Hengtai Securities Reports 30% Revenue Decline and CN¥0.49 Loss Per Share in Full Year 2022 Earnings.

March 30, 2023

Trending News ☀️

Hengtai Securities ($SEHK:01476) has reported their financial results for the full year of 2022, presenting a significant decline in revenue and an overall loss. Revenue for the period was CN¥2.26b, a decrease of 30% from the previous fiscal year. Moreover, the company reported a loss per share of CN¥0.49. This news comes as a surprise to many industry analysts, as just last month Hengtai Securities reported strong quarterly results with double-digit growth.

However, the full year results were significantly different, with the company’s bottom line suffering due to such a large decline in revenue. The company has not yet released a statement regarding the financial results. Investors and analysts are eager to hear what measures they are taking to reverse this negative trend, and help the company recover in the coming year. Overall, Hengtai Securities has reported a difficult financial year and investors are eager to see if the company can make a recovery in the future. It remains to be seen if Hengtai can turn its fortunes around in the coming months and quarters.

Market Price

Despite this news, investors did not seem overly concerned as the stock opened at HK$2.7 and closed at HK$2.7, down by only 2.9% from its last closing price of HK$2.8. This suggests that the market is expecting the company to bounce back in the near future as there has been generally positive media exposure surrounding HENGTAI SECURITIES recently. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hengtai Securities. More…

| Total Revenues | Net Income | Net Margin |

| 2.5k | -63.72 | 0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hengtai Securities. More…

| Operations | Investing | Financing |

| 3.26k | -1.23k | -1.82k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hengtai Securities. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 37.45k | 28.12k | 3.43 |

Key Ratios Snapshot

Some of the financial key ratios for Hengtai Securities are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.5% | – | 19.2% |

| FCF Margin | ROE | ROA |

| 124.6% | 3.3% | 0.8% |

Analysis

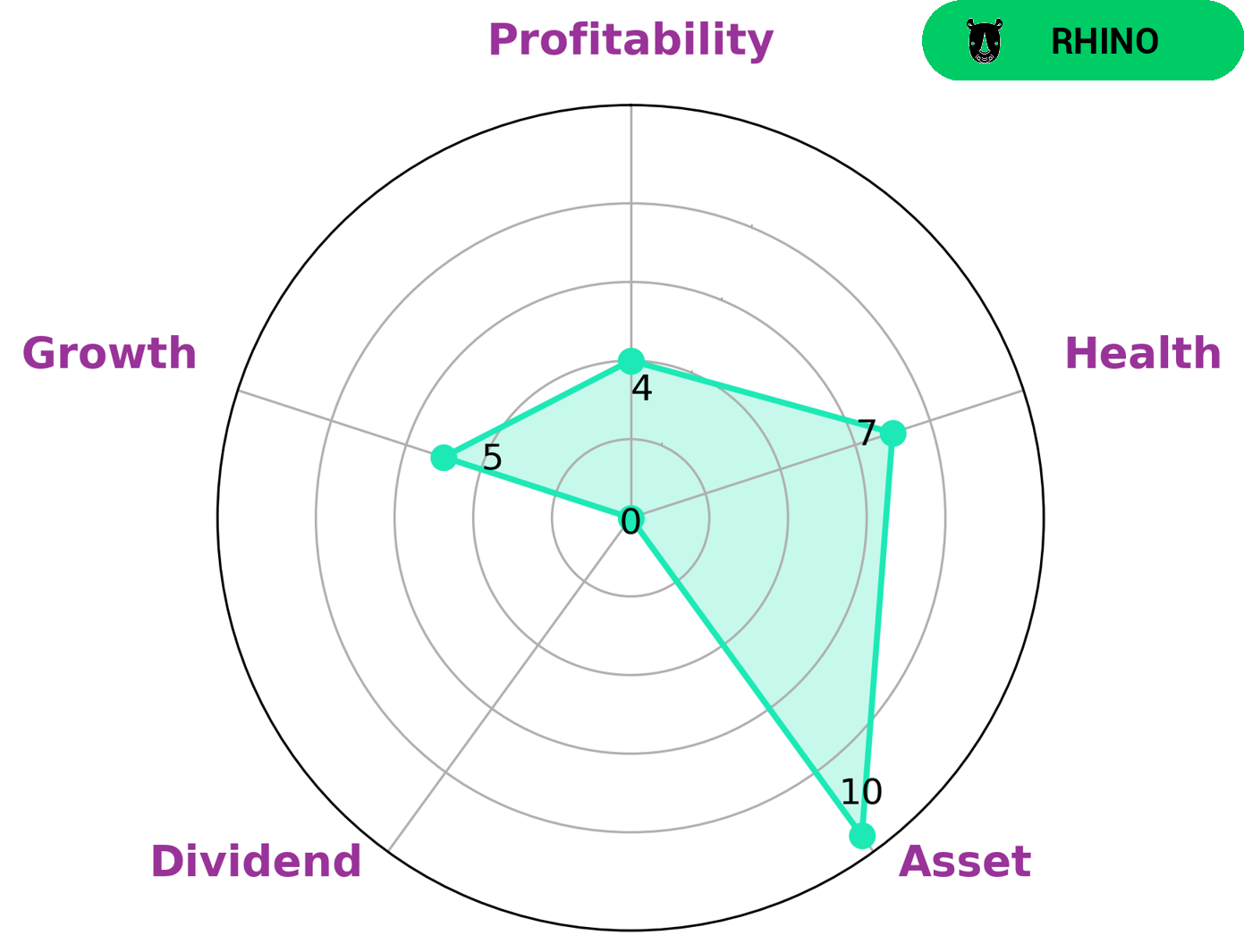

At GoodWhale, we have analyzed the financials of HENGTAI SECURITIES in great detail. According to our Star Chart, HENGTAI SECURITIES has a high health score of 7 out of 10, indicating that it is capable to pay off debt and fund future operations. We have classified HENGTAI SECURITIES as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. Based on our analysis, investors who are interested in companies with strong asset management but medium growth, profitability and dividend could look at HENGTAI SECURITIES. The company’s asset management appears to be strong and its revenue and earnings growth are at moderate levels. However, its profitability and dividend potential may be weaker than other companies in the industry. Overall, HENGTAI SECURITIES is a solid company when it comes to asset management, with potential for moderate growth. Investors should further investigate the company’s financials before investing to determine if the company is a good fit for their portfolio. More…

Peers

It competes with other large firms such as Haitong Securities Co Ltd, Guolian Securities Co Ltd, and Central China Securities Co Ltd for clients and for market share. All of these companies provide comprehensive services such as asset management, securities trading, and financial advisory services.

– Haitong Securities Co Ltd ($SHSE:600837)

Haitong Securities Co Ltd is one of the largest securities firms in China. It provides services such as stock and bond brokerage, underwriting, corporate finance, asset management and margin trading. Its market capitalization of 99.12B as of 2023, indicates the potential and size of the company. Additionally, the company’s Return on Equity (ROE) of 3.53% shows that it is making effective use of its assets to generate higher returns for its shareholders.

– Guolian Securities Co Ltd ($SEHK:01456)

Guolian Securities Co Ltd is a leading provider of securities brokerage and investment services in China. Founded in 1995 and listed on the Shenzhen Stock Exchange, the company has a market cap of 31.04B as of 2023. Guolian Securities Co Ltd has a strong balance sheet with a Return on Equity (ROE) of 8.64%, which indicates that the company is able to generate returns from its equity investments. This high ROE proves the company’s ability to effectively manage its assets and liabilities and generate profits. With a strong financial standing and a diversified portfolio of services, Guolian Securities Co Ltd is well-positioned to become an even stronger player in the Chinese securities and investments markets.

– Central China Securities Co Ltd ($SHSE:601375)

Central China Securities Co Ltd is a financial services company that provides brokerage, investment banking, research, and asset management services. It has a market capitalization of 14.19 billion as of 2023. This value represents the total value of its outstanding shares and gives an indication of how much the company is currently worth in the eyes of investors. Moreover, Central China Securities Co Ltd has a Return on Equity of 0.79%, which indicates the profitability of the company from its shareholders’ perspective. This number is a measure of how much money the company is able to generate from every dollar of shareholder’s equity. In conclusion, Central China Securities Co Ltd is a reliable and profitable financial services company.

Summary

Hengtai Securities, one of the leading providers of investment services in China, recently reported a 30% decline in revenue and CN¥0.49 loss per share for the full year 2022. Despite the impact of the pandemic, media coverage appears to remain generally positive on the company. Investors are advised to consider several factors before making a decision about Hengtai Securities. An analysis of the company’s financials is essential to gauge the effects of their recent losses on long-term profitability.

Additionally, investors should take into account the company’s market position, competitive environment, and growth potential. With a comprehensive evaluation, investors will be able to make informed decisions about their investments in Hengtai Securities.

Recent Posts