Invest In Huntsman Corporation For Its Exceptional Characteristics

May 18, 2023

Trending News 🌥️

As an investor, the Huntsman Corporation ($NYSE:HUN) could be a great choice due to its exceptional characteristics. The company also employs a highly experienced management team that has a long track record of success. This has enabled them to stay ahead of the competition and ensure their products remain competitive in the marketplace.

Additionally, Huntsman Corporation has an established customer base, which provides them with further growth potential. In conclusion, Huntsman Corporation is an attractive investment option for those seeking diversified exposure to the chemical manufacturing industry. It has a strong balance sheet, returns generous dividends, and boasts an experienced management team. The company’s extensive network of customers and proprietary technologies provide further assurance of long-term growth potential.

Market Price

Investing in Huntsman Corporation is a great decision to make. On Wednesday, the company’s stock opened at $24.9 and closed at $25.4, up 2.5% from the previous closing price of 24.8. This makes Huntsman Corporation an attractive investment opportunity for those looking for strong and consistent returns. The company boasts exceptional characteristics which have been driving their growth. Its vertically integrated operations, wide-ranging portfolio of products, and global reach set Huntsman Corporation apart from its competitors in the chemical industry. They have a strong foothold in the marketplace with loyal customers and a diversified customer base. Their strategic investments in innovation and technology have enabled them to increase their market share.

Their financials are also impressive with consistent growth in revenue, profits and cash flows. This creates a stable platform for investors with the potential for long-term returns. With their commitment to expanding their business, Huntsman Corporation is well-positioned to deliver superior returns to its shareholders. All in all, if you’re looking for a reliable yet profitable investment opportunity, look no further than Huntsman Corporation. Invest in them now and enjoy the benefits of their exceptional characteristics. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Huntsman Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 7.44k | 390 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Huntsman Corporation. More…

| Operations | Investing | Financing |

| 675 | 275 | -1.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Huntsman Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.76k | 3.77k | 20.8 |

Key Ratios Snapshot

Some of the financial key ratios for Huntsman Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.4% | 12.8% | 7.2% |

| FCF Margin | ROE | ROA |

| 5.7% | 9.1% | 4.3% |

Analysis

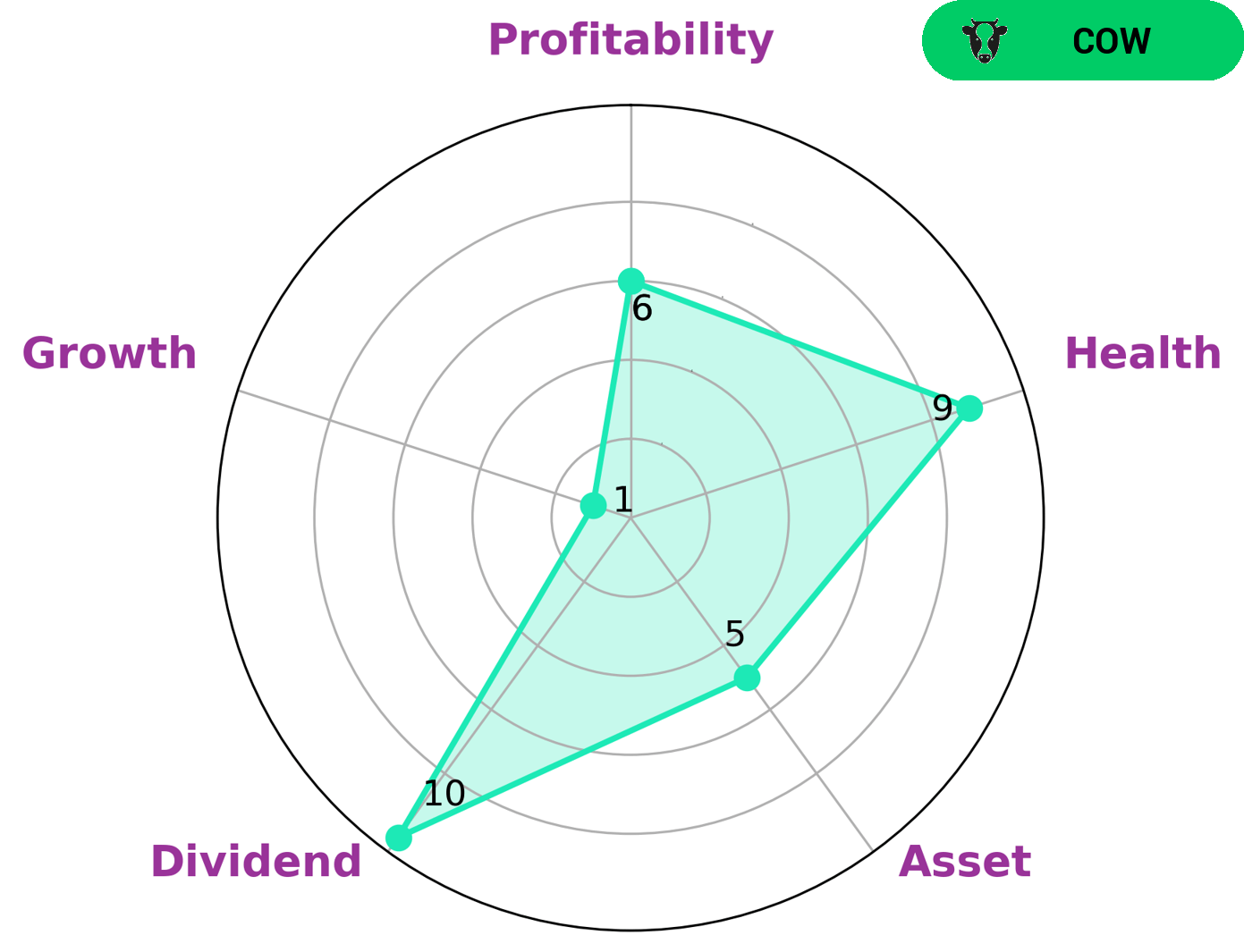

GoodWhale has conducted a financial analysis of HUNTSMAN CORPORATION and our Star Chart gives the company a very high health score of 9/10 with regards to its cashflows and debt, making it well suited to sustain future operations in times of crisis. We classify HUNTSMAN CORPORATION as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. Investors with an interest in dividend-paying stocks may be particularly attracted to HUNTSMAN CORPORATION as it is strong in this area. It also has a medium rating for asset, profitability and weak rating for growth, showing this is not an asset to focus on for long-term growth. However, the strong dividend potential may make it attractive for those looking for income or stability. More…

Peers

They operate in four segments: Polyurethanes, Performance Products, Advanced Materials and Textile Effects. Huntsman Corp’s competitors include Univar Solutions Inc, Solvay SA, Braskem SA.

– Univar Solutions Inc ($NYSE:UNVR)

Univar Solutions Inc is a chemical and ingredient distributor with a market cap of 4.58B as of 2022. The company has a return on equity of 23.02%. Univar Solutions Inc distributes chemicals and ingredients to customers in a variety of industries including oil & gas, food & beverage, pharmaceuticals, personal care, and more. The company has a network of over 200 distribution facilities in North America, Europe, Asia Pacific, and Latin America.

– Solvay SA ($OTCPK:SLVYY)

Solvay SA is a Belgian chemical company with a market cap of 9.61B as of 2022. The company has a Return on Equity of 13.2%. Solvay SA produces a wide range of chemicals, plastics, and performance materials. The company’s products are used in a variety of industries, including automotive, aerospace, electronics, construction, and healthcare. Solvay SA has a strong market position and is well-positioned to continue growing its business.

– Braskem SA ($NYSE:BAK)

Braskem SA is one of the world’s largest petrochemical companies, with a market capitalization of over $5 billion. The company produces a wide range of chemicals and plastics, and has a strong presence in Brazil and other Latin American countries. Braskem’s return on equity is an impressive 65.49%, indicating that the company is generate significant profits for its shareholders. The company is well-positioned to continue its growth in the coming years.

Summary

Huntsman Corporation is a great investment for those looking for long-term growth. The company has a solid track record of financial performance and its core business is supported by a wide range of products and services. Its balance sheet is strong, with low debt levels, and cash flow from operations is consistently positive.

Additionally, its dividend yield is attractive, giving investors access to a steady income stream. The company also enjoys strong support from analysts, which helps to underpin investor confidence in the stock. All in all, Huntsman Corporation is poised to provide investors with an excellent return on their investment.

Recent Posts