Pgt Innovations Stock Fair Value Calculator – PGT INNOVATIONS Reports Earnings Results for 1st Quarter of FY 2023

May 25, 2023

Earnings Overview

On May 11, 2023, PGT INNOVATIONS ($NYSE:PGTI) announced its earnings results for the first quarter of Fiscal Year 2023 (ending March 31, 2023). Total revenue reached USD 376.8 million, a 5.1% growth compared to the same period in the prior year. This quarter also saw a 45.0% year-over-year increase in net income, amounting to USD 33.6 million.

Stock Price

Despite a strong performance during the quarter, stock prices closed 3.0% lower than the previous day’s closing price of 26.1. At the opening bell, PGT INNOVATIONS stock was trading at 25.5, although it closed the day at 25.3. During the quarter, PGT INNOVATIONS achieved a record high in terms of revenue generation, surpassing its previous records set in the fourth quarter of last year. The company also announced an increase in its net income, and the income per share for the quarter was significantly higher. The robust performance during the quarter is attributed to PGT INNOVATIONS’ focus on innovation and its ability to stay ahead of the curve by introducing new products and services to the market.

Along with the successful launch of their new product line, the company also implemented various cost-cutting measures to maintain profitability in the longer run. The company also reported that the demand for their products has been increasing steadily, both domestically and globally. Despite a drop in stock prices, analysts remain confident that the company is on track to deliver strong performance in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pgt Innovations. More…

| Total Revenues | Net Income | Net Margin |

| 1.51k | 110.26 | 7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pgt Innovations. More…

| Operations | Investing | Financing |

| 202.97 | -237.71 | -20.58 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pgt Innovations. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.62k | 953.41 | 10.54 |

Key Ratios Snapshot

Some of the financial key ratios for Pgt Innovations are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.0% | 24.9% | 11.5% |

| FCF Margin | ROE | ROA |

| 10.2% | 17.2% | 6.7% |

Analysis – Pgt Innovations Stock Fair Value Calculator

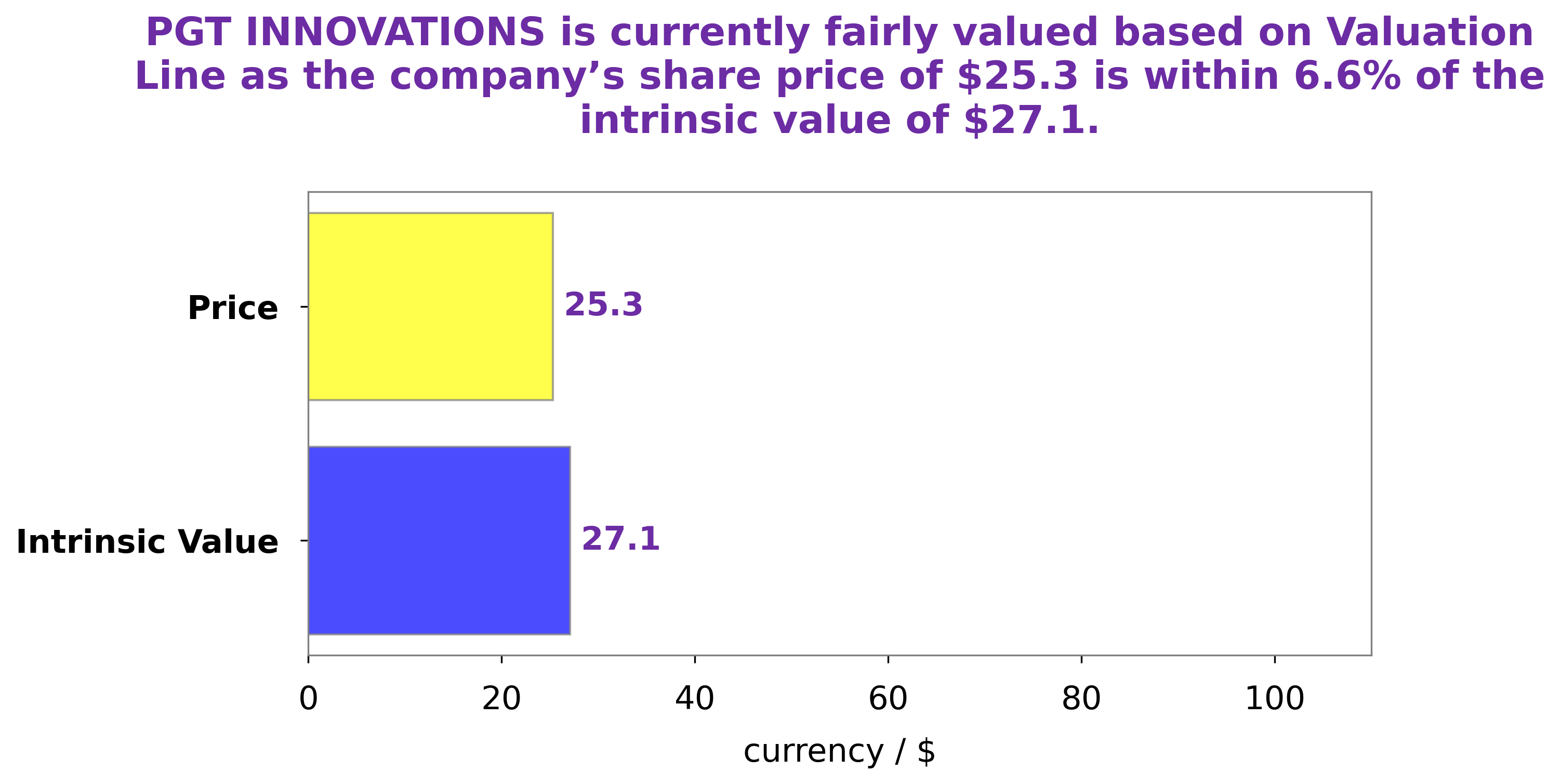

GoodWhale has analyzed the financials of PGT Innovations and found it to have an intrinsic value of around $27.1 as calculated by our proprietary Valuation Line. This means that the PGT Innovations share is currently trading at a price of $25.3, which is a fair price but still undervalued by 6.6%. Our analysis shows that PGT Innovations is currently trading at a discount, making it a good buy for investors looking to get in on a good deal. More…

Peers

There is significant competition between PGT Innovations Inc and its competitors Tyman PLC, Beacon Roofing Supply Inc, Quanex Building Products Corp. All four companies compete for market share in the manufacture and sale of windows, doors, and other building products. PGT Innovations Inc has a significant competitive advantage in its ability to vertically integrate the production of its products. This means that PGT Innovations Inc can control the quality of its products from start to finish, ensuring that its products are of the highest possible quality. Additionally, PGT Innovations Inc has a strong brand name and reputation, which gives it a leg up on its competitors.

– Tyman PLC ($LSE:TYMN)

Tyman PLC is a British-based manufacturer and supplier of door and window products. The company has a market cap of 382.79M as of 2022 and a Return on Equity of 9.35%. Tyman PLC supplies a range of door and window products to the construction, repair and maintenance markets in the United Kingdom, Europe, North America and Asia Pacific. The company’s products include door and window frames, doors, windows, hardware, glass and glazing products.

– Beacon Roofing Supply Inc ($NASDAQ:BECN)

Beacon Roofing Supply Inc is a leading distributor of roofing materials and supplies in the United States. The company has a market cap of 3.54 billion and a return on equity of 13.72%. Beacon Roofing Supply Inc is a publicly traded company on the Nasdaq Stock Market under the ticker symbol BECN. The company was founded in 1928 and is headquartered in Herndon, Virginia. Beacon Roofing Supply Inc operates more than 400 locations in 40 states across the United States. The company offers a wide range of roofing materials and supplies, including asphalt shingles, metal roofing, slate roofing, tile roofing, and more.

– Quanex Building Products Corp ($NYSE:NX)

Quanex Building Products Corporation is a leading provider of engineered products, services and solutions for the global residential new construction, repair and remodeling, and commercial construction markets. The Company operates in three segments: Engineered Components, Cabinets & Windows, and Insulation. Quanex Building Products Corporation is headquartered in Houston, Texas.

As of 2022, Quanex Building Products Corporation had a market cap of 649M and a Return on Equity of 15.63%. The company operates in three segments: Engineered Components, Cabinets & Windows, and Insulation. Quanex Building Products Corporation is headquartered in Houston, Texas.

Summary

PGT Innovations reported strong first-quarter earnings for Fiscal Year 2023 that saw a 5.1% increase in total revenue to USD 376.8 million and a 45.0% increase in net income to USD 33.6 million year-over-year. Despite the positive results, the stock price dropped on the same day. Investors should consider this as an opportunity to buy shares of the company as the long-term prospects remain favorable. PGT has a strong track record of delivering consistent earnings growth and cost control, and its latest results indicate that it is well-positioned to continue this trend.

In addition, the company has a diverse portfolio of products and services, which should provide potential for further growth in the future.

Recent Posts