Charles Schwab Reports Record Quarterly Earnings Despite Revenue Miss

April 18, 2023

Trending News ☀️

Charles Schwab ($NYSE:SCHW), a financial services and investment firm, recently reported its quarterly earnings. The company attributed the revenue miss to lower asset management fees due to lower market volatility and customer trading activity.

In addition, Schwab’s net interest income also declined due to lower yields and net interest margin compression. Despite the revenue miss, Charles Schwab reported record profits due to cost controls, higher client assets and increased customer deposits. The company also benefitted from a one-time gain from the sale of asset management business. Overall, Charles Schwab delivered record quarterly earnings despite missing its revenue target. The company’s cost controls and one-time gains enabled it to post profits that were significantly higher than the same period last year.

Market Price

Charles Schwab reported record quarterly earnings on Monday, with their stock opening at $49.5 and closing at $52.8, up by 3.9% from last closing price of 50.8. Despite this impressive performance, the company missed their revenue targets, suggesting that they still have some ground to make up in order to meet their financial goals. Despite this miss, the quarterly results demonstrate that Charles Schwab is continuing to grow and improve its financial picture.

This is reassuring to investors who are looking for a reliable and profitable investment. Going forward, Charles Schwab will need to continue to focus on increasing revenues and controlling costs in order to continue to deliver impressive returns for their investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Charles Schwab. More…

| Total Revenues | Net Income | Net Margin |

| 20.76k | 6.63k | 34.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Charles Schwab. More…

| Operations | Investing | Financing |

| 2.06k | 32.05k | -68.72k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Charles Schwab. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 551.77k | 515.16k | 19.74 |

Key Ratios Snapshot

Some of the financial key ratios for Charles Schwab are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.6% | – | – |

| FCF Margin | ROE | ROA |

| 5.2% | 15.9% | 1.1% |

Analysis

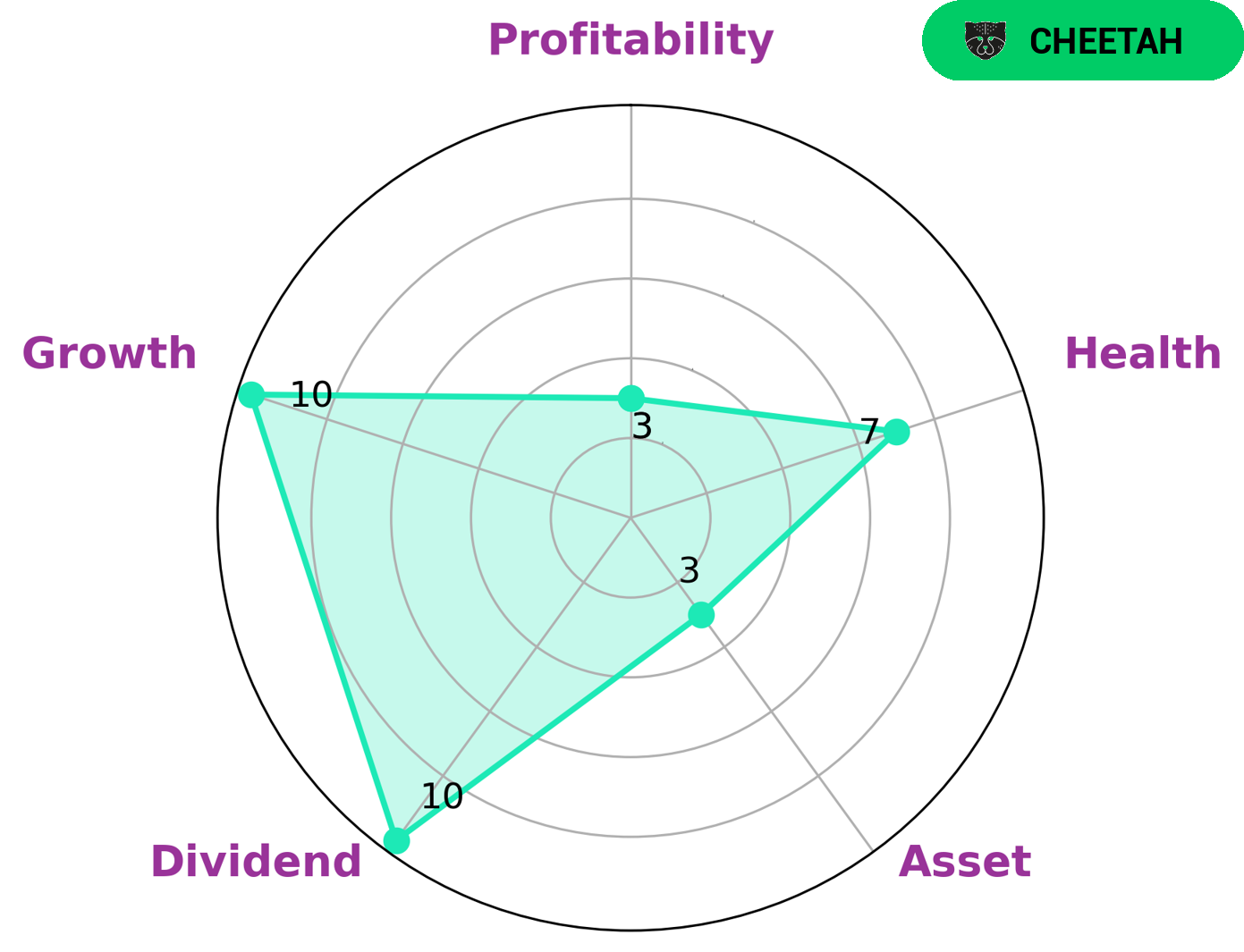

We at GoodWhale conducted an analysis of CHARLES SCHWAB‘s wellbeing and found that the company is strong in terms of dividend and growth. However, it is weak in asset and profitability. From our classification of ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability, we conclude that CHARLES SCHWAB is one such company. Considering the high health score of 7/10 that CHARLES SCHWAB has based on its cashflows and debt, investors who are looking for growth and value investing opportunities may be interested in this company. In addition, CHARLES SCHWAB is capable of safely riding out any crisis due to its strong financial health, making it a desirable choice for investors who seek stability and safe returns. More…

Peers

Charles Schwab Corp is an American financial services company with headquarters in San Francisco, California. The company was founded in 1971 by Charles Schwab and offers a wide variety of financial services including banking, investments, and retirement planning. Morgan Stanley, CITIC Securities Co Ltd, and Samsung Securities Co Ltd are all competitors of Charles Schwab in the financial services industry.

– Morgan Stanley ($NYSE:MS)

As of 2022, Morgan Stanley’s market cap is 137.06B with a ROE of 9.95%. Morgan Stanley is a leading global financial services firm that provides a full range of investment banking, securities, investment management and wealth management services. The company has offices in more than 42 countries and employs over 60,000 people.

– CITIC Securities Co Ltd ($SHSE:600030)

CITIC Securities Co Ltd has a market cap of 244.81B as of 2022. The company’s return on equity is 7.96%. CITIC Securities Co Ltd is a leading investment bank in China with a focus on providing comprehensive financial services to clients in the areas of securities, investment banking, and asset management.

– Samsung Securities Co Ltd ($KOSE:016360)

Samsung Securities Co Ltd is a South Korean investment bank and brokerage firm. It is a subsidiary of the Samsung Group. The company has a market capitalization of 2.84 trillion as of 2022 and a return on equity of 10.07%. The company provides a range of financial services, including investment banking, equity research, asset management, and more.

Summary

Charles Schwab reported non-GAAP earnings per share (EPS) of $0.93 for the quarter, beating analyst expectations by $0.03. Revenue of $5.12B fell short of analyst forecasts by $10M. Despite the revenue miss, the stock price moved up on the news.

This demonstrates that investors may be focusing more on the beat in EPS than the revenue miss. Analyzing the fundamentals of a company is essential to investing, and it appears that a strong earnings report was enough to outweigh any concerns over revenue in the case of Charles Schwab.

Recent Posts