“Shin-Etsu Chemical to Split Stock in 2023 on April 5th”.

March 26, 2023

Trending News 🌥️

SHIN-ETSU ($TSE:4063): Shin-Etsu Chemical, one of the world’s largest producers of inorganic and specialty chemicals, announced recently that it will be splitting its stock on Wednesday, April 5th, 2023. The split will be split into two shares for each existing share, resulting in a doubling of the total number of shares outstanding. This split is expected to improve liquidity and make the company’s shares more accessible to a broader range of investors. Shin-Etsu Chemical’s decision to divide its stock is part of an effort to increase its shareholder base and improve capital market efficiency. The split is projected to expand the number of shareholders, make the company’s stock more attractive to a larger range of investors, and increase liquidity.

Additionally, the split is expected to improve stock price volatility, making it easier for investors to trade in and out of the company’s stock more quickly. Furthermore, the split is expected to benefit long-term investors by reducing their cost-per-share. With more shares available, the cost per share will be significantly lower after the split. This can be attractive to investors looking for ways to diversify their portfolio with a lower price tag as well as those looking to acquire a larger amount of shares with a smaller upfront investment. In summary, Shin-Etsu Chemical’s decision to split its stock on Wednesday, April 5th, 2023 is expected to increase liquidity and make its shares more accessible and attractive to a wider range of investors. The split is projected to benefit both traders and long-term investors alike by reducing their cost-per-share and improving their ability to trade in and out of the company’s stock quickly and efficiently.

Market Price

On April 5th, 2023, SHIN-ETSU CHEMICAL announced that it would be splitting its stock 2-for-1 in order to increase their liquidity. The stock opened on Monday at JP¥20000.0 and closed at JP¥19900.0, which was a decrease of 1.3% from the previous closing price of 20155.0. This decision will be an effort on SHIN-ETSU CHEMICAL’s part to attract more investors and to increase their shareholder base. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shin-etsu Chemical. More…

| Total Revenues | Net Income | Net Margin |

| 2.75M | 725.5k | 26.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shin-etsu Chemical. More…

| Operations | Investing | Financing |

| 655.97k | -253.72k | -122.5k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shin-etsu Chemical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.77M | 684.85k | 9.28k |

Key Ratios Snapshot

Some of the financial key ratios for Shin-etsu Chemical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.8% | 36.2% | 36.5% |

| FCF Margin | ROE | ROA |

| 15.8% | 16.3% | 13.2% |

Analysis

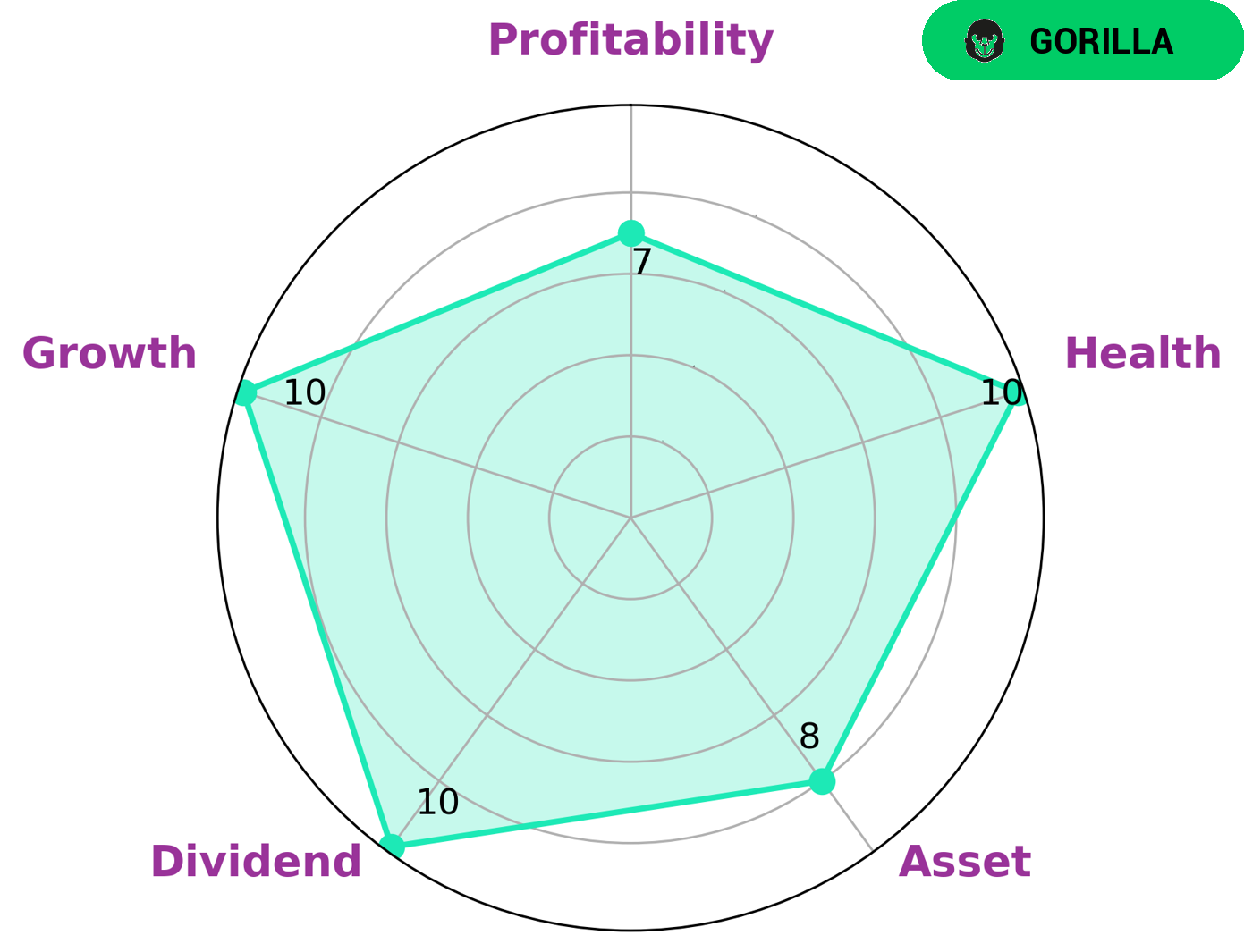

As GoodWhale, we’ve conducted an analysis of the fundamentals of SHIN-ETSU CHEMICAL and have classified it as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. This makes SHIN-ETSU CHEMICAL an attractive prospect for investors looking for a reliable, long-term return. We believe that SHIN-ETSU CHEMICAL will be especially attractive to investors interested in dividend payments, growth, and profitability. The company has a very impressive health score of 10/10 when considering its cash flows and debt, demonstrating that it is more than capable of sustaining future operations in times of crisis. Overall, we believe that SHIN-ETSU CHEMICAL is a fantastic opportunity for those investors looking for stability, growth, and long-term returns. More…

Peers

It is the largest chemical company in Japan and the second largest in the world. It has a strong presence in Asia, Europe and North America. Shin-Etsu Chemical‘s main competitors include Fuso Chemical Co Ltd, Yuki Gosei Kogyo Co Ltd, and Chin Yang Chemical Corp, all of which are prominent chemical companies in the industry.

– Fuso Chemical Co Ltd ($TSE:4368)

Fuso Chemical Co Ltd is a Japanese chemical company that produces various products, ranging from plastics and synthetic resins to pharmaceuticals. The company has a market cap of 123.35B as of 2023, reflecting its strong financial performance in recent years. In addition, the company’s Return on Equity (ROE) is 14.05%, indicating the company is generating a healthy return on its shareholders’ investments. Fuso Chemical Co Ltd is well-positioned to continue its growth in the near future.

– Yuki Gosei Kogyo Co Ltd ($TSE:4531)

Yuki Gosei Kogyo Co. Ltd. is a Japanese manufacturing company which produces automotive parts and components. The company has a market cap of 6.33 billion dollars as of 2023, making it one of the leading automotive parts manufacturers in Japan. Yuki Gosei Kogyo Co. Ltd. also has a very impressive Return on Equity (ROE) of 3.85%, indicating that the company has been able to generate a strong return on each dollar of shareholders’ equity. This is a testament to the company’s ability to create value for its shareholders and investors.

– Chin Yang Chemical Corp ($KOSE:051630)

Chin Yang Chemical Corp is a chemical manufacturing company that produces industrial chemicals such as solvents, lubricants and fuel additives. As of 2023, the company has a market capitalization of 57.99B. This indicates that the company is highly valued by investors due to its strong performance in the industry. The Return on Equity of -0.69% shows that the company is not generating a satisfactory return on its equity investment. This suggests that the company needs to improve its operational efficiency in order to increase its profitability.

Summary

Shin-Etsu Chemical announced plans to split its stock on April 5th, 2023. The company will divide its shares into two classes – Class A shares and Class B shares. This allows investors to diversify their investments and benefit from both classes of stocks. Analysts view the split as a positive move for shareholders, as it could lead to increased liquidity in the stock and higher returns over time.

The new classes of stock will also bring more transparency, as investors will be able to monitor the performance of each class separately. Shin-Etsu Chemical’s long-term growth potential remains strong despite the split, making it a smart investment for any investor looking for long-term returns.

Recent Posts