AMR Intrinsic Stock Value – Alpha Metallurgical Resources Defies Market Dip, Closes Up 0.47%

April 22, 2023

Trending News 🌥️

Alpha Metallurgical Resources ($NYSE:AMR) defied market trends on Monday, closing up 0.47% at $167.92. This was despite the current market dip witnessed among other stocks. The company produces and sells ferroalloys, metallurgical coal and other metallurgical products such as titanium dioxide pigments. It also provides metallurgical services including materials testing, consulting, product development and market research. In addition to its production operations, the company also owns and operates refineries and warehouses in six countries around the world.

Alpha Metallurgical Resources is committed to sustainable resource management and has set goals to increase energy efficiency, reduce waste, improve operational safety and reduce water consumption. The company is well positioned to take advantage of the growth in the global commodities market and is a major player in the ferroalloys, metallurgical coal and titanium dioxide pigments sectors. Its strong financial position and diversified portfolio make it well suited to capitalize on opportunities as they arise.

Price History

Despite the overall negative movement of the stock market on Thursday, ALPHA METALLURGICAL RESOURCES’ stock remained resilient and closed up 0.47%. This follows their opening stock price at $166.0 and their closing stock price at $163.7, down from last closing price of 167.9. It’s possible that the dip in ALPHA METALLURGICAL RESOURCES’ stock was due to the overall market trend, and other factors could have contributed as well, such as political and economic uncertainty, amongst others.

The fact that ALPHA METALLURGICAL RESOURCES was able to close the day with a 0.47% increase was remarkable, and might suggest that investors have faith in the company’s continued success and potential for future stability. Therefore, this could be a sign of a positive outlook for ALPHA METALLURGICAL RESOURCES’ stock in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AMR. More…

| Total Revenues | Net Income | Net Margin |

| 4.1k | 1.45k | 35.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AMR. More…

| Operations | Investing | Financing |

| 1.48k | -329.36 | -981.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AMR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.31k | 882.72 | 84.15 |

Key Ratios Snapshot

Some of the financial key ratios for AMR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.4% | 272.9% | 38.4% |

| FCF Margin | ROE | ROA |

| 32.2% | 70.3% | 42.6% |

Analysis – AMR Intrinsic Stock Value

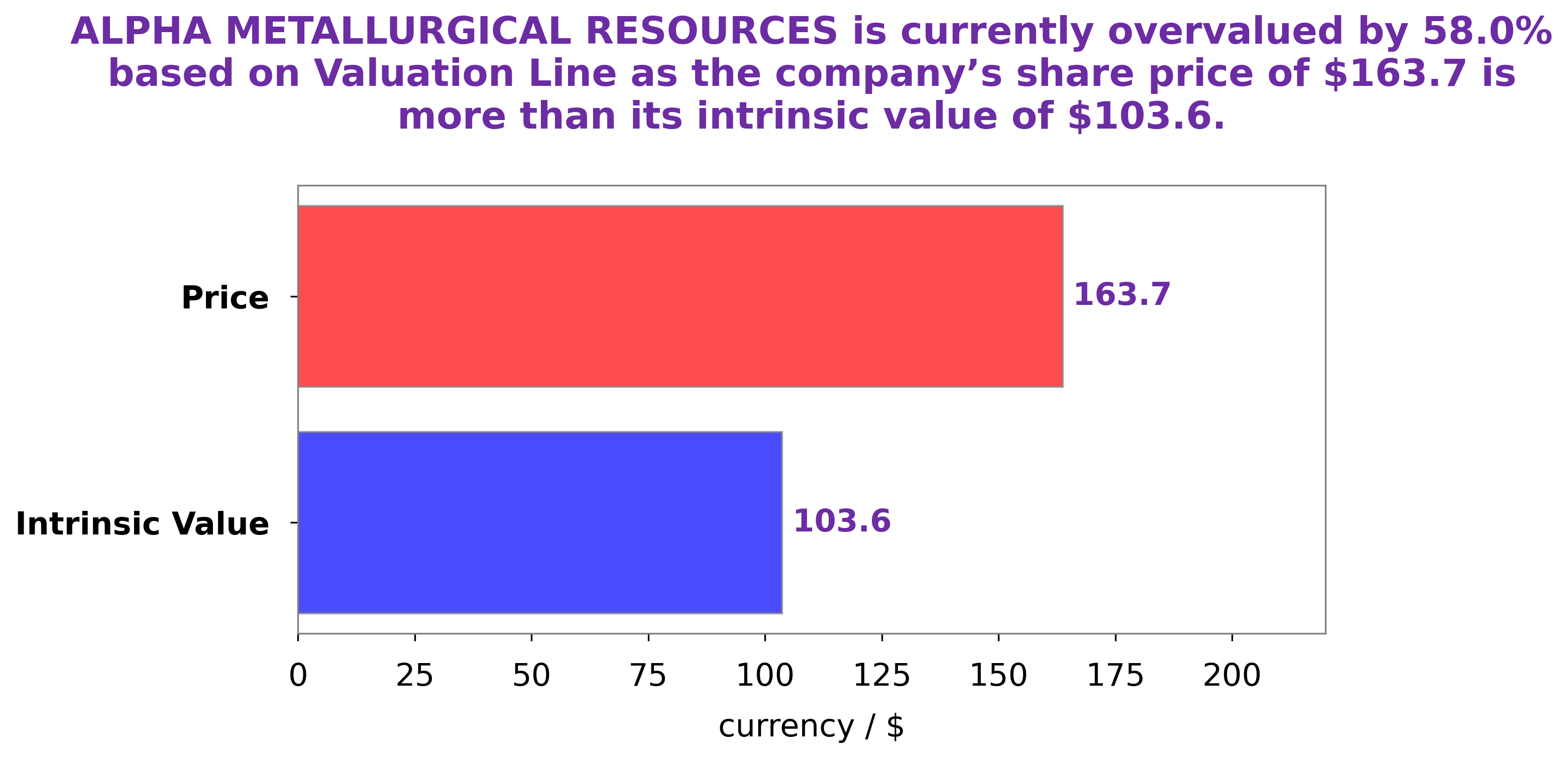

GoodWhale has taken an in-depth look at ALPHA METALLURGICAL RESOURCES’s financials to provide investors with a comprehensive assessment of the company. According to our proprietary Valuation Line, the intrinsic value of a share of ALPHA METALLURGICAL RESOURCES is around $103.6. Unfortunately, the stock is currently trading at $163.7, meaning it is overvalued by 58.1%. This is a clear signal that the market may have over-estimated the company’s potential, and investors should exercise caution when considering this stock for their portfolio. More…

Peers

The company is one of the largest suppliers of metallurgical coal in the world and its major competitors include Corsa Coal Corp, Warrior Met Coal Inc, and Mongolian Mining Corp. All these companies are involved in providing metallurgical coal and other related products to the global market.

– Corsa Coal Corp ($TSXV:CSO)

Corsa Coal Corp is a coal mining and production company based in Canada. As of 2022, the company has a market cap of 22.2M and a Return on Equity (ROE) of -2.81%. This indicates that the company is not earning money for its shareholders and is not a good investment option. Corsa Coal Corporation mainly produces metallurgical coal for the steel industry and thermal coal for the power generation industry. The company also has operations in North America, South America and Europe. The company’s focus is on creating value for its shareholders through efficient operations, disciplined capital allocation and a commitment to safety and environmental responsibility.

– Warrior Met Coal Inc ($NYSE:HCC)

Warrior Met Coal Inc is an Alabama-based metallurgical coal mining company. The company owns and operates underground mining complexes in Alabama, providing metallurgical coal primarily for the steel industry. As of 2022, Warrior Met Coal Inc has a market cap of 1.78 billion, making it one of the larger companies on the market. Its return on equity (ROE) of 40.7% indicates that the company has been successful in generating returns from the investments made by its shareholders. This high level of profitability is a testament to Warrior Met Coal Inc’s ability to manage their resources efficiently and effectively.

– Mongolian Mining Corp ($SEHK:00975)

Mongolian Mining Corporation (MMC) is a producer of coal, copper and other minerals. As of 2022, MMC has a market capitalization of 2.05 billion, reflecting its strong financial footing in the market. In addition, the company boasts a Return on Equity (ROE) of -3.82%, which is a measure of profitability relative to shareholder equity. This shows that although the company is not generating a positive profit, it is still generating a steady return on its equity. This is indicative of MMC’s ability to manage its resources effectively and efficiently.

Summary

Despite a market downturn, Alpha Metallurgical Resources experienced a 0.47% increase in share value. Investing analysts have been bullish on the company’s prospects going forward, citing its strong performance in the last quarter as well as its positive industry outlook. Alpha Metallurgical Resources is well-positioned to benefit from increased demand for metals and metallurgical products, which is expected to continue in the near future. The company’s solid balance sheet, combined with its commitment to increasing shareholder value, have made it an attractive choice for investors looking to diversify their portfolio.

Recent Posts