ALPHA METALLURGICAL RESOURCES Reports Fourth Quarter 2022 Earnings Results.

March 20, 2023

Earnings Overview

On February 23, 2023, ALPHA METALLURGICAL RESOURCES ($NYSE:AMR) reported their earnings results for the fourth quarter of fiscal year 2022, ending December 31, 2022. USD 220.7 million in revenue was reported, a decrease of 14.3% from the same quarter of the previous year. Net income amounted to USD 823.5 million, a slight decrease of 0.6% from the same quarter of the previous year.

Transcripts Simplified

-Fourth quarter adjusted EBITDA was $248 million, down from Q3’s $296 million. -Average realization for met segment in Q4 was $186.29 per ton, and export met tons priced against Atlantic indices realized $196.88 per ton. -Realizations in incidental thermal portion of the Met segment increased to $146.24 per ton in Q4 from $119.69 in Q3. -Realizations in the all other category were $126.10 per ton, up from $109.27 per ton for Q3. -Cost of cold sales within met segment increased to $112.97 per ton. Cost of coal sales in all other category rose to $80.76 per ton. -SG& A excluding non-cash stock compensation and non-recurring items increased to $19 million in Q4. -CapEx was $61 million, up from $33.3 million in Q3. -Cash and short term investments at end of December 2022 was $348 million, down from $404.4 million at end of Q3. -Total liquidity at end of December was $441.1 million, net of share repurchases during quarter and deposits related to special and quarterly dividends paid in early January.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AMR. More…

| Total Revenues | Net Income | Net Margin |

| 4.1k | 1.45k | 35.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AMR. More…

| Operations | Investing | Financing |

| 1.48k | -329.36 | -981.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AMR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.31k | 882.72 | 84.15 |

Key Ratios Snapshot

Some of the financial key ratios for AMR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.4% | 272.9% | 38.4% |

| FCF Margin | ROE | ROA |

| 32.2% | 70.3% | 42.6% |

Stock Price

Their stock opened at $162.8 and closed at $160.2, which marks a decrease of 2.2% from their previous closing price of 163.8. The results reveal the company’s profitability and the performance of their stocks over the last quarter. The quarterly earnings report contains various key metrics such as revenue, cash flow from operating activities, net income, and earnings per share. Apart from these, other important points are also discussed such as progress in research and development, investments in new technologies, and expansion into new markets. These are important indicators of the company’s future performance and growth potential.

Additionally, ALPHA METALLURGICAL RESOURCES’ management provides useful insights into their financial and operational strategy going forward. This further helps in understanding and assessing the company’s performance over the quarter. The company remains committed to delivering superior value to its stakeholders through its innovative products and services. Live Quote…

Analysis

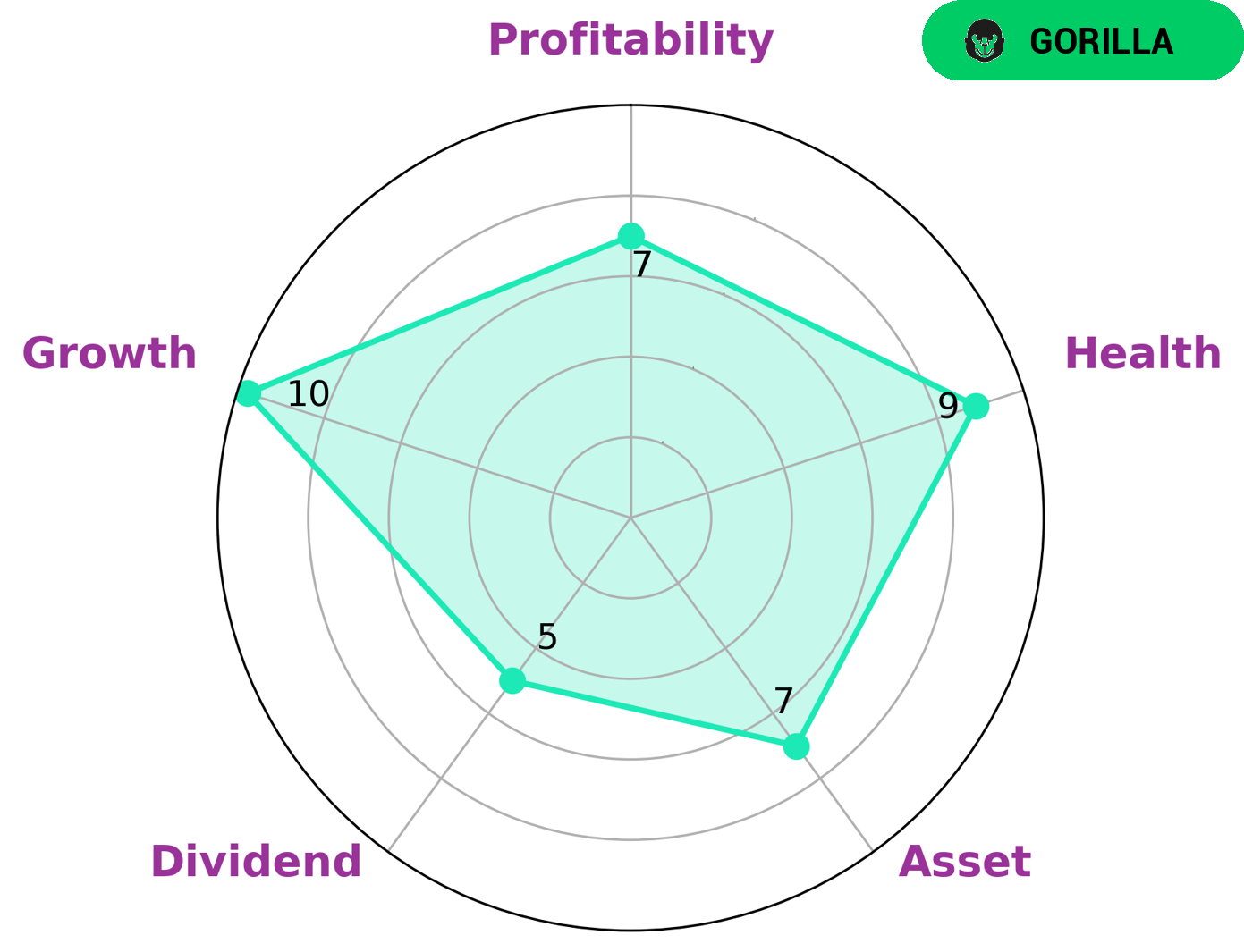

At GoodWhale, we always advise investors to check the fundamentals of any company before taking a decision. ALPHA METALLURGICAL RESOURCES is no exception. After a thorough analysis of its data, we can confidently assert that this company has a high health score of 9/10 with regard to its cashflows and debt. This means that the company is capable of paying off its debt and funding future operations as well. We have also classified ALPHA METALLURGICAL RESOURCES as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. We believe that such a company is an attractive investment opportunity for both active and passive investors. Looking at the other aspects, ALPHA METALLURGICAL RESOURCES is strong in asset, growth, and profitability, and medium in dividend. It is important to note that ALPHA METALLURGICAL RESOURCES is also significantly liquid, meaning that it can easily convert assets into cash. All these factors make ALPHA METALLURGICAL RESOURCES an attractive investment option for investors looking for stability and long-term potential. More…

Peers

The company is one of the largest suppliers of metallurgical coal in the world and its major competitors include Corsa Coal Corp, Warrior Met Coal Inc, and Mongolian Mining Corp. All these companies are involved in providing metallurgical coal and other related products to the global market.

– Corsa Coal Corp ($TSXV:CSO)

Corsa Coal Corp is a coal mining and production company based in Canada. As of 2022, the company has a market cap of 22.2M and a Return on Equity (ROE) of -2.81%. This indicates that the company is not earning money for its shareholders and is not a good investment option. Corsa Coal Corporation mainly produces metallurgical coal for the steel industry and thermal coal for the power generation industry. The company also has operations in North America, South America and Europe. The company’s focus is on creating value for its shareholders through efficient operations, disciplined capital allocation and a commitment to safety and environmental responsibility.

– Warrior Met Coal Inc ($NYSE:HCC)

Warrior Met Coal Inc is an Alabama-based metallurgical coal mining company. The company owns and operates underground mining complexes in Alabama, providing metallurgical coal primarily for the steel industry. As of 2022, Warrior Met Coal Inc has a market cap of 1.78 billion, making it one of the larger companies on the market. Its return on equity (ROE) of 40.7% indicates that the company has been successful in generating returns from the investments made by its shareholders. This high level of profitability is a testament to Warrior Met Coal Inc’s ability to manage their resources efficiently and effectively.

– Mongolian Mining Corp ($SEHK:00975)

Mongolian Mining Corporation (MMC) is a producer of coal, copper and other minerals. As of 2022, MMC has a market capitalization of 2.05 billion, reflecting its strong financial footing in the market. In addition, the company boasts a Return on Equity (ROE) of -3.82%, which is a measure of profitability relative to shareholder equity. This shows that although the company is not generating a positive profit, it is still generating a steady return on its equity. This is indicative of MMC’s ability to manage its resources effectively and efficiently.

Summary

Alpha Metallurgical Resources reported their earnings results for the 4th quarter of 2022, showing a decrease of 14.3% in revenue compared to the same quarter of the previous year, and 0.6% decrease in net income. This may not be seen as ideal for investors looking for growth, but could be an opportunity to buy in at a lower price. Investors should research further into the company’s financial performance to assess its potential for long-term returns.

Recent Posts