NIPPON COKE & ENGINEERING Reports Impressive Earnings for Q3 of FY2023

April 4, 2023

Earnings Overview

On February 14 2023, NIPPON COKE & ENGINEERING ($TSE:3315) announced their financial results for the third quarter of FY2023, ending December 31 2022. Total revenue decreased significantly by 123.5% compared to the previous year, amounting to a loss of JPY -0.6 billion. Fortunately, their net income saw an increase of 9.6% year-on-year, reaching JPY 39.4 billion.

Market Price

On Tuesday, NIPPON COKE & ENGINEERING reported impressive earnings for the third quarter of financial year 2023. The company’s stock opened at JP¥87.0 and closed at JP¥88.0, representing an increase of 2.3% from its previous closing price of JP¥86.0. This performance is notable as it comes after a period of significant hardships for the company due to the economic crisis of 2022. Despite these difficult economic conditions, NIPPON COKE & ENGINEERING was able to exceed many expectations and deliver a strong financial performance in Q3, which is a testament to their resilient business model and strong management team. The company’s success can be attributed to its focus on cost-effectiveness and efficient operations.

NIPPON COKE & ENGINEERING has implemented innovative technologies, streamlined processes, and invested in advanced manufacturing capabilities in order to remain competitive in the market. This strategic focus has allowed the company to weather the financial storms of the past year and continue to operate at a high level. Investors should take note of this impressive performance and consider investing in the company for long-term returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nippon Coke & Engineering. More…

| Total Revenues | Net Income | Net Margin |

| 173.83k | -2.52k | -1.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nippon Coke & Engineering. More…

| Operations | Investing | Financing |

| -18.03k | -4.16k | -1.07k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nippon Coke & Engineering. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 143.55k | 91.5k | 180.69 |

Key Ratios Snapshot

Some of the financial key ratios for Nippon Coke & Engineering are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.1% | 22.5% | -1.8% |

| FCF Margin | ROE | ROA |

| -10.4% | -3.7% | -1.4% |

Analysis

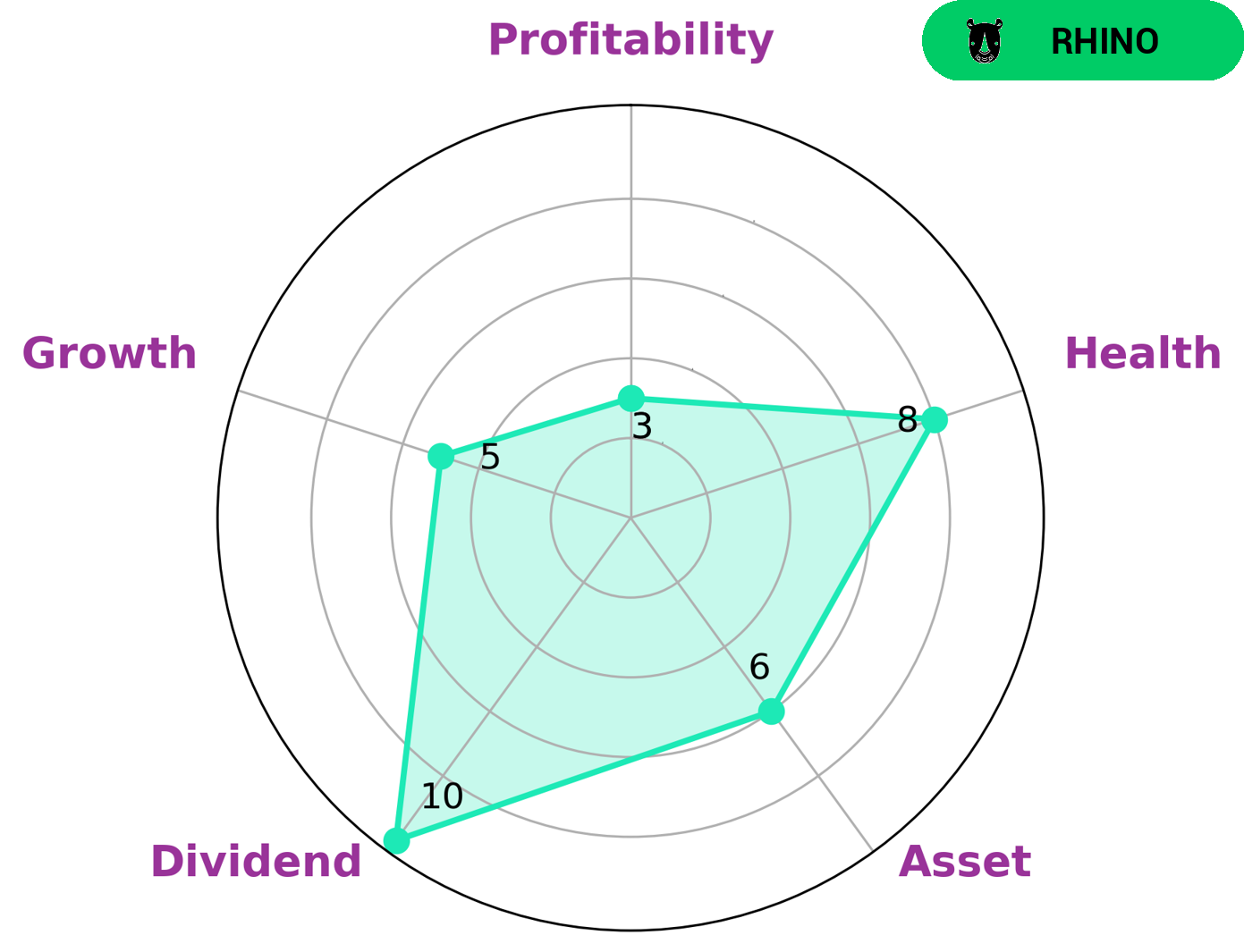

At GoodWhale, we have been analyzing the financials of NIPPON COKE & ENGINEERING and have classified them as a ‘rhino’ company. This company type typically has achieved moderate revenue or earnings growth and is recognizable as a well-established company. When it comes to NIPPON COKE & ENGINEERING specifically, they are strong in dividend, medium in asset and growth and weak in profitability. What this means is that they have been able to maintain a high dividend rate while their assets and growth have grown at a moderate rate. Additionally, their health score is 8/10, which means that they have strong cashflows and debt, making them capable of riding out any crisis without the risk of bankruptcy. This makes them an attractive option for investors looking for a safe bet. More…

Peers

With its comprehensive range of products and services, Nippon Coke & Engineering Co Ltd has established itself as one of the leading providers in the industry.

– Mongolian Mining Corp ($SEHK:00975)

Mongolian Mining Corporation is a leading producer of coal in Mongolia. It is listed on the Hong Kong stock exchange and has a market capitalization of 3.05 billion as of 2023. The company has a negative Return on Equity (ROE) of -3.82%, indicating that it is not generating sufficient returns for its investors. The company’s operations span coal mining, power generation, and other related services. Mongolian Mining Corporation has been working with the Mongolian government to develop new coal mining projects, and is currently looking to expand its operations into neighbouring countries.

– Shanxi Coking Co Ltd ($SHSE:600740)

Shanxi Coking Co Ltd is a Chinese coking and chemical company headquartered in Taiyuan, Shanxi province. The company is engaged in the production of coke, tar, ammonia, synthetic ammonia, and other related products. As of 2023, Shanxi Coking Co Ltd has a market cap of 14.5 billion, making it one of the largest companies by market capitalization in China. Its Return on Equity (ROE) is 9.46%, which indicates that the company is generating a decent level of profit from its investments. The company’s business model is based on a combination of technological innovations and cost-effective production strategies that have allowed it to remain competitive in the market.

– Shougang Fushan Resources Group Ltd ($SEHK:00639)

Shougang Fushan Resources Group Ltd is a Chinese mining and materials processing company that specializes in producing iron ore, steel, ferroalloys, and other metals. As of 2023, the company has a market cap of 13.19B and an impressive Return on Equity of 21.21%. The market cap reflects the company’s current value and its ability to generate returns for its investors. The Return on Equity indicates Shougang Fushan’s profitability and ability to generate returns on its investments. The company has a strong track record of delivering consistent profits for its shareholders and is a reliable option for investors looking for a long-term return on their investments.

Summary

NIPPON COKE & ENGINEERING reported their earnings for FY2023 Q3, ending December 31 2022, showing a significant decrease in revenue of 123.5%. Despite the drop in sales, their net income rose 9.6% compared to the same period the previous year. This indicates that the company is focusing on cost-cutting and efficiency measures to maintain profitability, despite challenging economic conditions. Investors should keep a close eye on the company’s future performance – if it is able to sustain profitability in a tough environment, it may be a good buy.

Recent Posts