Huntsman Corporation Stock Fair Value Calculator – Mizuho Americas Analysts Issue Neutral Rating on Huntsman Corporation

April 14, 2023

Trending News 🌥️

Mizuho Americas has recently issued a Neutral rating on Huntsman Corporation ($NYSE:HUN), a global manufacturer and marketer of specialty chemicals. The company operates in four segments including Specialty Products, Polyurethanes, Advanced Materials and Textile Effects. The company has a long history of innovation and has developed products for the automotive, electronics and construction industries. The analysts believe that Huntsman is well-positioned to manage the challenges brought on by the pandemic. Furthermore, they point out that Huntsman has been successful in acquiring companies to expand its presence in emerging markets and increase its product portfolio. They believe that the company is well-positioned to weather the current challenges brought on by the pandemic and continue its growth trajectory.

However, they also note that investors should be aware of the risks associated with investing in a volatile market.

Stock Price

On Wednesday, Mizuho Americas analysts issued a neutral rating for Huntsman Corporation, with the stock opening at $27.3 and closing at $26.8, representing a 0.5% decrease from the prior closing price of 27.0. While this may be concerning to some investors, the neutral rating suggests that analysts remain optimistic about the company’s potential to perform over the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Huntsman Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 8.02k | 460 | 6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Huntsman Corporation. More…

| Operations | Investing | Financing |

| 914 | -279 | -994 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Huntsman Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.22k | 4.38k | 19.73 |

Key Ratios Snapshot

Some of the financial key ratios for Huntsman Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.7% | 21.0% | 9.5% |

| FCF Margin | ROE | ROA |

| 8.0% | 12.8% | 5.8% |

Analysis – Huntsman Corporation Stock Fair Value Calculator

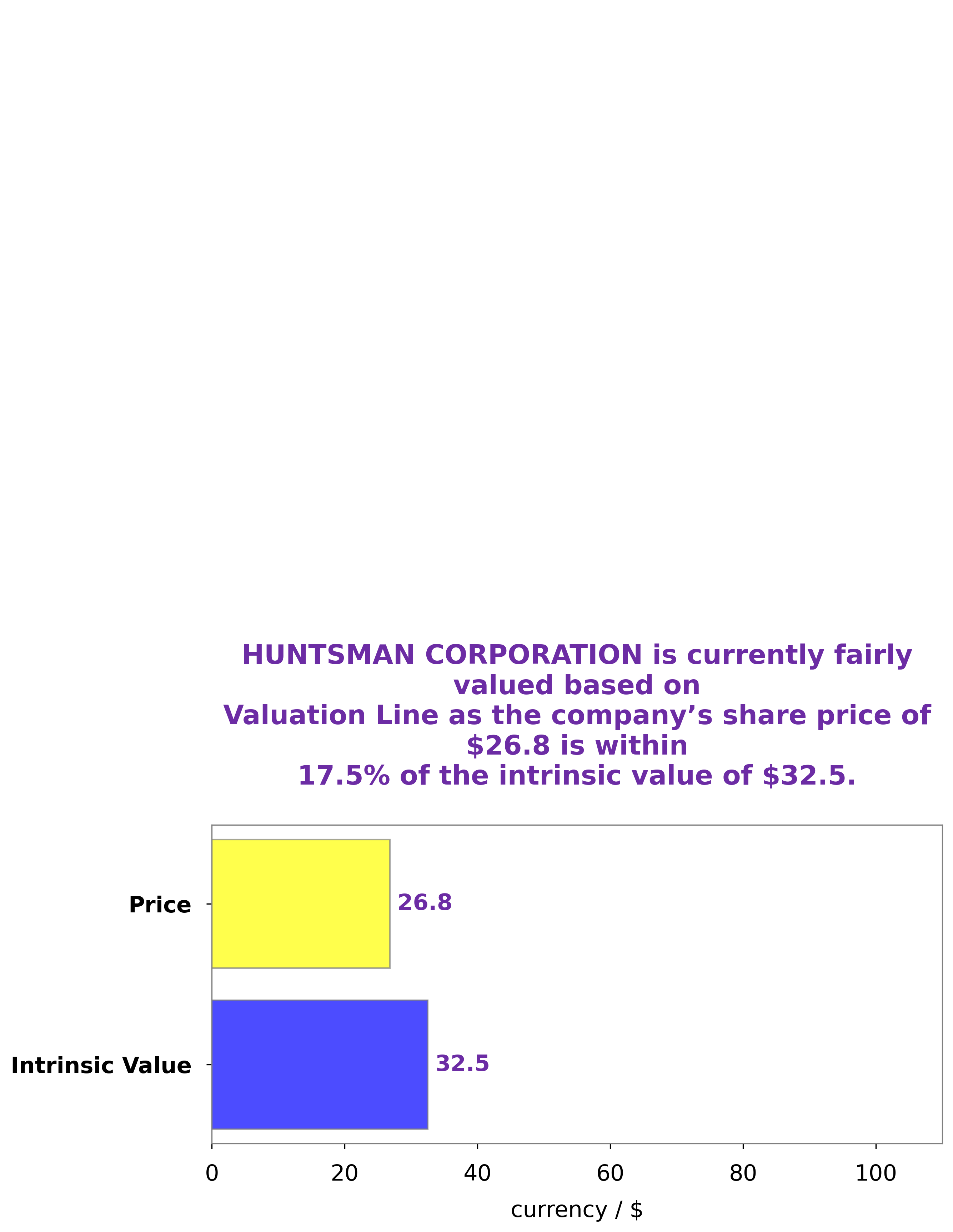

At GoodWhale, we have conducted an analysis of the fundamentals of HUNTSMAN CORPORATION. According to our proprietary Valuation Line, the fair value of HUNTSMAN CORPORATION share is around $32.5. However, currently the stock is traded at $26.8, which is a fair price that is undervalued by 17.6%. We believe that this represents a great opportunity for investors to buy the share at a discounted rate. More…

Peers

They operate in four segments: Polyurethanes, Performance Products, Advanced Materials and Textile Effects. Huntsman Corp’s competitors include Univar Solutions Inc, Solvay SA, Braskem SA.

– Univar Solutions Inc ($NYSE:UNVR)

Univar Solutions Inc is a chemical and ingredient distributor with a market cap of 4.58B as of 2022. The company has a return on equity of 23.02%. Univar Solutions Inc distributes chemicals and ingredients to customers in a variety of industries including oil & gas, food & beverage, pharmaceuticals, personal care, and more. The company has a network of over 200 distribution facilities in North America, Europe, Asia Pacific, and Latin America.

– Solvay SA ($OTCPK:SLVYY)

Solvay SA is a Belgian chemical company with a market cap of 9.61B as of 2022. The company has a Return on Equity of 13.2%. Solvay SA produces a wide range of chemicals, plastics, and performance materials. The company’s products are used in a variety of industries, including automotive, aerospace, electronics, construction, and healthcare. Solvay SA has a strong market position and is well-positioned to continue growing its business.

– Braskem SA ($NYSE:BAK)

Braskem SA is one of the world’s largest petrochemical companies, with a market capitalization of over $5 billion. The company produces a wide range of chemicals and plastics, and has a strong presence in Brazil and other Latin American countries. Braskem’s return on equity is an impressive 65.49%, indicating that the company is generate significant profits for its shareholders. The company is well-positioned to continue its growth in the coming years.

Summary

Huntsman Corporation is a global manufacturer and marketer of differentiated chemicals. The company has recently been the subject of an investment analysis by Mizuho Americas, which gave it a neutral rating. Mizuho’s analysis focused on a number of factors, including Huntsman’s diverse product portfolio, competitive pricing environment, cost-cutting initiatives and industry tailwinds.

It also highlighted Huntsman’s strong balance sheet, which provides the company with financial flexibility to invest in growth initiatives and increase shareholder returns. The analysis concluded that while Huntsman’s cost-cutting efforts and strategic investments could provide upside potential, its stock could remain range-bound given the company’s exposure to certain cyclical markets.

Recent Posts