Ennis dividend calculator – Ennis Announces 0.25 Cash Dividend

April 9, 2023

Dividends Yield

On April 1 2023, Ennis ($NYSE:EBF) Inc. announced its latest cash dividend of 0.25 USD per share, making it an attractive dividend stock for investors looking for steady income. Over the last three years, the company has issued a dividend per share of 1.0, 0.98 and 0.9 USD respectively. This gives a dividend yield of 5.37%, 4.94% and 5.0% from 2021 to 2023, with an average dividend yield of 5.1%.

The ex-dividend date for the next dividend payment is April 14 2023, meaning that investors must own the stock prior to this date in order to be eligible for the dividend payment. Ennis Inc. is a reliable dividend payer and would make a great addition to any portfolio looking for steady income.

Share Price

Following this announcement, the stock opened at $21.0 and closed the day at $21.1, up 0.1% from its previous closing price of $21.1. Ennis_Announces_0.25_Cash_Dividend”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ennis. More…

| Total Revenues | Net Income | Net Margin |

| 428.81 | 41.76 | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ennis. More…

| Operations | Investing | Financing |

| 50.38 | -14.5 | -29.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ennis. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 386.65 | 65.23 | 12.49 |

Key Ratios Snapshot

Some of the financial key ratios for Ennis are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | 5.9% | 13.7% |

| FCF Margin | ROE | ROA |

| 10.4% | 11.5% | 9.5% |

Analysis

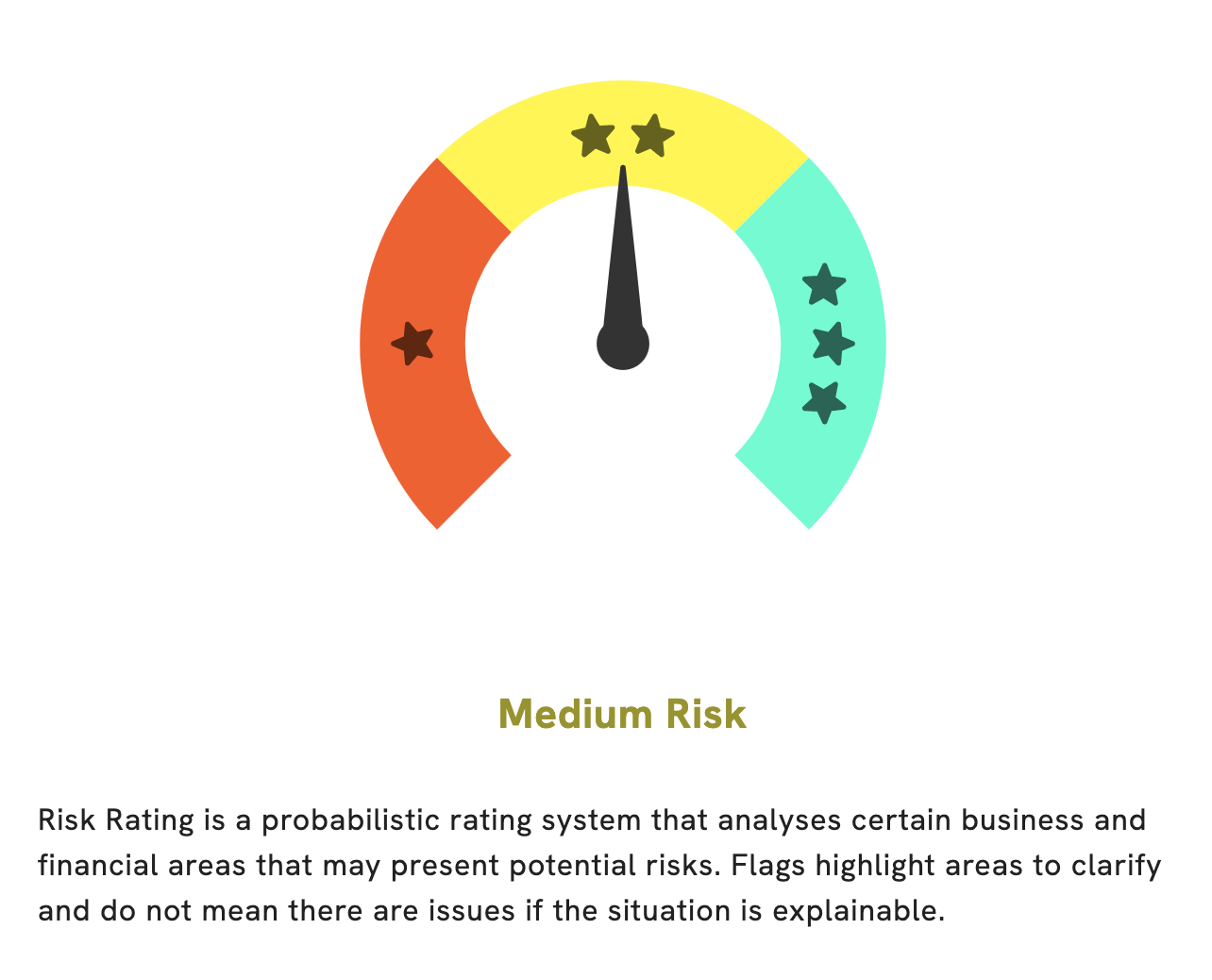

At GoodWhale, we have conducted a fundamental analysis of ENNIS. After examining the financial and business aspects, we have assessed ENNIS to be a medium risk investment. Within this assessment, there are two risk warnings that have been detected in the income sheet and balance sheet. These warnings may be indicative of potential issues and should be taken into consideration when making an investment decision. If you would like to find out more about these warnings, register with us today. We can provide the full details and help you to make an informed decision. More…

Peers

Headquartered in Fort Worth, Texas, Ennis employs approximately 4,200 people and operates 31 manufacturing facilities and 57 distribution centers in the United States, Canada, Mexico, Europe, Asia, and Australia. Ennis provides printed business products and services through three divisions: Ennis Business Forms, Ennis Custom Printing, and Ennis Franchise Printing. Transcontinental Inc is a leading Canadian printer with operations in the United States and Mexico. Koenig & Bauer AG is a leading German manufacturer of printing presses. Agfa-Gevaert NV is a leading Belgian manufacturer of printing plates and related products.

– Transcontinental Inc ($TSX:TCL.A)

Transcontinental Inc. is a Canadian printing and packaging company. The company has a market cap of 1.4B as of 2022 and a Return on Equity of 7.22%. Transcontinental Inc. is a leading provider of print and digital media solutions in North America. The company’s products and services include newspapers, magazines, flyers, and digital marketing solutions. Transcontinental Inc. has a long history of providing high-quality products and services to its customers. The company is headquartered in Montreal, Quebec, Canada.

– Koenig & Bauer AG ($LTS:0G15)

Koenig & Bauer AG is a publicly traded company with a market capitalization of 214.82M as of 2022. The company has a return on equity of 2.08%. Koenig & Bauer AG is a German printing press manufacturer. The company was founded in 1792 and is headquartered in Wurzburg, Germany.

– Agfa-Gevaert NV ($OTCPK:AFGVF)

Agfa-Gevaert NV is a Belgian company that specializes in the production of imaging products and services. The company has a market capitalization of 455.03 million as of 2022 and a return on equity of -2.01%. Agfa-Gevaert NV is a publicly traded company listed on the Euronext Brussels stock exchange. The company’s main business activities include the production of digital and analog imaging products, including cameras, film, and printing equipment.

Summary

Investing in Ennis Inc. can be a smart choice for dividend-seeking investors. The company has a consistent history of issuing dividends for the past three years, with a dividend per share of 1.0, 0.98 and 0.9 USD respectively. This has resulted in an average dividend yield of 5.1%, making it one of the highest yielding stocks on the market.

By investing in Ennis, investors can benefit from a steady stream of income while also enjoying potential share price appreciation in the long run. Furthermore, Ennis is expected to continue rewarding shareholders through its dividend payouts, making it an attractive and secure investment choice.

Recent Posts