Trane Technologies Stock Intrinsic Value – Nisa Investment Advisors LLC decreases stake in Trane Technologies by over a third in Q3

October 30, 2024

🌥️Trending News

Trane Technologies ($NYSE:TT) is a global leader in the manufacturing of innovative heating, ventilation, and air conditioning (HVAC) systems. Trane Technologies’ stock is listed on the New York Stock Exchange under the ticker symbol TT. The recent 13F filing by Nisa Investment Advisors LLC reveals that the investment firm has decreased its stake in Trane Technologies by over a third in the third quarter. This news has sparked interest among investors and analysts who closely follow the company’s performance in the market. The 13F filing is a report submitted by institutional investment managers to the Securities and Exchange Commission (SEC) every quarter. It provides insights into the holdings and transactions of these large investors, giving a glimpse into their investment strategies and decisions. This amounts to a 35.7% decrease in their holdings.

However, it could be due to a variety of factors, including changes in market conditions, company performance, or a shift in their investment strategy. Other institutional investors have also reduced their holdings in the company, with Vanguard Group, BlackRock Inc., and State Street Corp reporting decreases in their positions. While Nisa Investment Advisors LLC’s decreased stake in Trane Technologies may raise some concerns among shareholders, it is essential to keep in mind that institutional investment managers often make changes to their portfolios based on various factors. It is crucial to monitor the company’s performance and future actions of these investors to gain a better understanding of the reasoning behind their decisions. As Trane Technologies continues to navigate the ever-changing economic landscape, it will be interesting to see how the company’s stock performs in the coming quarters.

Stock Price

Trane Technologies, a global leader in energy-efficient climate control solutions, saw its stock open at $393.51 on Friday and close at $392.57. It is possible that the investment firm needed to free up funds for other investments or that they lost confidence in Trane Technologies’ performance. Despite this decrease in stake, Trane Technologies remains a strong player in the climate control industry, with a strong portfolio of innovative products and services designed to reduce energy consumption and improve sustainability. The company’s commitment to environmental responsibility and its focus on providing sustainable solutions make it an attractive long-term investment option for many.

However, with its strong track record and dedication to sustainability, Trane Technologies remains a promising investment opportunity in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Trane Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 17.68k | 2.02k | 11.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Trane Technologies. More…

| Operations | Investing | Financing |

| 2.39k | -1.17k | -1.35k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Trane Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.39k | 12.37k | 29.36 |

Key Ratios Snapshot

Some of the financial key ratios for Trane Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.4% | 23.6% | 15.8% |

| FCF Margin | ROE | ROA |

| 11.8% | 26.2% | 9.0% |

Analysis – Trane Technologies Stock Intrinsic Value

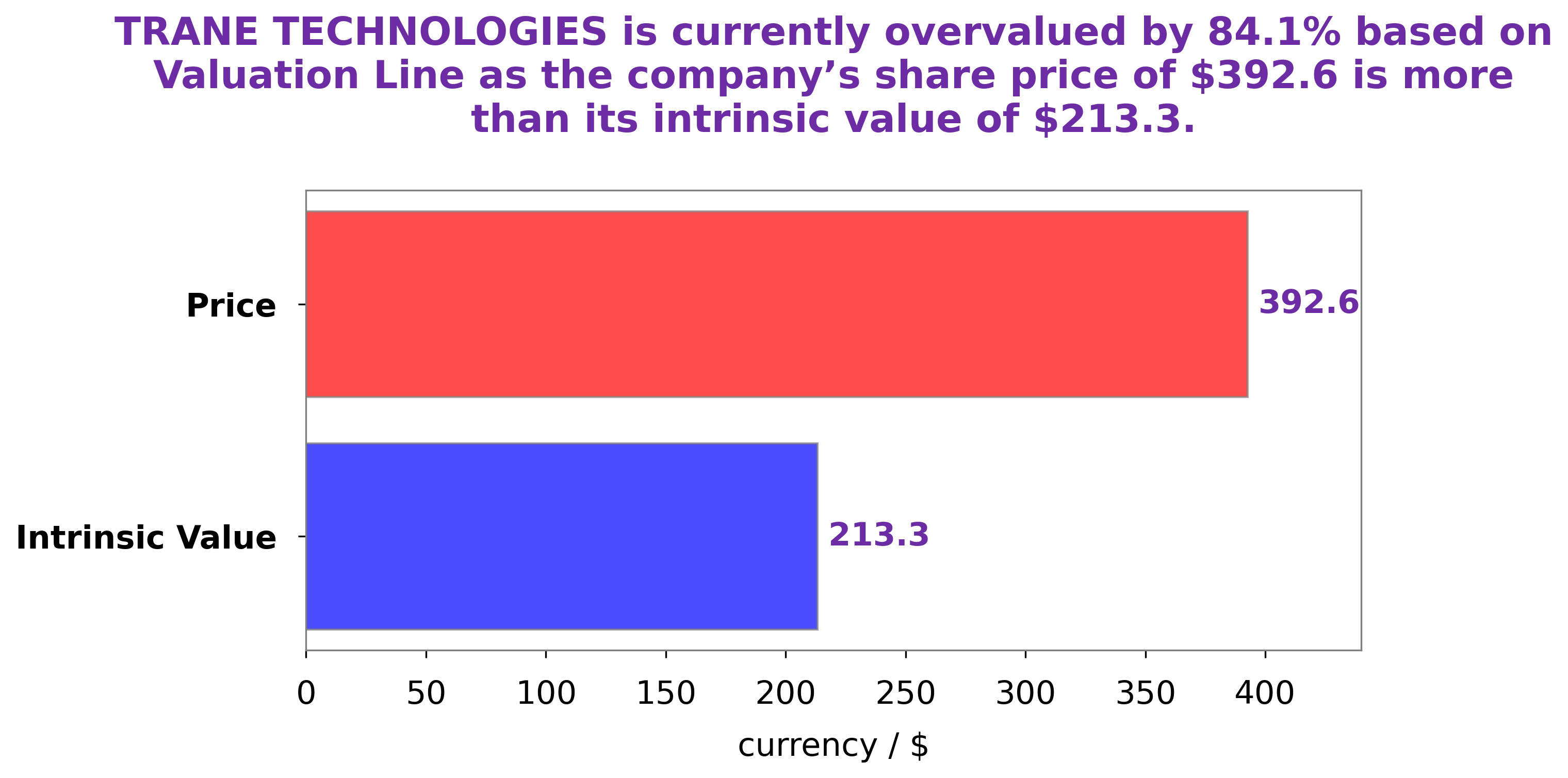

As an analyst at GoodWhale, I have conducted a thorough analysis of TRANE TECHNOLOGIES‘s fundamentals, and the results are as follows. Firstly, our proprietary Valuation Line has calculated the intrinsic value of TRANE TECHNOLOGIES’s share to be around $213.3. This valuation takes into account various factors such as the company’s financials, market trends, and industry comparisons. At the current market price of $392.57, TRANE TECHNOLOGIES’s stock is overvalued by 84.0%. This indicates that investors are currently paying a premium for the company’s shares, which may not be supported by its fundamentals. Overall, our analysis suggests that TRANE TECHNOLOGIES’s stock is overvalued and may not be a good investment at its current price. Investors should carefully consider their options before investing in the company’s shares. More…

Peers

Trane Technologies PLC is a leading global provider of indoor comfort solutions and services. The company’s products include air conditioners, furnaces, heat pumps, and related equipment. Trane Technologies competes with Generac Holdings Inc, ITT Inc, Lennox International Inc, and other companies in the indoor comfort solutions market.

– Generac Holdings Inc ($NYSE:GNRC)

Generac Holdings Inc, a Fortune 500 company, is a leading global designer and manufacturer of generators and other backup power products. The company has a market capitalization of $7.04 billion as of 2022 and a return on equity of 18.99%. Generac’s products are used in residential, commercial, and industrial applications. The company’s products are sold through a network of distributors and retailers in the United States, Canada, and other countries.

– ITT Inc ($NYSE:ITT)

In 2022, KBR had a market capitalization of $5.78 billion and a return on equity of 12.81%. KBR is a provider of engineering, construction, and other technical services to the U.S. government and other customers.

– Lennox International Inc ($NYSE:LII)

Lennox International Inc. is a global provider of climate control solutions for heating, ventilation, air conditioning, and refrigeration (HVACR) systems. The company operates in three segments: Residential Heating & Cooling, Commercial Heating & Cooling, and Refrigeration. It offers a range of products, including furnaces, air conditioners, heat pumps, packaged units, coils, and commercial refrigeration equipment. The company was founded in 1895 and is headquartered in Richardson, Texas.

Summary

Nisa Investment Advisors LLC reduced its holding in Trane Technologies plc by over a third in the third quarter. This move suggests that the investment advisor may have analyzed the company’s financial performance and future prospects and found it less attractive compared to other investment opportunities. While no specific details were provided, this action could indicate that Nisa Investment Advisors LLC believes that there are better options for their clients’ money. This move could also signal a lack of confidence in Trane Technologies’ ability to generate returns for shareholders in the near term.

Recent Posts