RayJay Raises Charles Schwab to Outperform as Cash Sorting Eases

May 16, 2023

Trending News ☀️

Investment bank Raymond James upgraded their rating of stock brokerage company Charles Schwab ($NYSE:SCHW) from “Market Perform” to “Outperform” on the back of easing cash sorting. Charles Schwab is a financial services company offering investment, banking, asset management, and other financial products and services to individual investors and independent investment advisors. As a leader in the financial industry, Charles Schwab is one of the largest retail brokerage firms in the United States. RayJay’s upgrade of Charles Schwab to “Outperform” is based on the increased ease of cash sorting for the company. The easing of cash sorting means that Charles Schwab can better serve its customers as well as save on costs associated with sorting and managing cash. This could potentially lead to higher profits and better customer satisfaction, which can benefit shareholders in the long-term.

Additionally, RayJay noted that the company’s focus on technology and investments in digital products have created a competitive advantage for the firm. Overall, RayJay’s upgrade of Charles Schwab to “Outperform” is based on the increased ease of cash sorting as well as its focus on technology and investments in digital products. This upgrade is good news for investors in the company, as it could lead to higher profits and improved customer satisfaction.

Price History

On Monday, CHARLES SCHWAB stock opened at $50.5 and closed at $50.9, up by 4.1% from prior closing price of 48.9. The bump in price was due to the easing of cash sorting in the near-term which should serve as a boost to the company’s financial performance. This upgrade follows recent success in the market as their shares continue to hit record highs. With the uncertainty of the current economic landscape, CHARLES SCHWAB has remained resilient and is expected to see a sustained positive outlook in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Charles Schwab. More…

| Total Revenues | Net Income | Net Margin |

| 21.21k | 6.89k | 34.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Charles Schwab. More…

| Operations | Investing | Financing |

| 2.06k | 32.05k | -68.72k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Charles Schwab. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 551.77k | 515.16k | 20.13 |

Key Ratios Snapshot

Some of the financial key ratios for Charles Schwab are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.9% | – | – |

| FCF Margin | ROE | ROA |

| 5.1% | 16.5% | 1.1% |

Analysis

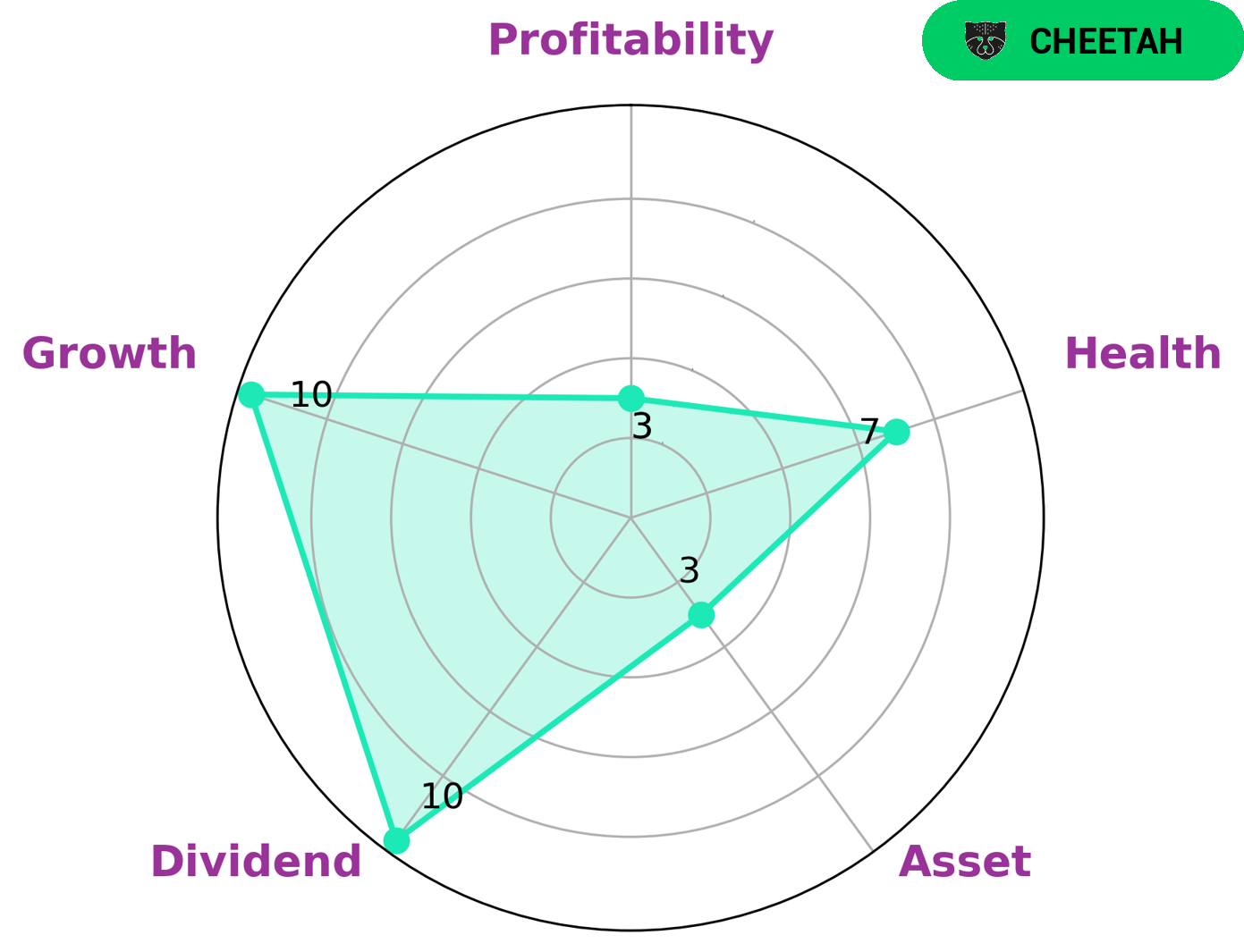

At GoodWhale, we have conducted an analysis of Charles Schwab’s fundamentals to better inform potential investors. We are pleased to report that the company has a high health score of 7/10, indicating a sound standing in terms of its cashflows and debt, and capability to safely ride out any crisis without the risk of bankruptcy. In accordance with our proprietary Star Chart, Charles Schwab is classified as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth in the past but is considered less stable due to lower profitability. This would make the company an interesting pick for investors seeking both dividend and growth opportunities. However, it is important to note that Charles Schwab performs weakly in terms of asset and profitability and should be taken into account when making an investment decision. More…

Peers

Charles Schwab Corp is an American financial services company with headquarters in San Francisco, California. The company was founded in 1971 by Charles Schwab and offers a wide variety of financial services including banking, investments, and retirement planning. Morgan Stanley, CITIC Securities Co Ltd, and Samsung Securities Co Ltd are all competitors of Charles Schwab in the financial services industry.

– Morgan Stanley ($NYSE:MS)

As of 2022, Morgan Stanley’s market cap is 137.06B with a ROE of 9.95%. Morgan Stanley is a leading global financial services firm that provides a full range of investment banking, securities, investment management and wealth management services. The company has offices in more than 42 countries and employs over 60,000 people.

– CITIC Securities Co Ltd ($SHSE:600030)

CITIC Securities Co Ltd has a market cap of 244.81B as of 2022. The company’s return on equity is 7.96%. CITIC Securities Co Ltd is a leading investment bank in China with a focus on providing comprehensive financial services to clients in the areas of securities, investment banking, and asset management.

– Samsung Securities Co Ltd ($KOSE:016360)

Samsung Securities Co Ltd is a South Korean investment bank and brokerage firm. It is a subsidiary of the Samsung Group. The company has a market capitalization of 2.84 trillion as of 2022 and a return on equity of 10.07%. The company provides a range of financial services, including investment banking, equity research, asset management, and more.

Summary

Charles Schwab is a leading investment services provider in the United States. Recently, Raymond James upgraded the company’s stock rating to Outperform, citing eased cash sorting as one of the major drivers that could aid its financial performance. As a result, the stock price of Charles Schwab moved up on the same day.

Analysts believe that Charles Schwab’s investments should keep growing in the near future, as investors could benefit from their broad range of services and low cost structure. Going forward, analysts expect that Charles Schwab will continue to be a strong performer in the investment market and create value for its stakeholders.

Recent Posts