on the development of its coal projects in the Russian Far East. As of 2023, the company’s market cap is 222.13M and it has a Return on Equity (ROE) of 12.25%. This reflects the company’s solid financial performance and ability to generate profits from its investments. The company is well positioned for further growth as it continues to explore and develop new coal projects in the Russian Far East.

Summary

Investors looking to analyze Perennial Energy Holdings Limited should consider their projected fair value of HK$1.33, which is based on the Dividend Discount Model. Unfortunately, the current share price of HK$1.24 indicates that the stock has moved down on the same day. Investors should take a closer look at the intrinsic value of the company and assess the risk-reward ratio before making a decision.

Factors such as dividend payout, financial stability, liquidity, debt-to-equity ratio, and earnings should be taken into consideration when analyzing a company’s performance. Furthermore, investors should also be mindful of any potential changes in the competitive landscape or regulatory framework that could impact the company’s future prospects.

Recent Posts