Valhi’s Stock Plummets Below 200-Day Moving Average

January 19, 2023

Trending News 🌥️

Valhi ($NYSE:VHI), Inc. is a publicly traded holding company that is involved in various industries such as chemicals, components, and real estate. Valhi’s stock has recently fallen below the 200-day Moving Average of $31.18. This is a significant decline for the company as the 200-day moving average is generally viewed as an indicator of long-term trends in the stock market. The decline in Valhi’s stock price is primarily due to a decrease in demand for their products, as well as a decrease in their stock price relative to their competitors. Valhi has also been hurt by negative earnings reports over the past few quarters, which has further weakened investor confidence in the company. Valhi’s management team has been working hard to turn the company around and has taken steps such as restructuring their operations, reducing costs, and increasing their research and development investments.

However, these efforts have yet to pay off in the form of improved financial performance.

Additionally, Valhi is facing challenging macroeconomic conditions which have further hindered their ability to recover. Investors should keep a close eye on Valhi’s performance over the coming months as the company attempts to overcome the challenges it faces and recover from its recent stock decline. If Valhi can continue to make progress towards becoming profitable, their stock could potentially recover from its current levels and move back above its 200-day moving average. Until then, however, investors should remain cautious when investing in Valhi’s stock.

Stock Price

Media sentiment has been largely negative in response to the news. On Tuesday, VALHI opened at $25.0 and closed at $24.4, a decrease of 1.0% from the prior closing price of $24.6. This drop in stock price has caused concern among investors and analysts alike, who are now watching to see how the stock will perform in the days ahead. The root cause of this sudden decline is uncertain, but some have suggested that it may be due to the company’s recent performance or lack thereof. Others have argued that it could be a result of the current market conditions and that the stock will eventually rebound. Whatever the cause, it has become clear that the company is not immune to the forces of the market and can suffer just as much as any other company. Valhi‘s management has yet to make an official statement regarding the recent drop in stock price.

In the meantime, investors have been left to speculate what the future holds for the company. Some have speculated that Valhi may be forced to make major changes in order to stay afloat, while others remain hopeful that the stock will eventually recover and reach its previous high. In any case, Valhi’s stock is now trending downward and investors are watching closely to see where it will end up. Many still believe that the company will eventually regain its footing and return to profitability, but for now all eyes are on Valhi as its stock continues to plummet. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Valhi. More…

| Total Revenues | Net Income | Net Margin |

| 2.5k | 151.6 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Valhi. More…

| Operations | Investing | Financing |

| 410.8 | -37.4 | -189.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Valhi. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.91k | 1.7k | 31.21 |

Key Ratios Snapshot

Some of the financial key ratios for Valhi are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.2% | 28.3% | 12.6% |

| FCF Margin | ROE | ROA |

| 13.5% | 23.4% | 7.1% |

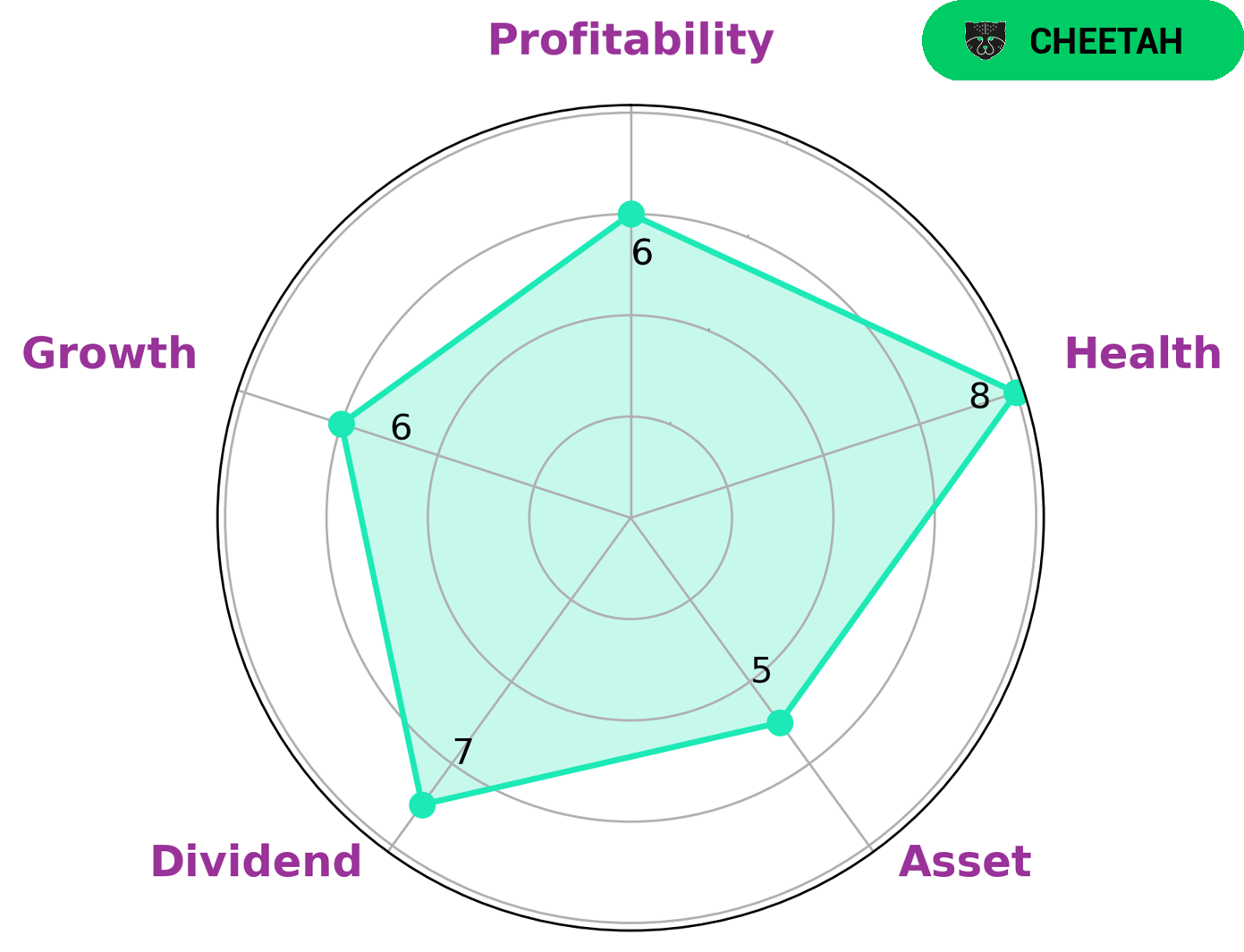

VI Analysis

Investors looking to capitalize on the potential of a company whose fundamentals reflect long-term potential may find VALHI an attractive option. According to the VI Star Chart, VALHI is classified as a “cheetah”, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. VALHI has a strong cashflow and debt structure, evidenced by its 8/10 health score, making it capable of safely riding out any crisis without the risk of bankruptcy. VALHI has also shown strength in dividends and medium in asset, growth, and profitability. This could make it an attractive target for investors looking to invest in a company with high potential but lower stability. Investors interested in VALHI may find the company to be a good fit for their portfolio. They may also be impressed by its strong cashflow and debt structure, which suggest that the company can continue to remain successful in the long-term. In conclusion, VALHI is an attractive option for investors looking to capitalize on the potential of a company that has achieved high revenue or earnings growth. Its strong cashflow and debt structure make it a safe option to ride out any crisis, while its dividends and medium asset, growth, and profitability make it an attractive target for investment. More…

VI Peers

The company operates in four segments: Titanium Dioxide, Fluorides, Performance Materials, and Energy. Valhi Inc has a market capitalization of $2.6 billion and its shares are traded on the New York Stock Exchange. Valhi Inc’s main competitors are PT Unggul Indah Cahaya Tbk, Brenntag SE, Diamines & Chemicals Ltd. Valhi Inc is the largest producer of titanium dioxide in the world with a market share of about 25%. PT Unggul Indah Cahaya Tbk is the second largest producer of titanium dioxide with a market share of about 15%. Brenntag SE is a leading chemical distributor with a global network of over 400 locations in 74 countries. Diamines & Chemicals Ltd is a leading manufacturer of specialty chemicals with operations in over 30 countries.

– PT Unggul Indah Cahaya Tbk ($IDX:UNIC)

PT Unggul Indah Cahaya Tbk is one of the largest companies in Indonesia with a market capitalization of 4.28 trillion as of 2022. The company has a strong focus on the mining and energy sectors and has a return on equity of 18.4%.

– Brenntag SE ($OTCPK:BNTGF)

Brenntag SE is a global chemical distribution company with a market cap of 9.51B as of 2022. The company has a return on equity of 16.33%. Brenntag SE operates in over 30 countries and serves more than 25,000 customers. The company offers a wide range of services such as sourcing, logistics, and distribution of chemicals and related products.

– Diamines & Chemicals Ltd ($BSE:500120)

Diamines & Chemicals Ltd is a publicly traded company with a market capitalization of 4.31 billion as of 2022. The company has a return on equity of 20.25%. Diamines & Chemicals Ltd is engaged in the manufacture and sale of chemicals. The company’s products are used in a variety of industries, including the textile, leather, plastics, and food industries.

Summary

Investing in VALHI is a risky move, as the stock has recently fallen below its 200-day moving average. The media sentiment for the company has largely been negative, suggesting that the stock may not be a good buy. Investors should keep a close eye on the market to determine if VALHI is a wise investment.

They should also consider factors such as company performance, industry trends, and company news to decide if VALHI is a good fit for their portfolio. With any investment, investors should remain aware of the risk and be prepared for potential losses.

Recent Posts