American Resources Corporation to be Showcased at 2023 Companies to Watch Virtual Investor Event

January 11, 2023

Trending News 🌥️

American Resources ($NASDAQ:AREC) Corporation (ARC) is a publicly traded natural resources company that is focused on the extraction, processing, and distribution of coal and other raw materials. The company operates in the United States and has operations in multiple states. ARC is listed on the Nasdaq Global Market under the ticker symbol “ARCR”. American Resources Corporation will be showcased at the 2023 Companies to Watch Virtual Investor Event. This annual event is designed to bring together the leading investment professionals from around the world to evaluate emerging companies. Investors will have the opportunity to learn more about ARC’s operations and get a first-hand look at the company’s growth potential. The event will feature presentations from executives representing ARC, as well as a panel of industry experts who will provide insights into the current and future landscape of the natural resources industry. The panelists will discuss the trends driving the sector, as well as what investors should be looking for in companies operating in this space. ARC’s presence at the event will provide investors with an invaluable opportunity to gain a better understanding of the company and its potential.

Additionally, it will give investors the chance to directly interact with the company’s leadership team and ask questions about their business strategy and performance. With new insights into the sector and a direct connection to ARC’s leadership, investors will be able to make more informed decisions about their investments.

Market Price

On Tuesday, AMERICAN RESOURCES stock opened at $1.4 and closed at $1.4, rising by 6.7% from the prior closing price of $1.4. This increase in value reflects the company’s promising outlook and investors’ enthusiasm for the company. AMERICAN RESOURCES will be one of the featured companies at the event, as its commitment to sustainability, growth, and innovation make it an ideal candidate for the showcase. During this event, the company will share its plans for the future and discuss how it is positioning itself to remain competitive in the changing marketplace. The event is expected to attract a wide range of investors, including venture capitalists, private equity firms, institutional investors, and financial advisors.

With the opportunity to network and gain insight into the latest trends in the industry, investors will gain valuable insight into AMERICAN RESOURCES and its potential for long-term growth and success. AMERICAN RESOURCES is an example of a company that has adapted to the changing environment and is committed to staying ahead of the curve in order to remain competitive. With its strong reputation and commitment to sustainable practices, AMERICAN RESOURCES is well-poised to thrive in the years ahead. The company’s presence at the 2023 Companies to Watch Virtual Investor Event is a testament to its commitment to excellence and innovation, and investors should take note of this opportunity to learn more. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Resources. More…

| Total Revenues | Net Income | Net Margin |

| 39.33 | -20.95 | -61.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Resources. More…

| Operations | Investing | Financing |

| -23.53 | 2.63 | 5.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 37.31 | 46.39 | -0.13 |

Key Ratios Snapshot

Some of the financial key ratios for American Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.3% | – | -46.1% |

| FCF Margin | ROE | ROA |

| -60.5% | 165.8% | -30.4% |

VI Analysis

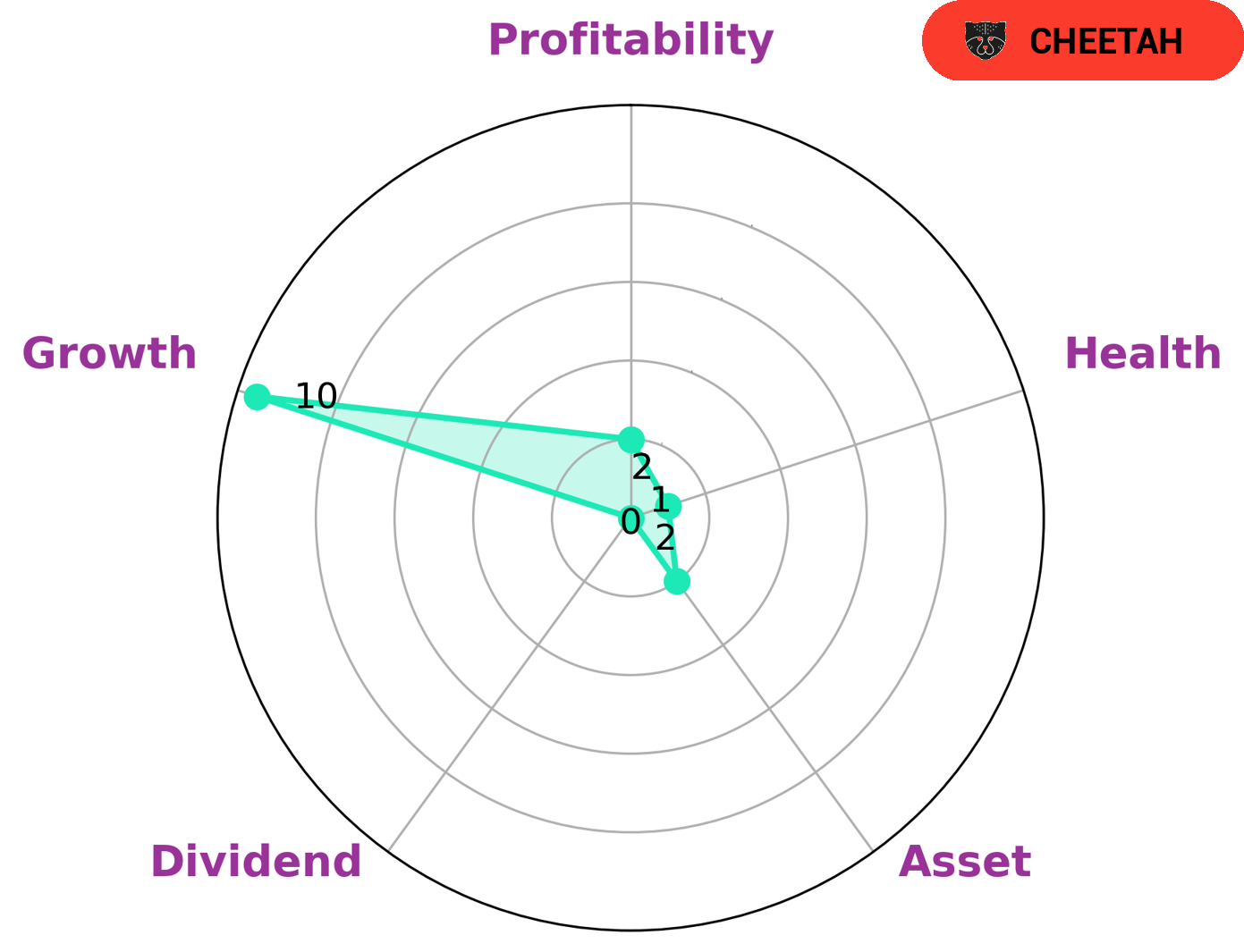

Fundamentals play an important role in assessing the long-term potential of a company. VI app simplifies the analysis of a company’s fundamentals. According to the VI Star Chart, American Resources is strong in its growth and weak in assets, dividends and profitability. This makes it a ‘Cheetah’, a type of company that has shown high revenue or earnings growth but is considered less stable due to lower profitability. Investors who seek higher returns and are comfortable with taking on additional risk may be interested in such a company. However, American Resources has a low health score of 1/10, which indicates that its cashflows and debt are not strong enough to sustain future operations in times of crisis. Overall, investors must assess the risk-reward ratio before investing in American Resources. It is essential to consider the company’s fundamentals, including its liquidity, solvency and profitability before making a decision. Additionally, it is important to keep track of news and industry developments to understand the company better. More…

VI Peers

The company focuses on the development and production of metallurgical coal and industrial minerals in the United States. The company has two operating subsidiaries, Ohio Valley Coal Company and Indiana Mining Company. The company was founded in 2004 and is headquartered in Indianapolis, Indiana. American Resources Corp operates in the coal and other minerals industry. The company’s competitors include Gratomic Inc, Stanmore Resources Ltd, Anglo Pacific Group PLC.

– Gratomic Inc ($TSXV:GRAT)

Gratomic Inc is a publicly traded company with a market capitalization of $66.5 million as of 2022. The company has a negative return on equity of -24.89%. Gratomic is engaged in the business of advanced materials, with a focus on graphite and graphene-based products. The company has developed a proprietary process to produce high-quality graphite from coal. Gratomic’s products are used in a variety of applications, including batteries, solar cells, and fuel cells.

– Stanmore Resources Ltd ($ASX:SMR)

Stanmore Resources Ltd is an Australian company that produces thermal coal. The company has a market cap of 2.33B as of 2022 and a Return on Equity of 55.75%. Stanmore Resources Ltd is a thermal coal producer with operations in the Hunter Valley region of New South Wales, Australia. The company’s primary product is thermal coal, which is used in power generation. Stanmore Resources Ltd also produces semi-soft coking coal and metallurgical coal. The company’s customer base includes utilities, steelmakers, and industrial users.

Summary

American Resources Corporation has been selected to be showcased at the 2023 Companies to Watch Virtual Investor Event, and this news has caused their stock price to move up. Investors should take note of this development as it suggests investor confidence in the company. AMERICAN RESOURCES has a strong portfolio of assets, including coal and metals, as well as an experienced management team. The company also has a strong track record of growth, thanks to its focus on efficiency and value creation.

Furthermore, the company has a history of generating positive cash flows, making it an attractive investment for those looking for long-term returns. With its continued progress, AMERICAN RESOURCES is well-positioned to deliver strong returns for investors in the future.

Recent Posts