Valhi, Sees Rise in Position Held by Janney Montgomery Scott LLC

January 31, 2023

Trending News 🌥️

Valhi ($NYSE:VHI), Inc. is a publicly traded company listed on the New York Stock Exchange (NYSE). It is involved in a variety of businesses in the chemical and industrial products and services industries. Valhi is the parent company of NL Industries, Inc., Kronos Worldwide Inc., CompX International Inc., and Waste Control Specialists LLC. Valhi has seen an increase in the position held by Janney Montgomery Scott LLC, a broker-dealer and a registered investment advisor. Janney Montgomery Scott LLC is one of the largest holders of Valhi stock as it currently holds nearly 10% of the outstanding shares of the company. Valhi has seen its stock price increase significantly in recent months as investors have become more bullish on the company’s prospects.

The company has seen an increase in sales and profits over the past few quarters and has announced plans to expand its operations into new markets. Valhi’s future looks bright and its stock could continue to rise as investors remain optimistic about its prospects. With Janney Montgomery Scott LLC increasing its position in Valhi, investors will be watching to see how this impacts the stock price in the coming months. The increased stake held by Janney Montgomery Scott LLC could be seen as a sign of confidence in Valhi’s future prospects and could be a catalyst for further gains in the stock price.

Share Price

The stock opened at $24.3 and closed at $24.7, representing a 2.2% increase from its previous closing price of 24.2. Janney Montgomery Scott LLC is one of Valhi‘s largest investors, and their increased stake in the company suggests that they are optimistic about Valhi’s future prospects. This is a positive development for Valhi, as it provides additional capital to invest in new projects and initiatives. It also provides a boost of confidence to other shareholders, who may be encouraged to increase their own investments in the company. Valhi, Inc. has seen its stock price rise steadily over the past few months.

The company is well-positioned to capitalize on current market trends, and with its increased capital base, it should be able to continue to grow its market share in the coming months. This increase in position held by Janney Montgomery Scott LLC is a sign of good things to come for Valhi, Inc., and the company has reason to be optimistic about its future prospects. As long as Valhi continues to execute on its strategic plans, investors should continue to benefit from its increasing share price and strong financial performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Valhi. More…

| Total Revenues | Net Income | Net Margin |

| 2.5k | 151.6 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Valhi. More…

| Operations | Investing | Financing |

| 410.8 | -37.4 | -189.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Valhi. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.91k | 1.7k | 31.21 |

Key Ratios Snapshot

Some of the financial key ratios for Valhi are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.2% | 28.3% | 12.6% |

| FCF Margin | ROE | ROA |

| 13.5% | 23.4% | 7.1% |

VI Analysis

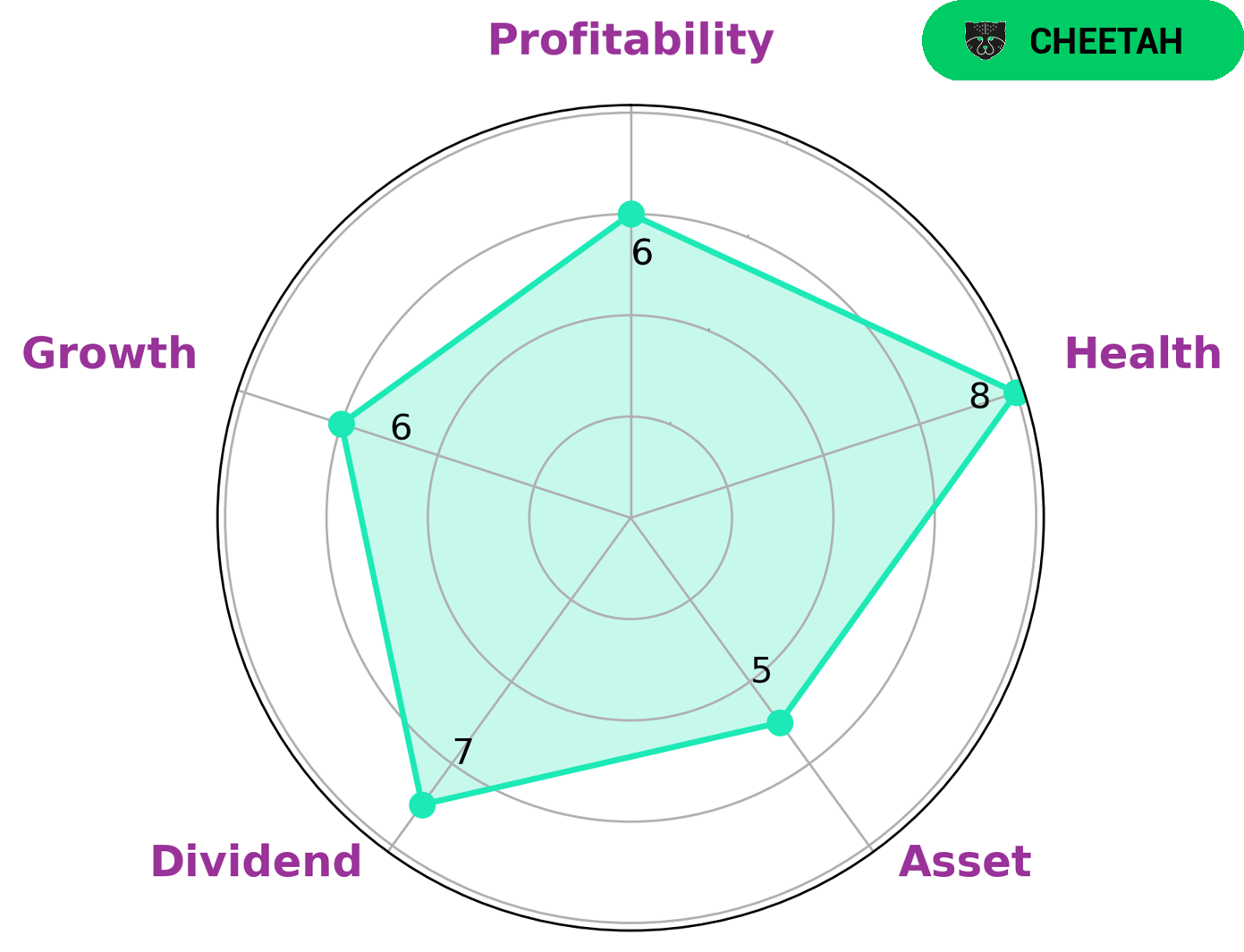

Company fundamentals reflect its long term potential and the VI app provides an easy way to analyze these fundamentals. In particular, VALHI has a strong dividend, medium asset, medium growth, and medium profitability according to the VI Star Chart. It is classified as a ‘cheetah’, meaning it has achieved high revenue or earnings growth yet is considered less stable due to lower profitability. Investors who are looking for higher capital appreciation or growth potential may be interested in VALHI due to its high revenue and earnings growth. However, such investors should keep in mind that VALHI’s profitability is lower than other types of companies, making it riskier than other options. Additionally, VALHI has a high health score of 8/10 with regard to its cashflows and debt, making it capable of sustaining future operations in times of crisis. As such, investors who are looking for stability and potential for growth can consider VALHI as an option. More…

VI Peers

The company operates in four segments: Titanium Dioxide, Fluorides, Performance Materials, and Energy. Valhi Inc has a market capitalization of $2.6 billion and its shares are traded on the New York Stock Exchange. Valhi Inc’s main competitors are PT Unggul Indah Cahaya Tbk, Brenntag SE, Diamines & Chemicals Ltd. Valhi Inc is the largest producer of titanium dioxide in the world with a market share of about 25%. PT Unggul Indah Cahaya Tbk is the second largest producer of titanium dioxide with a market share of about 15%. Brenntag SE is a leading chemical distributor with a global network of over 400 locations in 74 countries. Diamines & Chemicals Ltd is a leading manufacturer of specialty chemicals with operations in over 30 countries.

– PT Unggul Indah Cahaya Tbk ($IDX:UNIC)

PT Unggul Indah Cahaya Tbk is one of the largest companies in Indonesia with a market capitalization of 4.28 trillion as of 2022. The company has a strong focus on the mining and energy sectors and has a return on equity of 18.4%.

– Brenntag SE ($OTCPK:BNTGF)

Brenntag SE is a global chemical distribution company with a market cap of 9.51B as of 2022. The company has a return on equity of 16.33%. Brenntag SE operates in over 30 countries and serves more than 25,000 customers. The company offers a wide range of services such as sourcing, logistics, and distribution of chemicals and related products.

– Diamines & Chemicals Ltd ($BSE:500120)

Diamines & Chemicals Ltd is a publicly traded company with a market capitalization of 4.31 billion as of 2022. The company has a return on equity of 20.25%. Diamines & Chemicals Ltd is engaged in the manufacture and sale of chemicals. The company’s products are used in a variety of industries, including the textile, leather, plastics, and food industries.

Summary

Janney Montgomery Scott LLC has increased their position of Valhi, Inc. shares, signaling an optimistic outlook for the company. Valhi is a publicly traded company in the energy and chemicals sector, with a range of products from specialty chemicals to industrial services. Analysts suggest that increased demand for Valhi’s products, as well as their strong balance sheet, could lead to outperforming results in the long-term. Investors are advised to closely watch Valhi’s developments and take a long-term approach when investing in this stock.

Recent Posts