T r a d e w e b M a r k e t s I n c S h a r e s S t a l l i n F e b r u a r y D e s p i t e I m p r o v e d M a r k e t S e n t i m e n t

March 1, 2023

Trending News ☀️

TRADEWEB ($NASDAQ:TW): D e s p i t e i n c r e a s e d m a r k e t o p t i m i s m i n J a n u a r y , T r a d e w e b M a r k e t s I n c . s h a r e s h a v e s t a l l e d i n F e b r u a r y .

Market Price

In February, despite improved market sentiment, TRADEWEB MARKETS INC stocks remained relatively stagnant. On Tuesday, the company opened at $70.9, and closed at the same price, indicating no increase in stock prices. This trend is contrary to many other stocks that have shown an upturn in recent weeks, led in part by the optimism surrounding the new US presidential administration and their fiscal policies. TRADEWEB MARKETS INC may have seen a lack of investor confidence regarding their current prospects, though this is not yet clear.

It may also be the case that investors are still assessing whether or not the company will benefit from the new economic climate. The future of TRADEWEB MARKETS INC remains uncertain as the market sentiment continues to change in February. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tradeweb Markets. More…

| Total Revenues | Net Income | Net Margin |

| 1.19k | 309.34 | 26.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tradeweb Markets. More…

| Operations | Investing | Financing |

| 616.47 | -259.11 | -136.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tradeweb Markets. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.14k | 683.03 | 23.39 |

Key Ratios Snapshot

Some of the financial key ratios for Tradeweb Markets are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 24.1% | 35.9% |

| FCF Margin | ROE | ROA |

| 46.7% | 5.5% | 4.3% |

Analysis

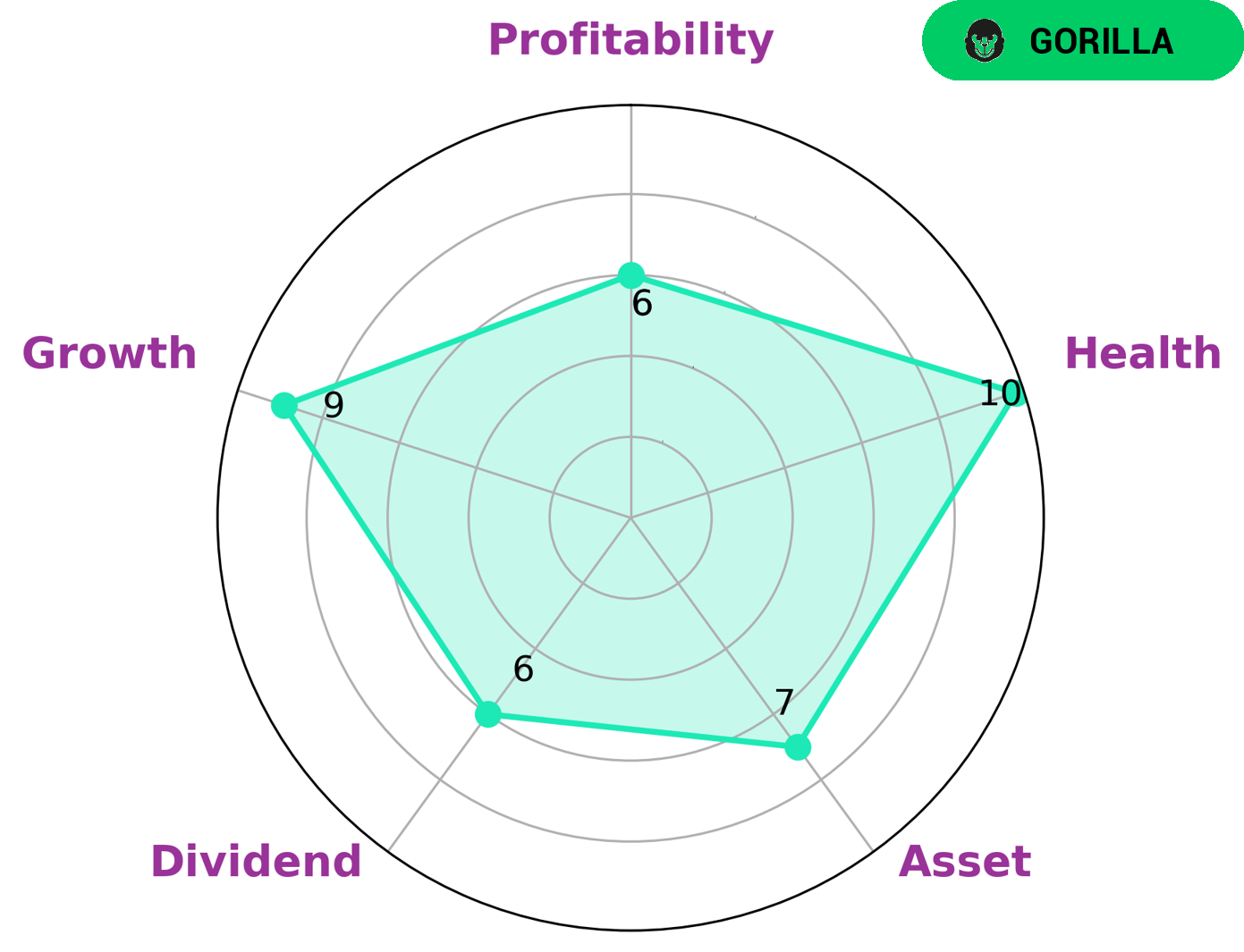

GoodWhale has analyzed the financials of TRADEWEB MARKETS and the results are encouraging. According to the Star Chart, TRADEWEB MARKETS boasts a high health score of 10/10, suggesting its cashflows and debt are managed in a way that will enable it to pay off debt and fund future operations. Further, TRADEWEB MARKETS is classified as a ‘gorilla’, meaning it achieved stable and high revenue or earning growth due to its strong competitive advantage. GoodWhale has reviewed the company’s asset, growth, dividend, and profitability metrics and found it is strong in asset and growth, and medium in dividend and profitability. These characteristics make it attractive to a variety of investors looking for a steady, secure option for their portfolio. Value investors may be particularly interested in this company as its low debt burden could indicate potential for further growth. Growth investors may also appreciate the company’s long-term prospects with its proven track record of success. More…

Peers

It is one of the four major electronic trading firms that dominate the global electronic trading landscape, alongside MarketAxess Holdings Inc, Global Brokerage Inc, and Gogia Capital Services Ltd. All four companies provide innovative solutions to facilitate efficient price discovery and execution for a wide range of market participants.

– MarketAxess Holdings Inc ($NASDAQ:MKTX)

Axess Holdings Inc is a leading provider of electronic trading and market data services to the global fixed income markets. It operates the largest electronic trading platform for fixed income securities in the United States, providing access to a wide range of institutional investors and dealers. As of 2022, Axess’s market capitalization stands at 10.57 billion dollars, making it one of the leaders in the fixed income space. Its impressive return on equity (ROE) of 20.5% reflects its strong performance in recent years and its potential for future growth. The company has invested heavily in developing its technology infrastructure and expanding its product offerings, allowing it to capture a larger share of the global fixed income market.

– Global Brokerage Inc ($OTCPK:GLBR)

Global Brokerage Inc is an international financial services company that specializes in providing a range of brokerage and investment services. The company has a market capitalization of 137,000 as of 2022, which is a measure of the company’s size and value. Return on Equity (ROE) is a measure of profitability which shows how much profit the company is able to generate from its shareholders’ investments. Global Brokerage Inc has a ROE of -19.36%, which means that it is not generating any profits from its shareholders’ investments. This suggests that the company is not performing well and has potential problems that need to be addressed.

– Gogia Capital Services Ltd ($BSE:531600)

Gogia Capital Services Ltd is a diversified financial services company based in India. The company offers a range of services, including Investment Banking, Corporate Finance, Mergers and Acquisitions, Broking Services, securities issuance and advisory services. As of 2022, the company has a market capitalization of 790.14M and a Return on Equity (ROE) of 6.0%. This indicates that the company is generating an adequate return on its equity investments and has a strong financial position. Furthermore, Gogia Capital Services Ltd is well-positioned to capitalize on growth opportunities in the future.

Summary

TRADEWEB MARKETS Inc. is a global financial services firm providing institutional investors and other market participants with access to an efficient, transparent and reliable trading platform. In February, despite improved market sentiment, the company’s shares stalled.

However, a thorough investment analysis reveals that TRADEWEB MARKETS Inc. has sound fundamentals, including a diversified product portfolio, successful partnerships with major banks, a broad range of services and experienced management.

Additionally, the company has invested in cutting-edge technology to ensure secure and efficient trading, and has a strong track record of financial stability and profitability. As such, investors may find value in TRADEWEB MARKETS shares for their long-term portfolios.

Recent Posts