RYAM Stock Fair Value Calculator – RAYONIER ADVANCED MATERIALS Reports Q3 FY2023 Earnings Results on September 30 2023

December 10, 2023

☀️Earnings Overview

On September 30, 2023, RAYONIER ADVANCED MATERIALS ($NYSE:RYAM) announced their Q3 earnings results for FY2023. Revenue for the quarter totaled USD 369.0 million, a decrease of 20.8% compared to the same period a year prior. Net income for Q3 was reported at USD -25.0 million, compared to the 30.0 million reported in the prior year.

Share Price

The company’s stock opened at $3.0 and closed at $3.0, up by 2.7% from the previous closing price of 3.0. RAYONIER ADVANCED MATERIALS president and CEO Paul Boynton remarked that “we are pleased with our performance during this challenging economic environment and are proud of our ability to deliver on our goals”. He added that “we are confident that we will continue to drive future growth through our focus on innovation and operational efficiency”. The earnings report comes as a welcome news for RAYONIER ADVANCED MATERIALS, which has seen its stock price rise steadily since the start of 2023. Investors are hopeful that the company can continue to deliver solid results as it further develops its product portfolio and increases its market share in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RYAM. More…

| Total Revenues | Net Income | Net Margin |

| 1.72k | -36.65 | -2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RYAM. More…

| Operations | Investing | Financing |

| 143.5 | -120.06 | -133.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RYAM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.18k | 1.39k | 12.02 |

Key Ratios Snapshot

Some of the financial key ratios for RYAM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.4% | -13.6% | 1.2% |

| FCF Margin | ROE | ROA |

| 1.4% | 1.6% | 0.6% |

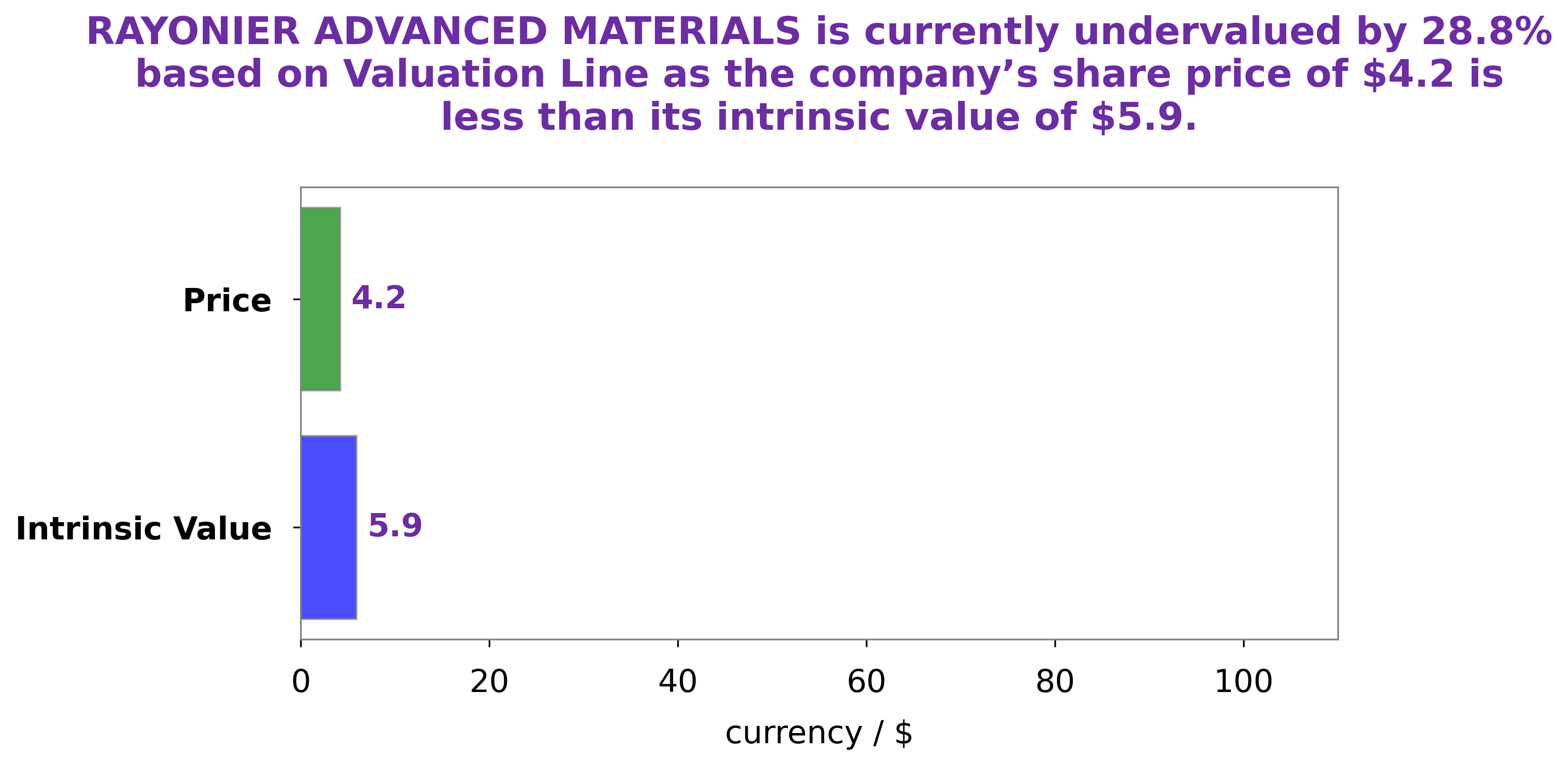

Analysis – RYAM Stock Fair Value Calculator

As GoodWhale analysts, we have conducted a thorough financial analysis of RAYONIER ADVANCED MATERIALS. Our proprietary Valuation Line tool has determined that the intrinsic value of its shares is around $5.9. Currently the stock is trading at $3.0, which means that it is undervalued by 49.6%. In other words, the stock is currently priced at nearly half of its intrinsic value, making it a particularly attractive investment option. More…

Peers

The company competes with Altech Chemicals Ltd, Supreme Petrochem Ltd, and Nanogate SE. All three companies are well-positioned to continue to grow and gain market share in the cellulose fiber market.

– Altech Chemicals Ltd ($ASX:ATC)

Altech Chemicals Ltd is an Australian-based chemicals company. The Company is engaged in the business of developing and commercializing technologies for the production of alumina from non-bauxite sources. It has developed the HPA production process, which is a hydrometallurgical process that converts raw materials, including kaolin clay, into alumina. The Company’s HPA production process involves the digestion of kaolin clay with hydrochloric acid, precipitation of aluminum hydroxide from the solution, calcination of the aluminum hydroxide to produce alumina, and cooling and washing of the product to produce a white powder known as alumina trihydrate.

– Supreme Petrochem Ltd ($LTS:0W1E)

Nanogate SE is a Germany-based company that develops, produces, and sells nanoscale coatings, surface treatments, and additives. It operates in three segments: Automotive, Industry, and Home. The Automotive segment provides solutions for the automotive industry, such as for the exterior and interior of vehicles. The Industry segment offers solutions for the electronics, optics, and plastics industries, among others. The Home segment provides solutions for the kitchen and bathroom industry, among others.

Summary

RAYONIER ADVANCED MATERIALS reported their earnings results for the third quarter of FY2023 on September 30, 2023. Total revenue was down 20.8% year-over-year to USD 369.0 million, and net income decreased to a loss of USD -25.0 million from the prior year’s figure of USD 30.0 million. This negative performance presents a challenging investing environment in RAYONIER ADVANCED MATERIALS, and investors may want to take a cautious approach given the current market conditions. Further analysis will be needed to determine whether or not investments in RAYONIER ADVANCED MATERIALS are appropriate at this time.

Recent Posts