AMR Intrinsic Value Calculation – Alpha Metallurgical Resources: Overlooked Value in a Pessimistic Market

May 11, 2023

Trending News 🌧️

Alpha Metallurgical Resources ($NYSE:AMR) (AMR) is an overlooked value in a pessimistic market. Despite the bearish outlook of the market in which it operates, optimism appears to be reflected in the price of its stock. The company specializes in the production of metallurgical coal, which is used in steel production, and it has been quietly building an impressive portfolio of assets since its inception. Since that time, the company has expanded its operations considerably and now operates mines in several states across the United States. It also produces metallurgical coke, another key component in steelmaking, and has begun to develop new technology and processes that could revolutionize the industry. The company’s growth has been impressive; despite the headwinds posed by the current market conditions, AMR’s share price has steadily risen over the past year.

Its strong balance sheet and resilient operations have enabled it to weather the storm, while its innovation has opened up new opportunities for growth. As such, investors are beginning to recognize the value of AMR’s stock and its potential for continuing growth. Overall, Alpha Metallurgical Resources represents an attractive investment opportunity for those willing to look beyond the pessimism of the current market. With its impressive portfolio of assets and a commitment to innovation and progress, AMR appears well-positioned to capitalize on any upturn in the market.

Share Price

On Thursday, the company’s stock opened at $136.9 and closed at $139.2, representing a 0.6% increase from its previous closing price of 138.4. This slight, yet significant, change indicates that those who have invested in the company are still seeing returns, despite the current downbeat market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AMR. More…

| Total Revenues | Net Income | Net Margin |

| 4.1k | 1.45k | 35.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AMR. More…

| Operations | Investing | Financing |

| 1.48k | -329.36 | -981.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AMR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.31k | 882.72 | 84.15 |

Key Ratios Snapshot

Some of the financial key ratios for AMR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.4% | 272.9% | 38.4% |

| FCF Margin | ROE | ROA |

| 32.2% | 70.3% | 42.6% |

Analysis – AMR Intrinsic Value Calculation

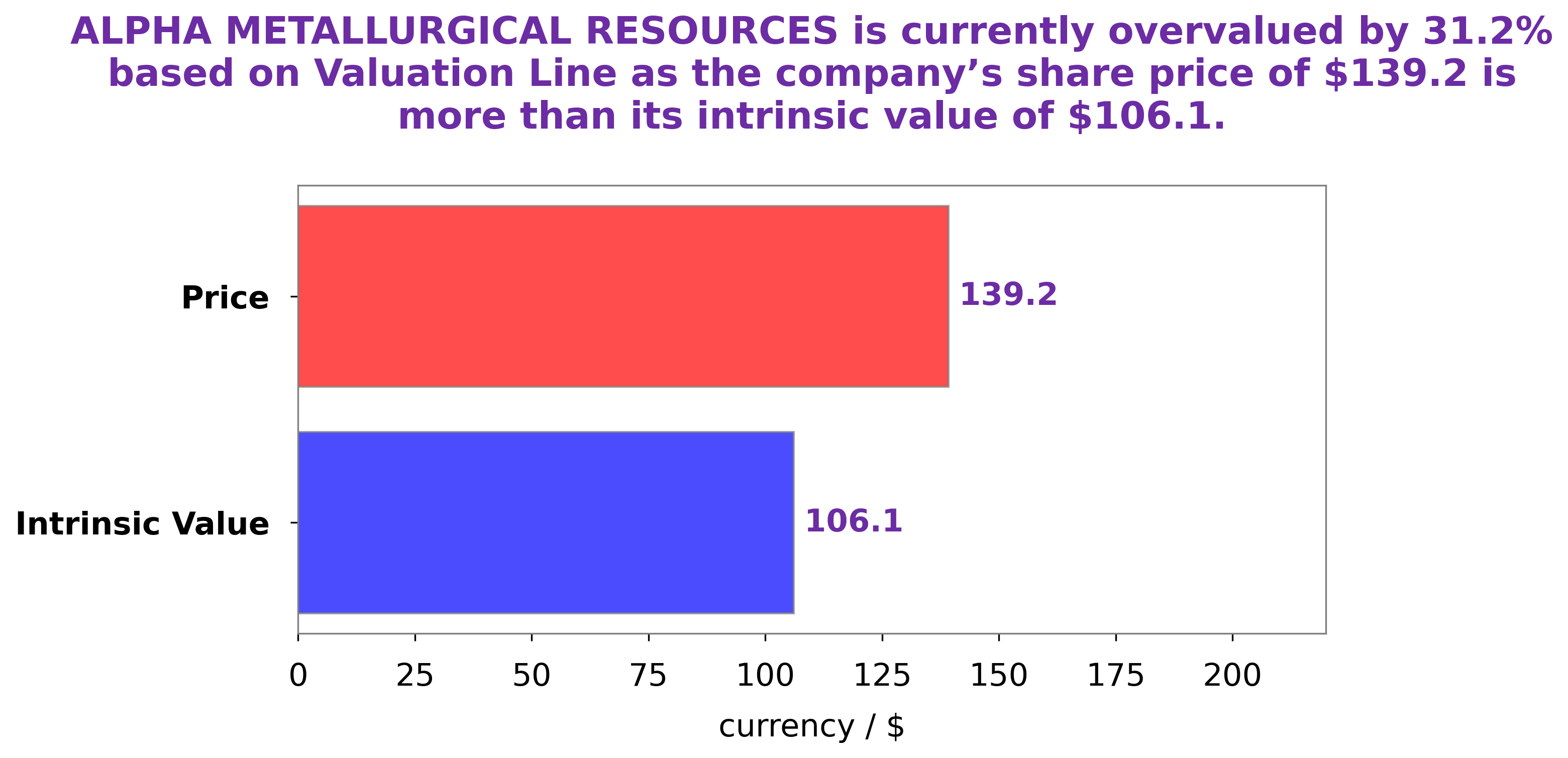

Analyzing the fundamentals of ALPHA METALLURGICAL RESOURCES can be easy with GoodWhale. Our proprietary Valuation Line has calculated the intrinsic value of ALPHA METALLURGICAL RESOURCES shares to be around $106.1. Currently, ALPHA METALLURGICAL RESOURCES stock is traded at $139.2, which is 31.2% overvalued compared to the intrinsic value. More…

Peers

The company is one of the largest suppliers of metallurgical coal in the world and its major competitors include Corsa Coal Corp, Warrior Met Coal Inc, and Mongolian Mining Corp. All these companies are involved in providing metallurgical coal and other related products to the global market.

– Corsa Coal Corp ($TSXV:CSO)

Corsa Coal Corp is a coal mining and production company based in Canada. As of 2022, the company has a market cap of 22.2M and a Return on Equity (ROE) of -2.81%. This indicates that the company is not earning money for its shareholders and is not a good investment option. Corsa Coal Corporation mainly produces metallurgical coal for the steel industry and thermal coal for the power generation industry. The company also has operations in North America, South America and Europe. The company’s focus is on creating value for its shareholders through efficient operations, disciplined capital allocation and a commitment to safety and environmental responsibility.

– Warrior Met Coal Inc ($NYSE:HCC)

Warrior Met Coal Inc is an Alabama-based metallurgical coal mining company. The company owns and operates underground mining complexes in Alabama, providing metallurgical coal primarily for the steel industry. As of 2022, Warrior Met Coal Inc has a market cap of 1.78 billion, making it one of the larger companies on the market. Its return on equity (ROE) of 40.7% indicates that the company has been successful in generating returns from the investments made by its shareholders. This high level of profitability is a testament to Warrior Met Coal Inc’s ability to manage their resources efficiently and effectively.

– Mongolian Mining Corp ($SEHK:00975)

Mongolian Mining Corporation (MMC) is a producer of coal, copper and other minerals. As of 2022, MMC has a market capitalization of 2.05 billion, reflecting its strong financial footing in the market. In addition, the company boasts a Return on Equity (ROE) of -3.82%, which is a measure of profitability relative to shareholder equity. This shows that although the company is not generating a positive profit, it is still generating a steady return on its equity. This is indicative of MMC’s ability to manage its resources effectively and efficiently.

Summary

Alpha Metallurgical Resources is a mining company that has seen its share price decline due to weak demand in the market. Investors seem to be pricing in a pessimistic outlook for the firm, as the stock has dropped significantly.

However, it is important to note that this stock may be undervalued given its assets and long-term potential. Analysts suggest that investors may want to consider adding Alpha Metallurgical Resources to their portfolios as a long-term investment, as the company remains well positioned to benefit from a potential rebound in the market.

Additionally, the firm is poised to benefit from its strong balance sheet, which should allow it to continue to invest in growth initiatives. With the stock trading at a discounted rate and potential upside from a recovery in the market, Alpha Metallurgical Resources could be a smart addition to any portfolio.

Recent Posts