RBC Boosts Price Target for AZEK to $25, Maintains Outperform Rating

January 29, 2023

Trending News ☀️

AZEK ($NYSE:AZEK) Company is a leading manufacturer of building materials, namely PVC and composite decking and railing products. AZEK’s products are designed to be durable, low-maintenance, and cost-effective, making them popular among homeowners and contractors alike. Recently, RBC Capital Markets has increased its price target for AZEK to $25 and maintained its Outperform Rating. This is an increase from its previous price target of $20. According to RBC, AZEK is well-positioned to benefit from the current housing market, as well as from favorable pricing trends in the home improvement industry.

RBC also noted that AZEK’s product portfolio is well-positioned to benefit from a housing recovery, as well as from an increase in demand for remodeling projects. Overall, AZEK is well-positioned to capitalize on the current housing market and to benefit from the favorable pricing trends in the home improvement industry. With RBC’s increased price target and maintained Outperform Rating, AZEK may be an attractive investment opportunity for those looking to capitalize on the current market conditions.

Market Price

This news has been met with mostly positive media coverage. Despite the good news, AZEK Company stock opened and closed at $22.6, down 0.9% from the previous closing price of $22.9. The company’s products are designed to offer superior performance compared to traditional wood materials. AZEK Company is focused on expanding its product portfolio, increasing its market share, and enhancing its presence in the building materials market. The stock has had a strong start to the year, despite the overall market sentiment. AZEK Company has seen an increase in demand for its products due to their superior performance and innovation.

The company has also been able to capitalize on the increased demand for outdoor living spaces as more people spend time outdoors due to the pandemic. RBC Capital Markets believes that AZEK Company has strong potential for growth and is well-positioned to benefit from continuing demand for its products. They have expressed confidence in the company’s ability to drive long-term growth and profitability. With its strong product portfolio, innovative offerings, and expanding customer base, AZEK Company is well-positioned to capitalize on the opportunities ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Azek Company. More…

| Total Revenues | Net Income | Net Margin |

| 1.36k | 75.22 | 5.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Azek Company. More…

| Operations | Investing | Financing |

| 105.83 | -280.18 | 44.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Azek Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.38k | 938.65 | 9.56 |

Key Ratios Snapshot

Some of the financial key ratios for Azek Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.5% | 28.8% | 9.5% |

| FCF Margin | ROE | ROA |

| -4.9% | 5.5% | 3.4% |

VI Analysis

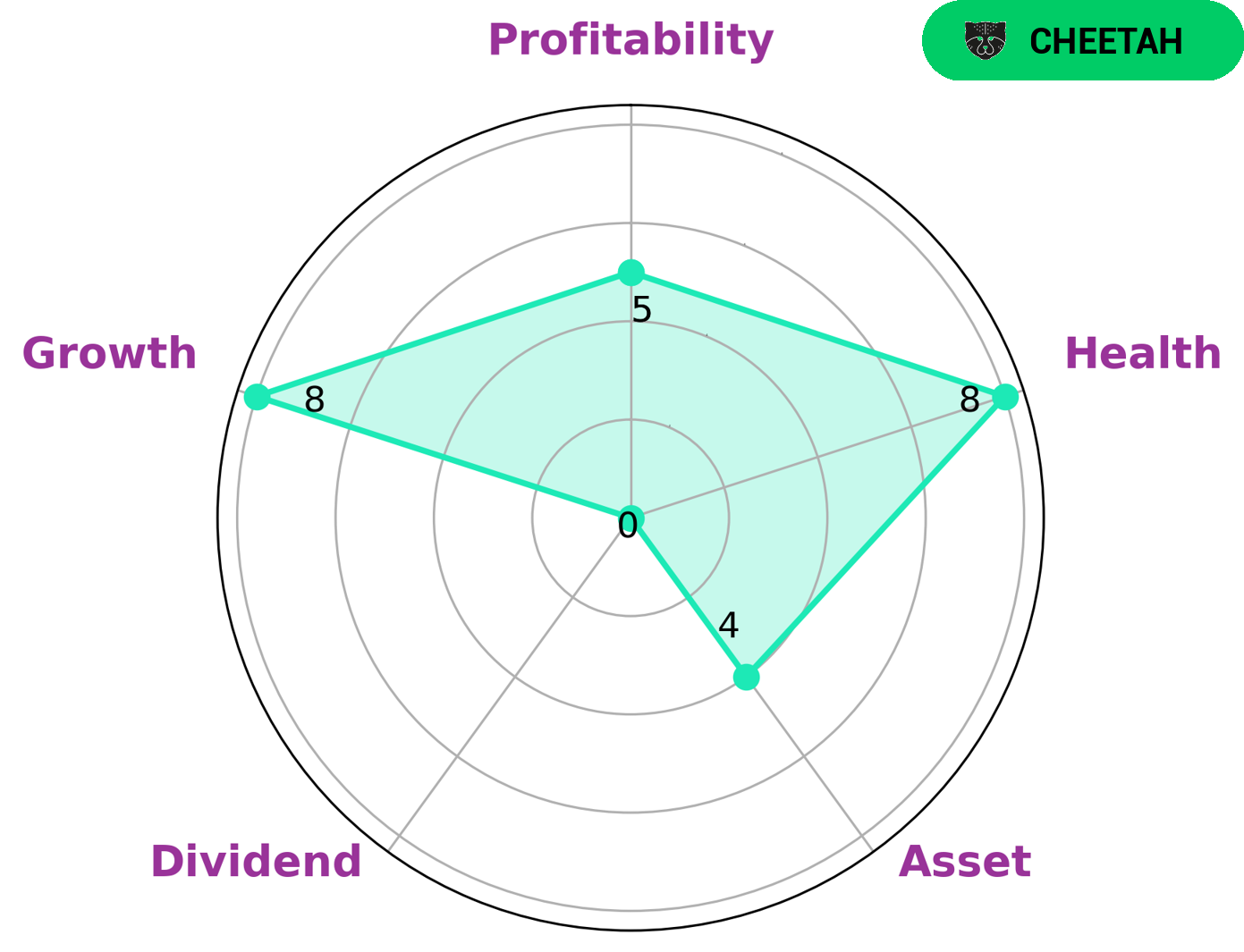

AZEK COMPANY has been classified as a ‘cheetah’ according to the VI Star Chart, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Such companies may be of interest to investors who are looking for short-term growth opportunities or are more comfortable taking risks in order to potentially achieve higher returns. When assessing AZEK COMPANY’s long-term potential, its fundamentals must also be taken into account. With regard to cashflows and debt, the company has a high health score of 8/10, indicating that it is capable of sustaining future operations in times of crisis. Moreover, the company is strong in growth and medium in asset, profitability and dividend. Overall, AZEK COMPANY appears to be a company with potential for short-term growth, though investors should be mindful of the risks associated with its lower profitability. By considering the company’s fundamentals and taking a long-term perspective, investors can better assess the potential of AZEK COMPANY and make an informed decision about whether to invest. More…

VI Peers

The AZEK Co Inc competes with Louisiana-Pacific Corp, Byggma ASA, and Masco Corp in the market for wood-based building products. These companies all produce similar products, but AZEK has a competitive advantage in terms of product quality and customer service.

– Louisiana-Pacific Corp ($NYSE:LPX)

Louisiana-Pacific Corp is a publicly traded company with a market capitalization of $3.71 billion as of March 2022. The company has a return on equity of 63.05%. Louisiana-Pacific Corp is a leading manufacturer of building products and engineered wood products. The company’s products are used in a variety of applications, including residential construction, commercial construction, and industrial applications. Louisiana-Pacific Corp operates manufacturing facilities in the United States, Canada, and Chile.

– Byggma ASA ($LTS:0DVM)

Byggma ASA is a trusted provider of construction and building materials in Norway. The company has a market capitalization of 2.06 billion as of 2022 and a return on equity of 29.21%. Byggma ASA is committed to providing quality products and services to its customers, and its strong financial performance is a testament to its success. The company’s products and services are in high demand, and its customer base is growing. Byggma ASA is well-positioned to continue its growth and expansion in the Norwegian construction market.

– Masco Corp ($NYSE:MAS)

Masco Corporation is a global leader in the design, manufacture and distribution of branded home improvement and building products. Our products include faucets, cabinets, windows, doors, plumbing fixtures, architectural hardware, lumber and other building materials. We operate more than 60 manufacturing facilities in the United States, Canada, Europe and Asia. Our products are sold under a variety of brand names including Delta®, Hansgrohe®, Brizo®, Axor®, InSinkErator®, KraftMaid®, Merillat®, QualityCabinets®, Masco Cabinetry®, Kichler®, Simonswerk® and many other regional brands. Our products are distributed through a variety of channels including home centers, mass merchants, Showrooms, International distributors, OEMs and other specialty retailers.

Summary

This follows recent media coverage which has been mostly positive. The company is a leader in the building products industry, offering innovative and low-maintenance solutions and services. Investors should take note of AZEK Company‘s strong fundamentals, including its strong financial position, robust growth potential, and diversified product portfolio. With a history of strong returns and strong potential for future growth, AZEK Company is an attractive investment option for those looking to add value to their portfolios.

Recent Posts