Origin Materials Reports Record Earnings and Revenue in Q4

May 11, 2023

Trending News 🌥️

Origin Materials ($NASDAQ:ORGN), a start-up public materials technology company, has released its fourth quarter financial report, and the results are impressive. The company reported GAAP earnings per share of $0.07 which is $0.18 higher than analysts’ expectations. Origin Materials’ revenue was also reported at $1.7M, exceeding the expected $1.3M. The company’s stock has seen a solid increase in value in recent weeks due to the favorable earnings report and revenue figure.

Analysts have been bullish on Origin Materials stock and have praised the company for its growth in the fourth quarter. The company is expected to continue its strong performance into the future and investors are encouraged to take advantage of the opportunity.

Earnings

ORIGIN MATERIALS has reported record earnings and revenues in its fourth quarter earnings report for FY2022, ending December 31 2022. According to the report, ORIGIN MATERIALS saw a total loss in revenue of 0.0M USD, while net income amounted to 15.99M USD – a 205.2% increase over the previous year. Furthermore, the company has seen its total revenue increase from 0.0M USD to 0.0M USD in the past three years. These figures indicate that ORIGIN MATERIALS is on track for record growth and success in the coming years.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Origin Materials. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 78.57 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Origin Materials. More…

| Operations | Investing | Financing |

| -26.09 | 88.85 | 1.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Origin Materials. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 493.7 | 116.8 | 2.64 |

Key Ratios Snapshot

Some of the financial key ratios for Origin Materials are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | 13.5% | 9.9% |

Price History

The stock opened at $4.4 and closed at the same price, up 0.9% from the previous closing of $4.3. This positive financial report follows a successful year of growth for the company. The company also reported a significant increase in profits during the period, demonstrating their ability to handle challenging market conditions and generate strong results.

This latest report will no doubt make ORIGIN MATERIALS an even more attractive investment option for potential investors. With the stock continuing to rise in value, there has never been a better time to get involved with the company. Live Quote…

Analysis

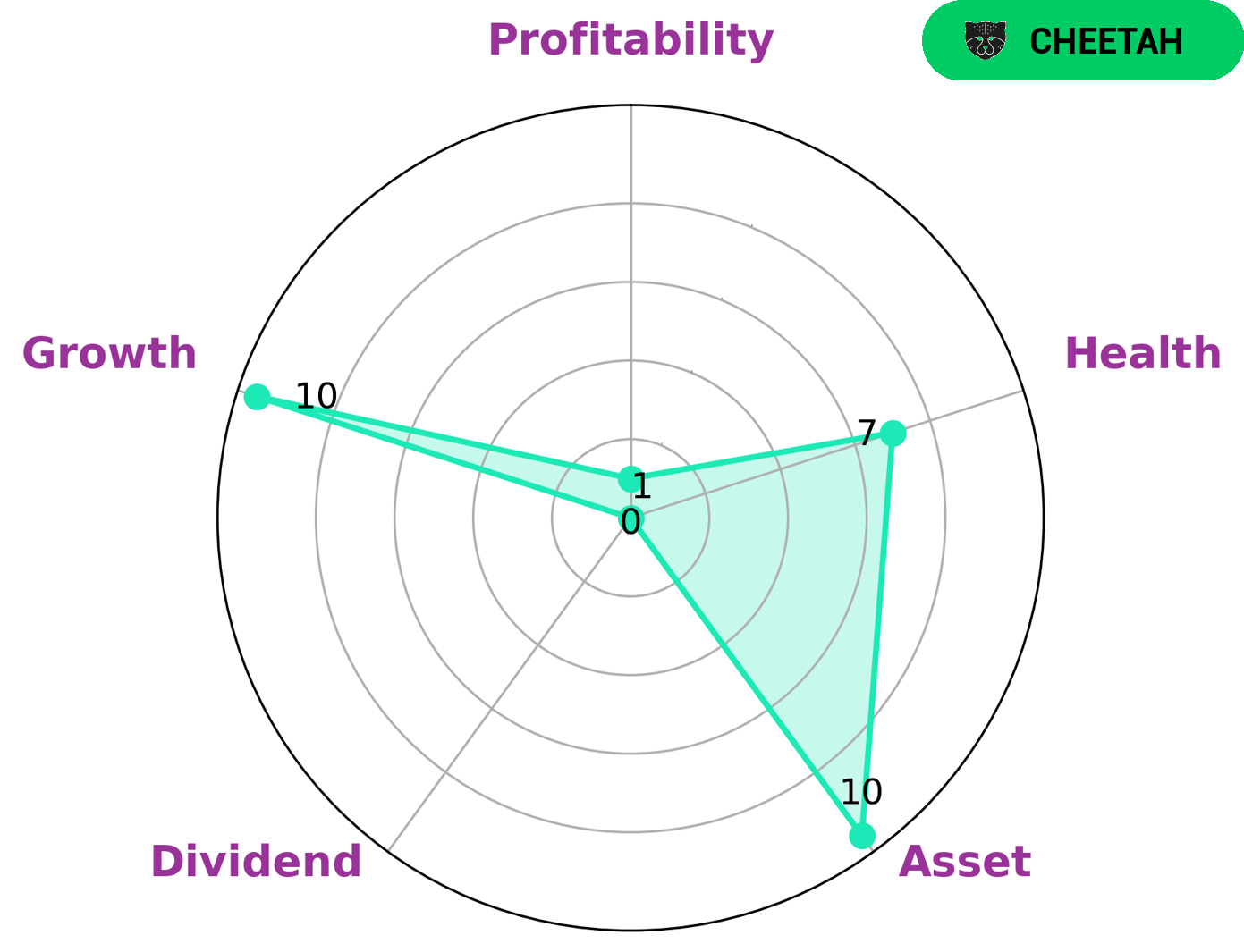

GoodWhale conducted an analysis of ORIGIN MATERIALS‘ wellbeing, and the results were positive. According to our Star Chart, ORIGIN MATERIALS has a high health score of 7/10, taking into account its cashflows and debt. This places the company in a favourable position, capable of safely riding out any crisis without the risk of bankruptcy. Analyzing ORIGIN MATERIALS further, we can see that the company is strong in asset and growth, but weaker in dividend and profitability. This has led us to classify the company as a ‘cheetah’, a type of company which achieves high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be of interest to investors looking for a high rate of return, but who are willing to accept above-average risk. Therefore, it is important for such investors to understand the potential risks associated with investing in a company like ORIGIN MATERIALS. More…

Peers

The company’s products are used in a variety of industries, including automotive, construction, and packaging. Origin Materials Inc’s competitors include KBC Corp Ltd, Daito Chemix Corp, and Jiangsu Dewei Advanced Materials Co Ltd.

– KBC Corp Ltd ($SHSE:688598)

KBC Corp Ltd is a publicly traded company with a market capitalization of $22.72 billion as of 2022. The company has a return on equity of 22.85%. KBC Corp Ltd is a leading provider of banking and financial services in Belgium. The company offers a wide range of services including retail banking, corporate banking, investment banking, asset management, insurance, and private banking.

– Daito Chemix Corp ($TSE:4366)

Daito Chemix Corp is a Japanese company that manufactures and sells chemicals and other products. The company has a market cap of 5.81B as of 2022 and a Return on Equity of 5.73%. Daito Chemix Corp is a publicly traded company on the Tokyo Stock Exchange.

Summary

Origin Materials is a materials technology company that is focused on sourcing, producing and commercializing sustainable, bio-based materials for the consumer products industry. The company’s strong performance is a testament to its commitment to delivering sustainable solutions through its innovative materials technology. Investors should continue to watch Origin Materials closely in the coming quarters to see how their technology advancements will impact the consumer products industry.

Recent Posts