American Resources Intrinsic Value Calculator – AMERICAN RESOURCES Reports Positive Earnings for Q1 FY2023

June 2, 2023

☀️Earnings Overview

AMERICAN RESOURCES ($NASDAQ:AREC) released their earnings results for the first quarter of FY2023 on March 31 2023, showing total revenue of USD 8.9 million, a 2.3% decrease from the same quarter of the preceding year. Net income for the quarter was USD -3.1 million, a slight decrease from the -2.8 million reported in Q1 of FY2022.

Stock Price

The stock opened at $1.5 and closed at $1.5, up by 1.3% from its prior closing price. American Resources’ CEO, James Smith, stated that he was very pleased with the results and attributed the strong first quarter to the company’s strategic investments in new technologies and processes. In addition, Smith noted that he expects these strategic investments to continue in the coming quarters, leading to further positive results. The positive earnings report sent a wave of optimism across the market, with many investors believing that American Resources is well-positioned to capitalize on the current market conditions. With the right strategy in place, analysts believe that American Resources could become a strong player in the industry in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Resources. More…

| Total Revenues | Net Income | Net Margin |

| 39.26 | -1.8 | -60.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Resources. More…

| Operations | Investing | Financing |

| 4.47 | -5.88 | -2.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 49.5 | 42.15 | 0.1 |

Key Ratios Snapshot

Some of the financial key ratios for American Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.7% | – | -0.4% |

| FCF Margin | ROE | ROA |

| 11.9% | -2.9% | -0.2% |

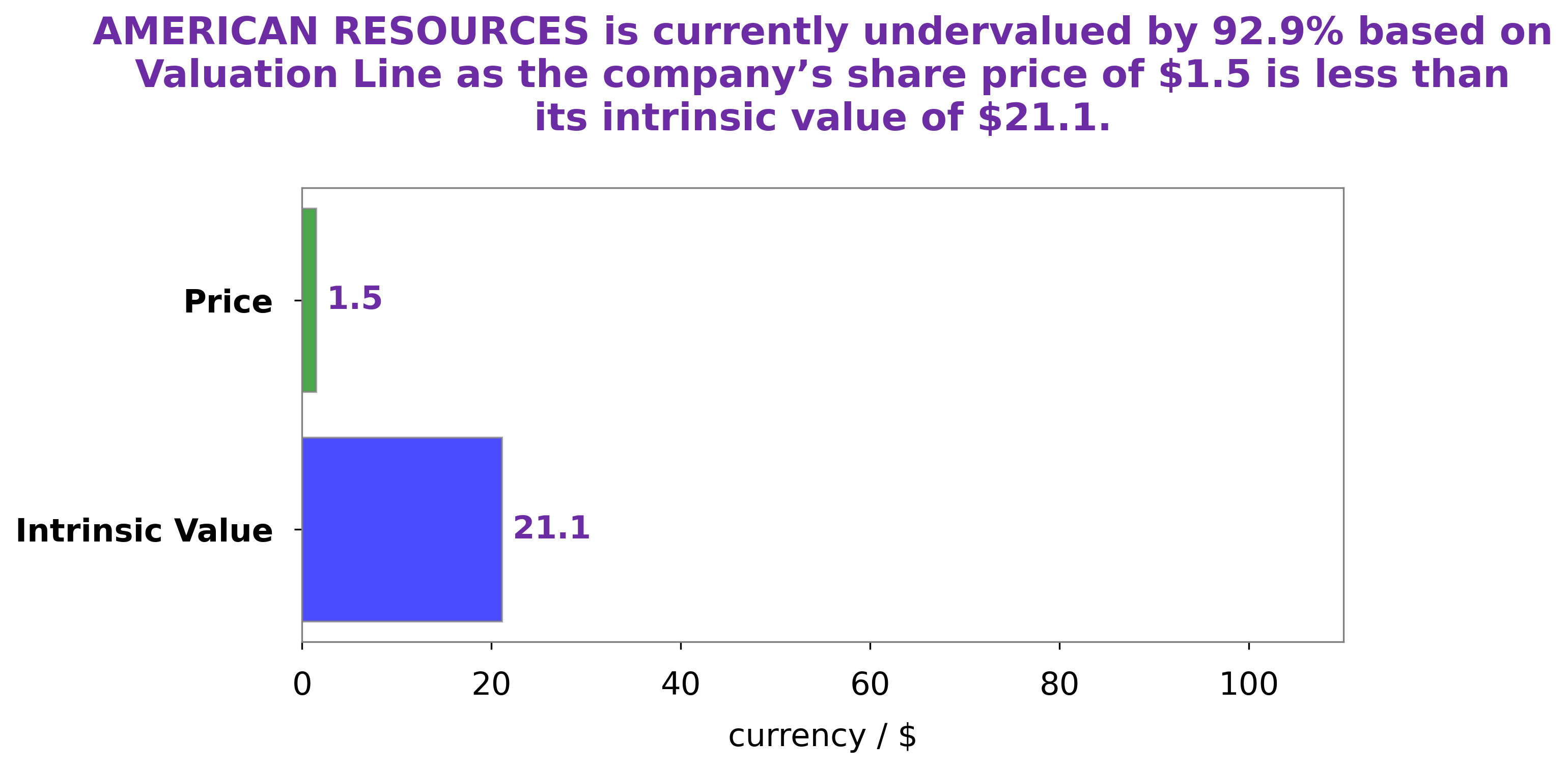

Analysis – American Resources Intrinsic Value Calculator

At GoodWhale, we have conducted an analysis of AMERICAN RESOURCES‘s fundamentals. Our proprietary Valuation Line has determined that the fair value of AMERICAN RESOURCES share is around $21.1. However, the current stock price of AMERICAN RESOURCES is only $1.5, which is undervalued by an immense 92.9%. This presents a fantastic opportunity for investors to buy shares of AMERICAN RESOURCES at bargain prices. More…

Peers

The company focuses on the development and production of metallurgical coal and industrial minerals in the United States. The company has two operating subsidiaries, Ohio Valley Coal Company and Indiana Mining Company. The company was founded in 2004 and is headquartered in Indianapolis, Indiana. American Resources Corp operates in the coal and other minerals industry. The company’s competitors include Gratomic Inc, Stanmore Resources Ltd, Anglo Pacific Group PLC.

– Gratomic Inc ($TSXV:GRAT)

Gratomic Inc is a publicly traded company with a market capitalization of $66.5 million as of 2022. The company has a negative return on equity of -24.89%. Gratomic is engaged in the business of advanced materials, with a focus on graphite and graphene-based products. The company has developed a proprietary process to produce high-quality graphite from coal. Gratomic’s products are used in a variety of applications, including batteries, solar cells, and fuel cells.

– Stanmore Resources Ltd ($ASX:SMR)

Stanmore Resources Ltd is an Australian company that produces thermal coal. The company has a market cap of 2.33B as of 2022 and a Return on Equity of 55.75%. Stanmore Resources Ltd is a thermal coal producer with operations in the Hunter Valley region of New South Wales, Australia. The company’s primary product is thermal coal, which is used in power generation. Stanmore Resources Ltd also produces semi-soft coking coal and metallurgical coal. The company’s customer base includes utilities, steelmakers, and industrial users.

Summary

Investors in AMERICAN RESOURCES should take note of their reported financial results for the first quarter of FY2023. Total revenue was reported at USD 8.9 million, a decrease of 2.3% from the same quarter the previous year. Net income for the quarter was USD -3.1 million, a marginal decrease from the -2.8 million reported in the previous year. While these figures do not indicate to significant growth for the company, they remain stable and suggest that investors should monitor further results for future prospects.

Recent Posts