Origin Materials Sees Price Increase Following Restructuring Announcement

April 13, 2023

Trending News ☀️

Origin Materials ($NASDAQ:ORGN) Inc. is a leading materials science and manufacturing company that specializes in sustainable and innovative materials production. The announcement of a potential restructuring has caused their stock to increase in price significantly. In the last session, Origin Materials Inc. closed at $4.08, which is an increase of 4.88% from its previous closing price of $3.89. This price increase may indicate that there is a good chance that the company is plans to go through another restructuring. The market has reacted positively to the news of Origin Materials Inc. potentially restructuring their business, as this suggests that shareholders may benefit from cost-cutting measures.

This may include cost reductions in production, research and development, or marketing. The restructuring could also include promotions for key personnel, which can further increase the stock’s value. It will be interesting to see what the outcome of the restructuring of Origin Materials Inc. will be and how it will affect their stock price in the future. Investors should monitor the news closely to determine whether Origin Materials Inc. will continue to see increases in their stock price or if the proposed restructuring will have a negative impact on the stock.

Stock Price

On Tuesday, shares of ORIGIN MATERIALS Inc. experienced a 1.7% decrease in price following their restructuring announcement. The company’s stock opened at $4.1, but closed at $4.0, which was down from its previous closing price of $4.1. Investors appeared to be cautious when evaluating the implications of the restructuring and its impact on the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Origin Materials. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 78.57 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Origin Materials. More…

| Operations | Investing | Financing |

| -26.09 | 88.85 | 1.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Origin Materials. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 493.7 | 116.8 | 2.64 |

Key Ratios Snapshot

Some of the financial key ratios for Origin Materials are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | 13.5% | 9.9% |

Analysis

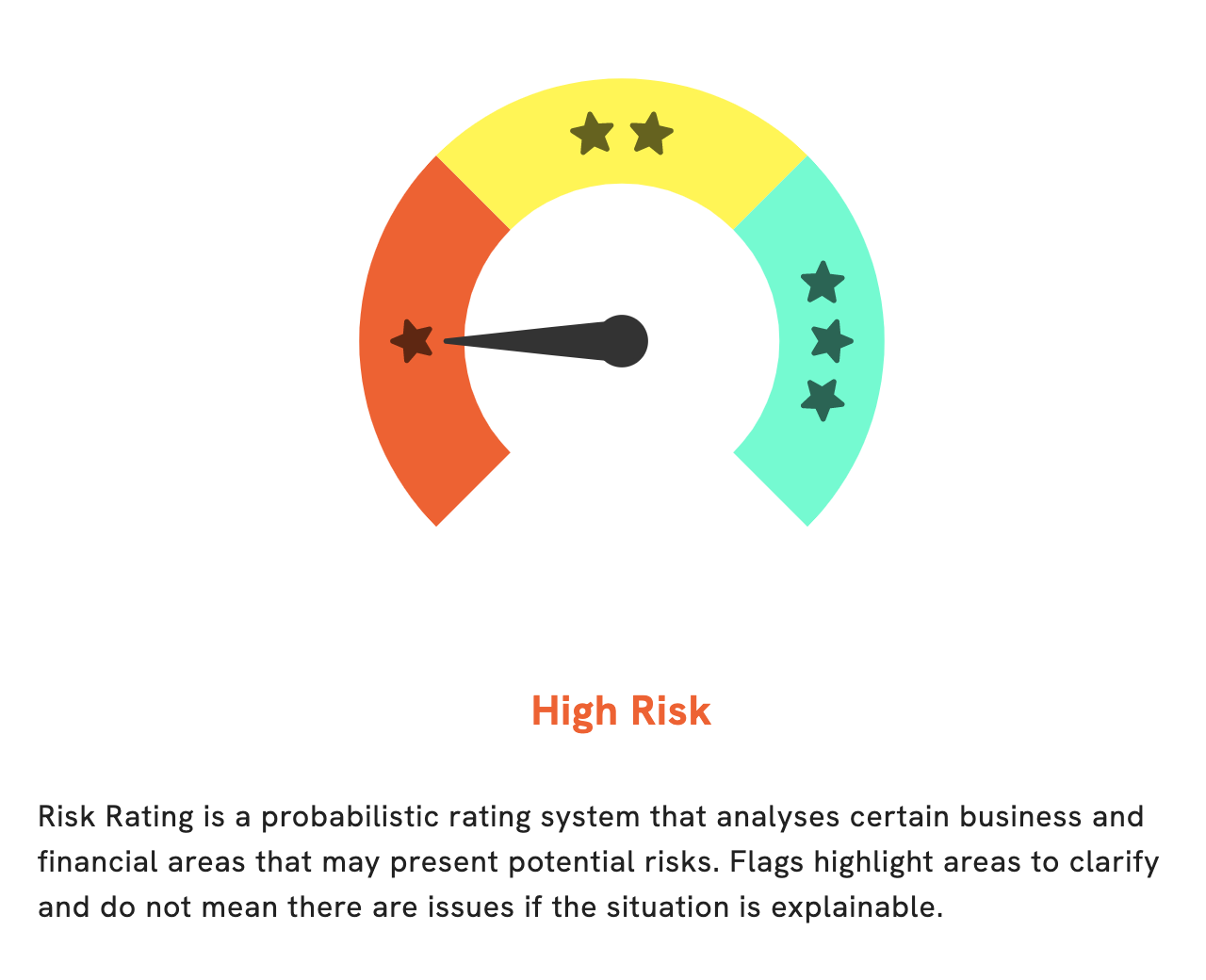

At GoodWhale, we have conducted a thorough financial analysis of ORIGIN MATERIALS. Our risk rating for the company puts it in the high-risk category in terms of both financial and business aspects. We have detected one risk warning in the cashflow statement. To learn more, please register on goodwhale.com. As part of our analysis, we have investigated the company’s balance sheet, income statement, and cashflow statement. We looked at how much money was coming in and out of the business, how capital was being allocated, and what liabilities the company was taking on. We also reviewed the company’s cash reserves and the sources of its cash. Our analysis revealed that ORIGIN MATERIALS is facing a number of risks that could affect its financial performance and put investors at risk. To gain a better understanding of the risks associated with this investment, please register on our website. We will provide you with an in-depth risk report that outlines all of the risks associated with this particular investment. More…

Peers

The company’s products are used in a variety of industries, including automotive, construction, and packaging. Origin Materials Inc’s competitors include KBC Corp Ltd, Daito Chemix Corp, and Jiangsu Dewei Advanced Materials Co Ltd.

– KBC Corp Ltd ($SHSE:688598)

KBC Corp Ltd is a publicly traded company with a market capitalization of $22.72 billion as of 2022. The company has a return on equity of 22.85%. KBC Corp Ltd is a leading provider of banking and financial services in Belgium. The company offers a wide range of services including retail banking, corporate banking, investment banking, asset management, insurance, and private banking.

– Daito Chemix Corp ($TSE:4366)

Daito Chemix Corp is a Japanese company that manufactures and sells chemicals and other products. The company has a market cap of 5.81B as of 2022 and a Return on Equity of 5.73%. Daito Chemix Corp is a publicly traded company on the Tokyo Stock Exchange.

Summary

Origin Materials Inc. is a stock worth considering for investment. In the last session, it closed at $4.08, up 4.88% from closing price the day before. It has undergone at least one restructuring before and there is a good chance that it may go through another restructuring soon.

Investors considering Origin Materials should do their own research and carefully assess the risk associated with investing in this stock. They should also consider the potential rewards, such as the potential for price appreciation, dividends, and other returns associated with investing in Origin Materials.

Recent Posts