Huntsman Corporation (NYSE: HUN) Sees Biggest Drop in History – How Will Investors React?

March 31, 2023

Trending News 🌧️

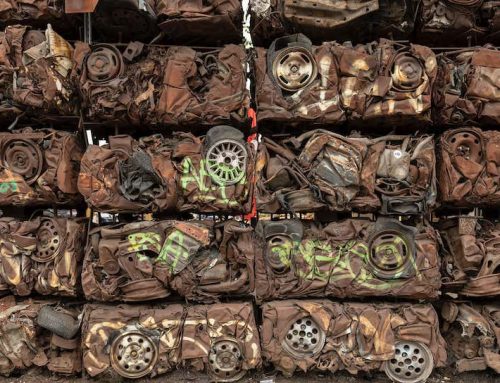

The recent decline in Huntsman Corporation ($NYSE:HUN) (NYSE: HUN) shares has been the biggest drop in the company’s history. In a single day, HUN saw its stock price drop by as much as -50.95% from its peak and left investors wondering how things will turn out in the future. Despite the huge decline, many investors are still hopeful that a swift rebound is possible for Huntsman Corporation. The company’s products serve a broad range of automotive, construction, apparel, health and personal care, refrigeration and air conditioning, agriculture and packaging markets.

Some may choose to take a wait-and-see approach while others may decide to invest in the company at its lowest point in hopes of a recovery. No matter what the individual investor’s strategy is, it is clear that the recent drop in HUN stock is sure to be on the minds of many as the company works to recover and regain investor confidence.

Price History

The stock opened the day at $27.3, but closed at $26.9, signaling a drop of almost two percent from the day before. The market responded quickly, and the drop in stock value was almost immediate. This unexpected drop has investors wondering how to best react to the current situation. While some may choose to remain invested, others may choose to divest their holdings in the company.

Those who choose to remain invested may also consider adjusting their portfolios to minimize their exposure to risk. It remains to be seen how investors will respond in the long-term, but the sudden drop in stock value has certainly caused a stir among those invested in HUNTSMAN CORPORATION. This volatility highlights the importance of diversifying investments, so as to minimize the risk of large losses due to unexpected market drops. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Huntsman Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 8.02k | 460 | 6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Huntsman Corporation. More…

| Operations | Investing | Financing |

| 914 | -279 | -994 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Huntsman Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.22k | 4.38k | 19.73 |

Key Ratios Snapshot

Some of the financial key ratios for Huntsman Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.7% | 21.0% | 9.5% |

| FCF Margin | ROE | ROA |

| 8.0% | 12.8% | 5.8% |

Analysis

We at GoodWhale have conducted an in-depth analysis of HUNTSMAN CORPORATION and their wellbeing. After taking into consideration various financial and business aspects, we have rated them a medium risk investment. This means that there is potential for growth, but also the possibility of losses. We have detected two risk warnings in the income sheet and balance sheet of HUNTSMAN CORPORATION that should be taken into account when considering investing. If you’d like to view more detailed analysis of these warnings, please register on goodwhale.com to get a full report. More…

Peers

They operate in four segments: Polyurethanes, Performance Products, Advanced Materials and Textile Effects. Huntsman Corp’s competitors include Univar Solutions Inc, Solvay SA, Braskem SA.

– Univar Solutions Inc ($NYSE:UNVR)

Univar Solutions Inc is a chemical and ingredient distributor with a market cap of 4.58B as of 2022. The company has a return on equity of 23.02%. Univar Solutions Inc distributes chemicals and ingredients to customers in a variety of industries including oil & gas, food & beverage, pharmaceuticals, personal care, and more. The company has a network of over 200 distribution facilities in North America, Europe, Asia Pacific, and Latin America.

– Solvay SA ($OTCPK:SLVYY)

Solvay SA is a Belgian chemical company with a market cap of 9.61B as of 2022. The company has a Return on Equity of 13.2%. Solvay SA produces a wide range of chemicals, plastics, and performance materials. The company’s products are used in a variety of industries, including automotive, aerospace, electronics, construction, and healthcare. Solvay SA has a strong market position and is well-positioned to continue growing its business.

– Braskem SA ($NYSE:BAK)

Braskem SA is one of the world’s largest petrochemical companies, with a market capitalization of over $5 billion. The company produces a wide range of chemicals and plastics, and has a strong presence in Brazil and other Latin American countries. Braskem’s return on equity is an impressive 65.49%, indicating that the company is generate significant profits for its shareholders. The company is well-positioned to continue its growth in the coming years.

Summary

Huntsman Corporation (NYSE: HUN) is a chemical manufacturing company that has recently seen a sharp decrease in its stock market value. An investing analysis of the company indicates that the drop from its high of -50.95% is unlikely to be reversed quickly due to factors such as increasing competition in the industry, unaddressed debt, and a large number of shares outstanding. While the company’s long-term future remains unclear, investors should carefully monitor its progress as it works to address debt and other challenges facing the company in order to secure long-term growth.

Recent Posts