American Resources Corporation Makes Second Rare Earth Oxide Offtake Agreement Following Initial Strategic Investment

December 31, 2022

Trending News ☀️

American Resources ($NASDAQ:AREC) Corporation is a diversified natural resources company that mines, processes and distributes metals and minerals in the United States. The company is headquartered in Denver, Colorado, and has a number of production sites across the country. Following an initial strategic investment, American Resources Corporation has just announced that it has completed its second rare earth oxide offtake agreement with Advanced Magnet Lab Inc. This agreement will give American Resources Corporation access to rare earth oxides produced by Advanced Magnet Lab Inc. The American Resources Corporation will be able to purchase the rare earth oxides at an agreed-upon price and the agreement has been structured to provide a secure supply of rare earth oxides for years to come. These oxides are essential for a number of technological applications, including computers, cell phones, and other electronic components. The rare earth oxide offtake agreement is the latest in a series of investments made by American Resources Corporation in order to secure its long-term supply of metals and minerals.

This agreement further strengthens the partnership between the two companies and allows for more efficient production of rare earth oxides. This agreement also demonstrates their commitment to their partners, as it provides Advanced Magnet Lab Inc with a secure market for their rare earth oxides. This agreement will ensure that American Resources Corporation remains a leader in the natural resources industry, while also providing its customers with reliable supplies of rare earth oxides.

Share Price

The news has been received positively by the media, with many expressing confidence in the company’s future prospects. On Thursday, the stock opened at $1.3 and closed at $1.2, a drop of 6.2% from its last closing price of $1.3. This could be attributed to market volatility, or may have been caused by investors taking profits. Overall, the long-term prospects for American Resources Corporation look promising. Their second offtake agreement is a major step forward in the company’s goal of becoming a leader in rare earth oxide production. In addition to their strong management team, they offer a diversified portfolio of resources and a commitment to creating value for their shareholders.

The company’s stock price may have dropped in the short-term, but as they continue to make progress on their strategic objectives, investors are likely to become more bullish on the stock in the months ahead. With more than two decades of experience in the resources industry, American Resources Corporation is well-positioned to take advantage of the growing demand for rare earth oxides. The future looks bright for American Resources Corporation, and investors should keep an eye on their progress as they continue to expand their operations in rare earth oxide production. With their second offtake agreement in place, the company is well-positioned to benefit from the increasing demand for rare earth oxides, and could potentially see significant growth in their stock price in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Resources. More…

| Total Revenues | Net Income | Net Margin |

| 39.33 | -20.95 | -61.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Resources. More…

| Operations | Investing | Financing |

| -23.53 | 2.63 | 5.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 37.31 | 46.39 | -0.13 |

Key Ratios Snapshot

Some of the financial key ratios for American Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.3% | – | -46.1% |

| FCF Margin | ROE | ROA |

| -60.5% | 165.8% | -30.4% |

VI Analysis

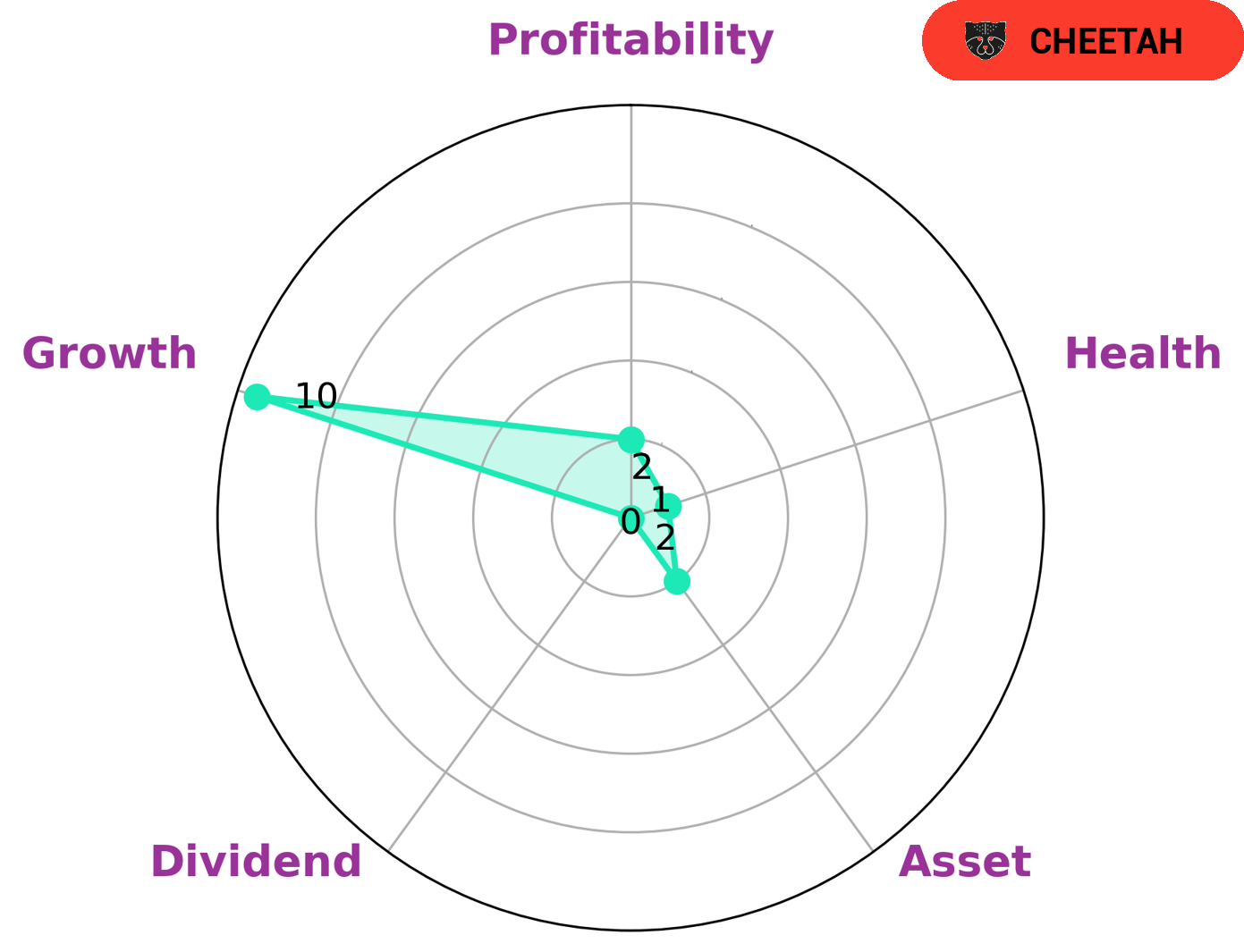

American Resources is a company with high potential for long-term growth. According to the VI Star Chart, it is classified as a ‘cheetah’, a type of company that has achieved rapid revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who are looking for higher returns in exchange for more risk. Despite its potential for growth, American Resources has a low health score of 1/10 based on its cashflows and debt. This indicates that it is less likely to safely ride out any crisis without risking bankruptcy. Furthermore, American Resources is strong in growth but weak in asset, dividend, and profitability. In conclusion, investors interested in American Resources must consider the risks associated with its low health score and lack of stability. However, the company’s high potential for growth may make it attractive to those looking for higher returns despite the associated risks. More…

VI Peers

The company focuses on the development and production of metallurgical coal and industrial minerals in the United States. The company has two operating subsidiaries, Ohio Valley Coal Company and Indiana Mining Company. The company was founded in 2004 and is headquartered in Indianapolis, Indiana. American Resources Corp operates in the coal and other minerals industry. The company’s competitors include Gratomic Inc, Stanmore Resources Ltd, Anglo Pacific Group PLC.

– Gratomic Inc ($TSXV:GRAT)

Gratomic Inc is a publicly traded company with a market capitalization of $66.5 million as of 2022. The company has a negative return on equity of -24.89%. Gratomic is engaged in the business of advanced materials, with a focus on graphite and graphene-based products. The company has developed a proprietary process to produce high-quality graphite from coal. Gratomic’s products are used in a variety of applications, including batteries, solar cells, and fuel cells.

– Stanmore Resources Ltd ($ASX:SMR)

Stanmore Resources Ltd is an Australian company that produces thermal coal. The company has a market cap of 2.33B as of 2022 and a Return on Equity of 55.75%. Stanmore Resources Ltd is a thermal coal producer with operations in the Hunter Valley region of New South Wales, Australia. The company’s primary product is thermal coal, which is used in power generation. Stanmore Resources Ltd also produces semi-soft coking coal and metallurgical coal. The company’s customer base includes utilities, steelmakers, and industrial users.

Summary

American Resources Corporation (AMER) has made a second rare earth oxide offtake agreement following its initial strategic investment. The news was generally welcomed by the media, though the stock price dropped on the same day. Nevertheless, investors may consider this as a long-term investment opportunity as AMER is a leading provider of raw materials to the rapidly growing global clean energy industry.

The company is well-positioned to capitalize on the growing demand for rare earth oxides and should benefit from increased demand for clean energy technologies. Investors should monitor AMER’s progress in developing its strategic investments and offtake agreements to understand the potential for long-term growth.

Recent Posts