Tronox Holdings stock dividend – Tronox Holdings PLC Announces 0.125 Cash Dividend

June 10, 2023

🌥️Dividends Yield

On June 8 2023, TRONOX HOLDINGS ($NYSE:TROX) PLC announced a 0.125 USD cash dividend for its shareholders. If you are in the market for dividend stocks, then TRONOX HOLDINGS is a viable option for you. The company has been steadily issuing annual dividends over the past three years, with per share payments of 0.5 USD in 2021, 0.5 USD in 2022, and 0.36 USD in 2023.

With these payments, the dividend yields for 2021, 2022, and 2023 were 3.37%, 3.09%, and 1.69%, respectively, with an average dividend yield of 2.72%. The ex-dividend date for TRONOX HOLDINGS is May 12 2023, which means that anyone who purchases the stock before this date will be eligible for the dividend payment.

Stock Price

The distribution was made in light of the company’s strong financial position and cash flow. Following the announcement, the stock opened at $12.6 on Thursday and closed at $12.2, down by 2.9% from its previous closing price of $12.6. The company believes that this dividend reflects its commitment to providing value to its shareholders. TRONOX HOLDINGS expects to continue to evaluate the dividend level and provide updates as appropriate, given the company’s financial position and outlook. Investors should take note of the new dividend policy and consider it when deciding if they would like to invest in TRONOX HOLDINGS PLC. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tronox Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 3.2k | 504 | 16.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tronox Holdings. More…

| Operations | Investing | Financing |

| 330 | -404 | -101 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tronox Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.36k | 3.96k | 14.99 |

Key Ratios Snapshot

Some of the financial key ratios for Tronox Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.4% | 35.3% | 13.3% |

| FCF Margin | ROE | ROA |

| -2.8% | 11.3% | 4.2% |

Analysis

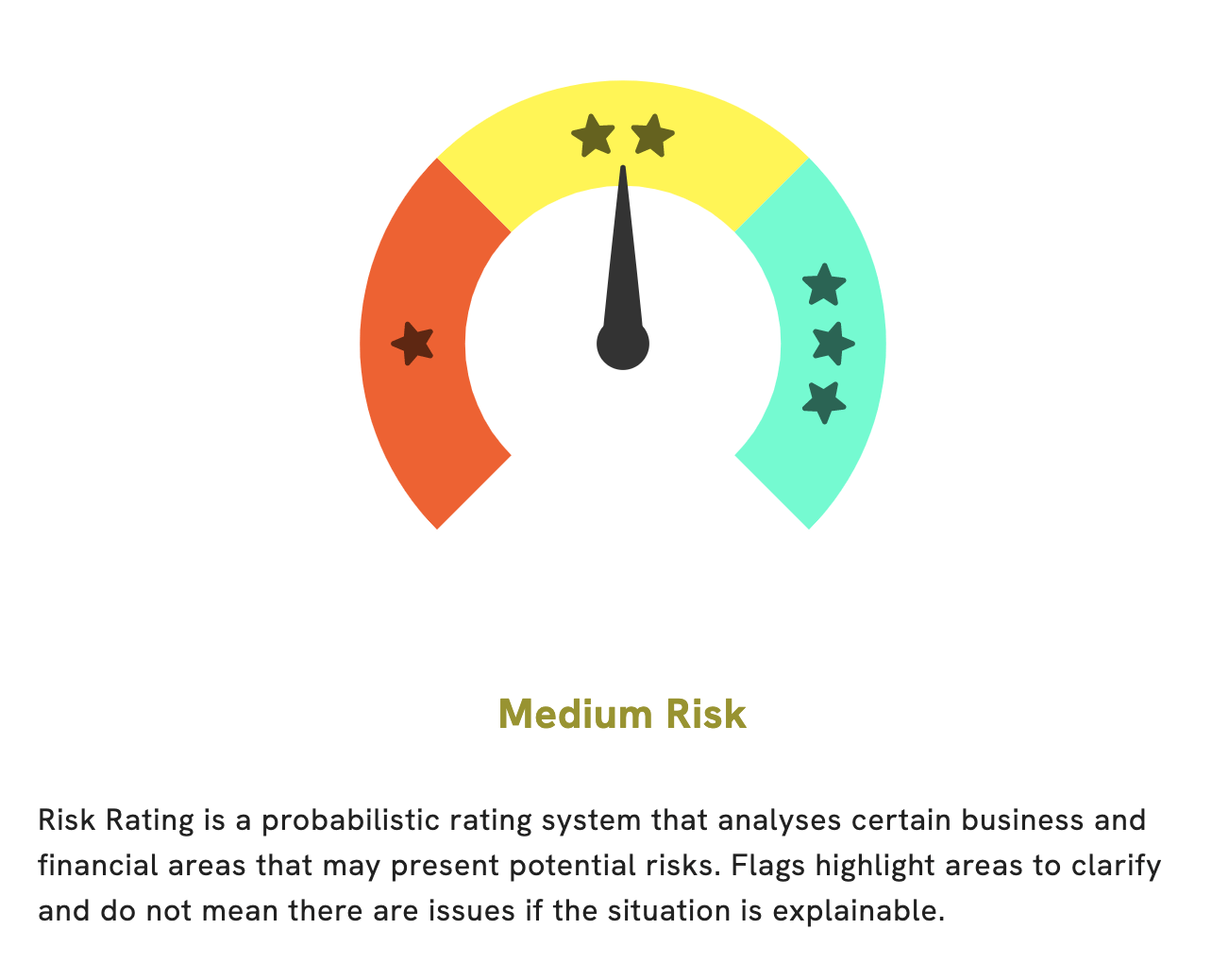

GoodWhale recently conducted an analysis of TRONOX HOLDINGS‘ fundamentals. We have assessed the company’s financial and business aspects and concluded that it is a medium risk investment. Our analysis of the income sheet and balance sheet revealed two risk warnings that we believe investors should be aware of. We recommend that potential investors register with us to gain access to our analysis in full detail and to be able to make an informed decision about whether or not TRONOX HOLDINGS is a good investment for them. More…

Peers

The company has strong competition from Hartalega Holdings Bhd, WD-40 Co, and Iofina PLC, all of which offer similar products and services. Despite the strong competition, Tronox Holdings PLC has managed to remain a leader in its industry thanks to its commitment to innovation and customer service.

– Hartalega Holdings Bhd ($KLSE:5168)

Hartalega Holdings Bhd is a Malaysian-based glove manufacturer that produces various types of gloves for medical, industrial and food service use. As of 2023, the company has a market capitalization of 5.33 billion and a Return on Equity (ROE) of 9.26%, indicating that the company is generating a good return on its investments. The company has been able to achieve such high returns due to its efficient operations, management and sales strategies. Its ability to remain competitive in the market has made it one of the leading glove manufacturers in Malaysia.

– WD-40 Co ($NASDAQ:WDFC)

WD-40 Co is a multinational corporation that specializes in the production of lubricants, cleaners, and degreasers. It has a current market cap of 2.37 billion, making it one of the largest publicly traded companies in its industry. WD-40 Co’s return on equity over the last year has been 26.96%, indicating that the company is efficiently utilizing its assets to generate a return on investment. This high return on equity and sizable market cap are indicative of WD-40 Co’s strong and profitable operations.

– Iofina PLC ($LSE:IOF)

Iofina PLC is a specialty chemical company that produces iodine, iodide and derivatives. The company has a market capitalization of 47.01M as of 2023 and a return on equity of 9.17%. This market capitalization indicates that the company has a large presence in the market, and a return on equity of 9.17% shows that it is making a good return on its investments. The company is well-positioned to continue to grow and expand its business.

Summary

TRONOX HOLDINGS is a dividend stock that has issued an average dividend yield of 2.72% over the past three years. In 2021, the dividend yield was 3.37%, in 2022 it was 3.09%, and in 2023 it was 1.69%. This makes TRONOX HOLDINGS an attractive option for dividend-seeking investors, as it has provided consistent, albeit decreasing, yields over the past three years. Prospective investors should analyze TRONOX HOLDINGS’ financials and fundamentals to determine if the company is a good fit for their portfolio.

Recent Posts