Prudential Financial Invests in MarketAxess Holdings, Purchasing 15866 Shares.

February 3, 2023

Trending News ☀️

MARKETAXESS ($NASDAQ:MKTX): Prudential Financial Inc. recently announced their investment in MarketAxess Holdings Inc. by purchasing a total of 15866 shares. MarketAxess Holdings Inc. is a leading operator in the electronic trading of fixed-income securities and a provider of related services worldwide. It is headquartered in New York City with offices in Amsterdam, Boston, London, Hong Kong, and other locations across the globe. The company operates its Marketplace, which is an electronic trading platform that connects institutional investor clients with broker-dealer firms that provide liquidity in the global credit markets. This platform provides pre-trade analytics, real-time price discovery, and post-trade processing services. Through its Open Trading protocol, MarketAxess also provides clients with an integrated end-to-end trading solution for the execution of fixed-income transactions.

MarketAxess has also achieved several awards and recognitions for their innovative technology, including the FinTech Breakthrough Award for Best Trading Platform and the American Financial Technology Award for Best Trading Platform. The recent investment by Prudential Financial Inc. further demonstrates their recognition of MarketAxess’ strong market presence and its potential for continued growth and success. Prudential is a global financial services leader that provides solutions to help individuals, families and businesses reach their financial goals. By investing in MarketAxess, Prudential is helping to ensure that the company continues to provide the best services to its clients.

Stock Price

The news was met with mostly positive sentiment, as shares rose in the market shortly after the announcement. On Monday, MarketAxess Holdings stock opened at $370.9 and closed at $367.2, down by 1.4% from its previous closing price of $372.4. This investment has been seen as a sign of confidence in the company and its products, especially in light of recent market volatility. The company has also recently been expanding on a global level and is now one of the largest online trading platforms for corporate bonds and other fixed-income instruments. The company has seen steady growth over the past few years, and many investors feel that the investment from Prudential Financial Inc. will only further strengthen its standing in the market.

This could open up more opportunities for market participants, as well as providing a more efficient and secure platform for trading fixed-income securities. Overall, Prudential Financial Inc.’s investment in MarketAxess Holdings Inc. is seen as a vote of confidence in the company and its products. It is expected that this investment will help to further enhance the company’s presence in the market and provide more opportunities for market participants. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Marketaxess Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 718.3 | 250.22 | 34.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Marketaxess Holdings. More…

| Operations | Investing | Financing |

| 300.72 | -67.69 | -189.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Marketaxess Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.61k | 526.68 | 27.07 |

Key Ratios Snapshot

Some of the financial key ratios for Marketaxess Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.0% | 9.2% | 47.2% |

| FCF Margin | ROE | ROA |

| 35.6% | 20.2% | 13.2% |

VI Analysis

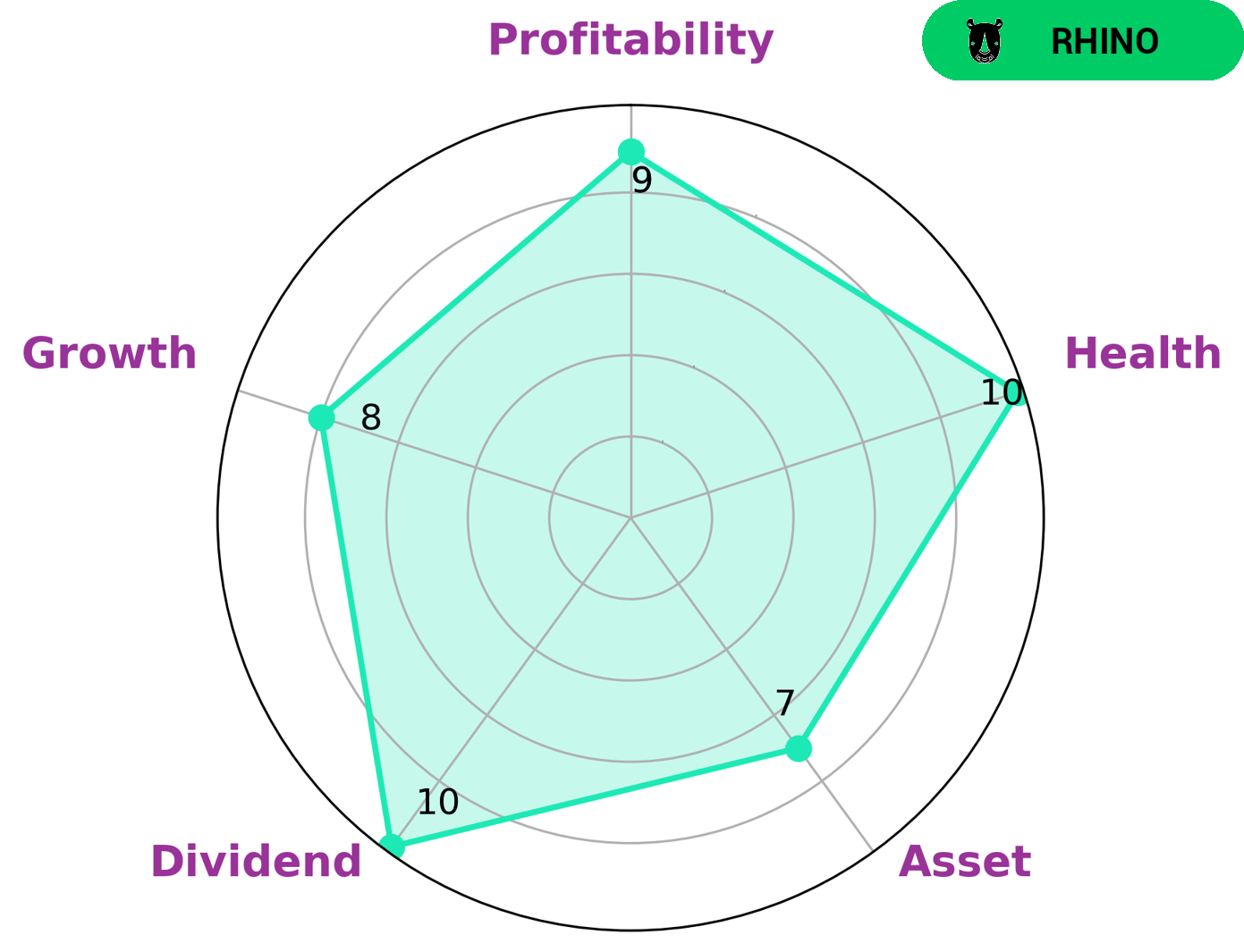

The VI app makes analyzing MARKETAXESS HOLDINGS‘ fundamentals and long-term potential easier than ever. The VI Star Chart shows that MARKETAXESS HOLDINGS has strong fundamentals in asset, dividend, growth, and profitability. MARKETAXESS HOLDINGS is also classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This makes MARKETAXESS HOLDINGS an attractive option for investors who are looking for a moderate amount of growth. Investors who are looking for steady returns may be interested in this type of company due to its stability and reliability.

Furthermore, MARKETAXESS HOLDINGS has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. Overall, MARKETAXESS HOLDINGS is a strong investment option for investors who are looking for moderate returns with minimal risk. The company has a strong balance sheet, healthy cash flows and debt management, and moderate growth potential. This makes MARKETAXESS HOLDINGS an attractive option for investors who want a reliable and steady return on their investments.

Peers

MarketAxess Holdings Inc is a leading financial markets technology company. It provides an electronic trading platform for fixed income securities, including corporate bonds, government and agency bonds, asset-backed securities, and credit default swaps. The company’s competitors include Tradeweb Markets Inc, Aryaman Capital Markets Ltd, and Matsui Securities Co Ltd.

– Tradeweb Markets Inc ($NASDAQ:TW)

Tradeweb Markets Inc is a financial markets platform company. It has a market cap of 10.91B and a ROE of 6.51%. The company offers electronic trading for a variety of fixed income products, including government bonds, corporate bonds, mortgage-backed securities, and credit default swaps. It also provides post-trade processing and analytics. The company was founded in 1996 and is headquartered in New York, New York.

– Aryaman Capital Markets Ltd ($BSE:538716)

With a market cap of 707.85M as of 2022, Aryaman Capital Markets Ltd is a company that is doing quite well. The company has a Return on Equity of 10.69%. The company deals in providing financial services and is based in India. The company is doing quite well in terms of its market cap and ROE.

– Matsui Securities Co Ltd ($TSE:8628)

Matsui Securities Co., Ltd. is a Japanese securities firm headquartered in Tokyo. It is a member of the Nikkei 225 stock index. The company was founded in 1931 and its current president is Takuya Matsui. The company offers a range of services including retail and institutional brokerage, investment banking, and research. It has offices in Tokyo, Osaka, Nagoya, and Fukuoka.

Summary

MarketAxess Holdings Inc. is an online fixed income securities trading platform and is a leading provider of electronic trading in credit markets. Prudential Financial Inc. recently invested in MarketAxess, purchasing 15866 shares. Analysts are optimistic about the investment, citing MarketAxess’ strong market presence, solid liquidity, and innovative technology as reasons for the potential success of the purchase. The company’s stock has been trending upwards since the announcement and looks poised to continue its growth trajectory.

MarketAxess also has a strong customer base, with a wide range of institutional investors, banks, and financial services firms utilizing its services. As such, analysts believe that the company’s future looks bright and that the investment by Prudential Financial could be a lucrative one.

Recent Posts