AMR Intrinsic Value Calculator – Alpha Metallurgical Resources Gains Attention on TAM Stock Screener

June 12, 2023

☀️Trending News

Alpha Metallurgical Resources ($NYSE:AMR) Inc. (ALPHA) has recently gained a lot of attention on the TAM Stock Screener, a leading platform for investors seeking information about trading stocks and shares. ALPHA is an independent mining company based in the Democratic Republic of Congo that specializes in producing cobalt, copper, and nickel. Its main goal is to capitalize on the current cobalt supply and demand imbalance by providing high-quality, low-cost cobalt to the industry’s major players. The company currently has several projects underway throughout the DRC that are expected to yield significant cobalt production over the next few years. In addition to producing cobalt, ALPHA also provides technical and logistical support to its customers to ensure that they receive the best product possible.

Through its work on the TAM Stock Screener, ALPHA has been able to showcase its business model and potential future growth to a wide range of investors. Investors have responded positively to ALPHA’s innovative approach and have been eager to get involved in what is undoubtedly one of the most promising stocks in the industry. With continued success and commitment to delivering high-quality cobalt, ALPHA is sure to draw more attention in the coming months and years.

Stock Price

Alpha Metallurgical Resources Inc. gained significant attention on the TAM Stock Screener on Friday, as the stock opened at $149.1 and closed at $150.2, representing an increase of 1.2% from the previous closing price of $148.4. This positive momentum has led to renewed interest in the company and its offerings. Investors are clearly encouraged by the growth and are turning to the stock market for opportunities. As Alpha Metallurgical Resources Inc. continues to gain traction on TAM Stock Screener, investors can expect the stock to potentially reach new heights. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AMR. More…

| Total Revenues | Net Income | Net Margin |

| 3.94k | 1.32k | 33.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AMR. More…

| Operations | Investing | Financing |

| 1.33k | -353.7 | -993.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AMR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.35k | 800.54 | 104.63 |

Key Ratios Snapshot

Some of the financial key ratios for AMR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.4% | 555.6% | 36.5% |

| FCF Margin | ROE | ROA |

| 28.3% | 60.3% | 38.3% |

Analysis – AMR Intrinsic Value Calculator

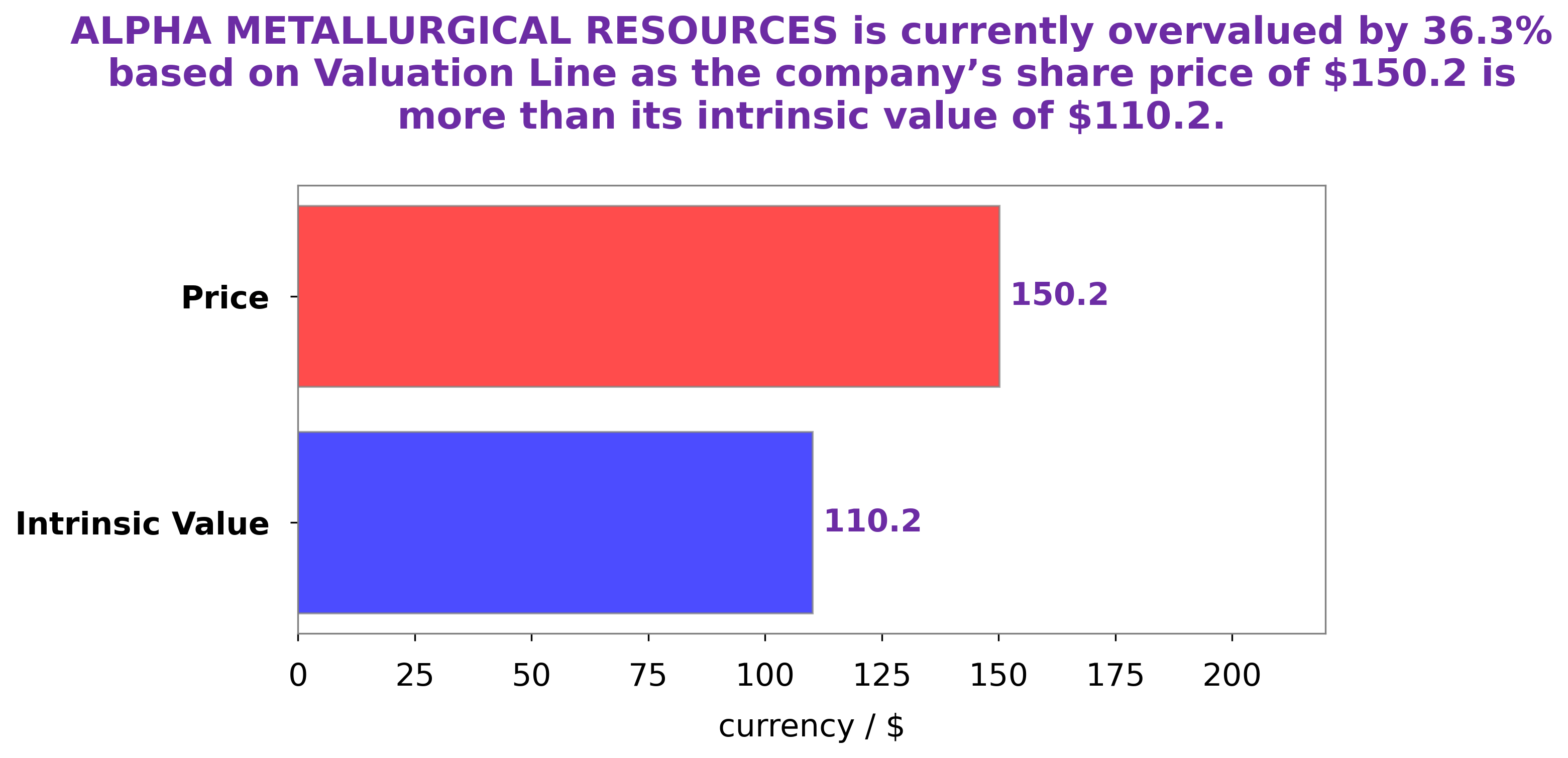

At GoodWhale, we analyze ALPHA METALLURGICAL RESOURCES’s financials to give our investors the best possible insights into the company. Our proprietary Valuation Line shows that the fair value of ALPHA METALLURGICAL RESOURCES share is around $110.2. However, right now ALPHA METALLURGICAL RESOURCES stock is traded at $150.2, making it an overvalued stock by 36.4%. More…

Peers

The company is one of the largest suppliers of metallurgical coal in the world and its major competitors include Corsa Coal Corp, Warrior Met Coal Inc, and Mongolian Mining Corp. All these companies are involved in providing metallurgical coal and other related products to the global market.

– Corsa Coal Corp ($TSXV:CSO)

Corsa Coal Corp is a coal mining and production company based in Canada. As of 2022, the company has a market cap of 22.2M and a Return on Equity (ROE) of -2.81%. This indicates that the company is not earning money for its shareholders and is not a good investment option. Corsa Coal Corporation mainly produces metallurgical coal for the steel industry and thermal coal for the power generation industry. The company also has operations in North America, South America and Europe. The company’s focus is on creating value for its shareholders through efficient operations, disciplined capital allocation and a commitment to safety and environmental responsibility.

– Warrior Met Coal Inc ($NYSE:HCC)

Warrior Met Coal Inc is an Alabama-based metallurgical coal mining company. The company owns and operates underground mining complexes in Alabama, providing metallurgical coal primarily for the steel industry. As of 2022, Warrior Met Coal Inc has a market cap of 1.78 billion, making it one of the larger companies on the market. Its return on equity (ROE) of 40.7% indicates that the company has been successful in generating returns from the investments made by its shareholders. This high level of profitability is a testament to Warrior Met Coal Inc’s ability to manage their resources efficiently and effectively.

– Mongolian Mining Corp ($SEHK:00975)

Mongolian Mining Corporation (MMC) is a producer of coal, copper and other minerals. As of 2022, MMC has a market capitalization of 2.05 billion, reflecting its strong financial footing in the market. In addition, the company boasts a Return on Equity (ROE) of -3.82%, which is a measure of profitability relative to shareholder equity. This shows that although the company is not generating a positive profit, it is still generating a steady return on its equity. This is indicative of MMC’s ability to manage its resources effectively and efficiently.

Summary

Alpha Metallurgical Resources Inc. is a mining company focused on the exploration and development of mineral resources. Its primary focus is on the development of iron ore and base metals in Australia, but it also has operations in the United States, Brazil, and Canada. Investing analysis of Alpha Metallurgical Resources Inc. reveals a stock with strong potential for growth. The company has a low debt-to-equity ratio, which indicates its ability to pay back debts in the event of a downturn in the markets.

Additionally, its impressive cash flow indicates the company’s financial position is well-positioned to take advantage of positive market conditions. Alpha Metallurgical Resources Inc. holds a number of attractive projects that are currently under development. Its extensive mineral exploration program has identified a number of potential high-value ore deposits that could be tapped in the future. Moreover, Alpha Metallurgical Resources Inc. has experienced management personnel with extensive experience in the mining industry, which could lead to better decision-making and improved operational efficiency. With these factors in mind, Alpha Metallurgical Resources Inc. may be an attractive option for investors looking to capitalize on the potential of the mining industry.

Recent Posts