New York State Common Retirement Fund Increases Investment in Aspen Aerogels to Support ESG Investing.

April 27, 2023

Trending News ☀️

The New York State Common Retirement Fund has recently increased its investment in Aspen Aerogels ($NYSE:ASPN), Inc., a leading provider of advanced aerogel insulation solutions, to demonstrate their commitment to ESG investing. Aspen Aerogels’ innovative and high-performance products have been gaining much attention from a variety of investors, with the Fund taking the lead. The company’s products are characterized by superior performance and unique properties such as high thermal insulation, fire resistance, durability, and chemical resistance. Aspen Aerogels’ products are used in a wide range of sectors including energy, oil and gas, and industrial markets.

This move is part of the Fund’s ongoing effort to promote ESG investing, which has been gaining considerable traction in recent years. It remains to be seen how this additional capital injection will benefit Aspen Aerogels and what kind of impact it will have on the company’s performance.

Share Price

On Wednesday, Aspen Aerogels Inc.’s stock opened at $5.7 and closed at $5.6, down by 1.4% from the previous closing price of $5.7. The company’s products are based on patented aerogel technology and are designed to help customers reduce energy use and improve building efficiency, while at the same time offering superior comfort and low-cost installation. The company prides itself on its commitment to sustainability, which includes a focus on reducing energy use and carbon emissions, as well as investing in renewable energy sources.

The fund hopes to capitalize on the potential of Aspen Aerogels’ products and services to help customers reduce their environmental footprint and contribute to a greener future. NYSCRF believes this move will benefit both investors and the environment in the long run, making it a win-win situation for all parties involved. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aspen Aerogels. More…

| Total Revenues | Net Income | Net Margin |

| 180.36 | -82.74 | -45.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aspen Aerogels. More…

| Operations | Investing | Financing |

| -82.37 | -13.78 | 92.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aspen Aerogels. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 646.57 | 203.23 | 0 |

Key Ratios Snapshot

Some of the financial key ratios for Aspen Aerogels are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.0% | – | -43.0% |

| FCF Margin | ROE | ROA |

| -116.1% | -53.2% | -7.5% |

Analysis

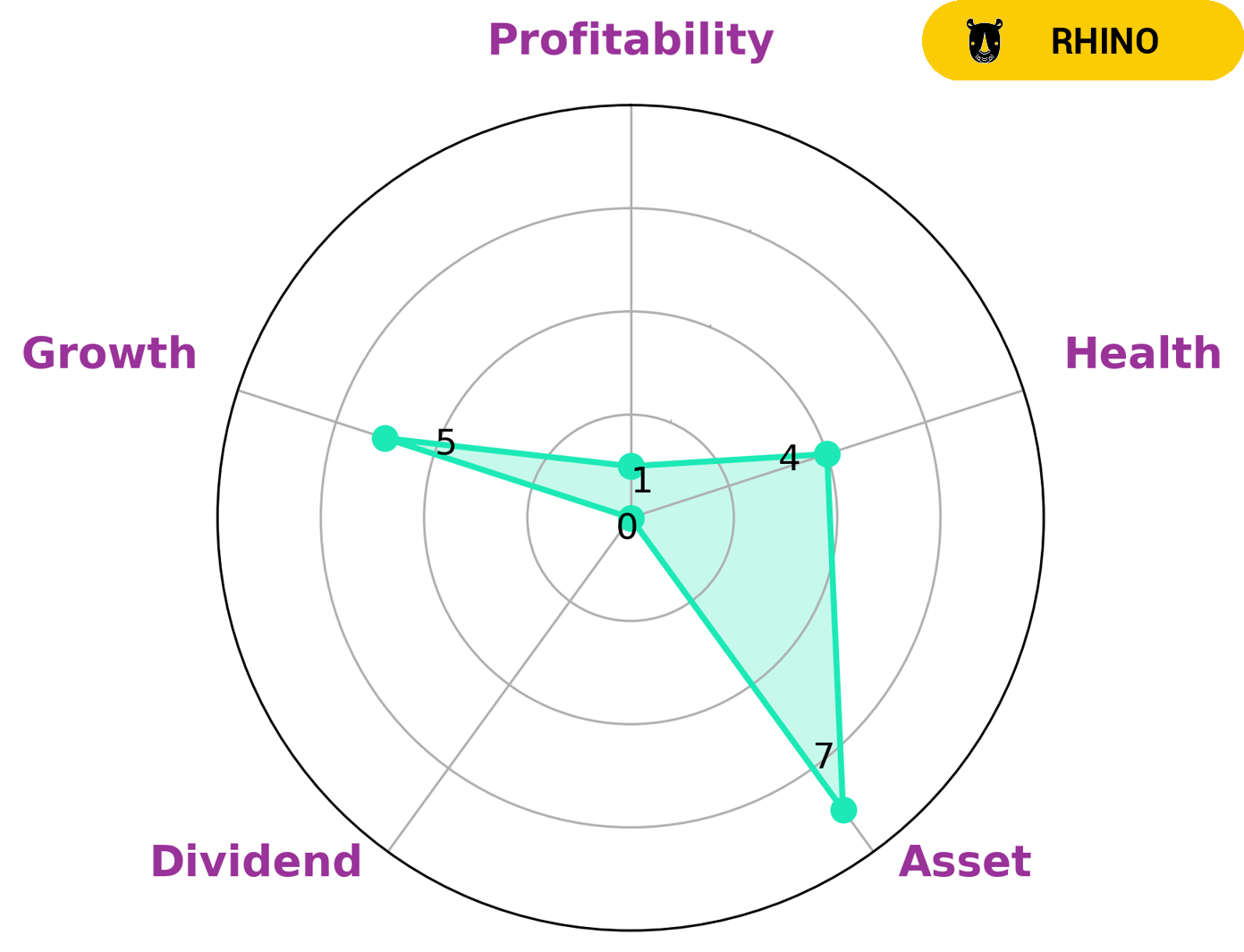

GoodWhale has analyzed ASPEN AEROGELS‘s financials to give a better understanding of the company. Our Star Chart categorizes ASPEN AEROGELS as a ‘rhino’, indicating that the company has achieved moderate revenue or earnings growth. This makes ASPEN AEROGELS an interesting prospect for investors who are looking to invest in a company with steady growth and potential. ASPEN AEROGELS also has an intermediate health score of 4/10 when it comes to its cashflows and debt. This indicates that the company is likely to have sufficient funds to pay off its debt and fund future operations. When considering the other aspects of the business, GoodWhale’s analysis suggests that ASPEN AEROGELS has a strong asset base, medium growth, and weak dividend and profitability. More…

Peers

Its main competitors are Goodtech ASA, LifeSafe Holdings PLC, and Jiangsu Jingxue Insulation Technology Co Ltd.

– Goodtech ASA ($LTS:0ELH)

Goodtech ASA is a Norwegian engineering and technology company. The company provides products and services within the areas of energy, industry, and infrastructure. Goodtech ASA has a market cap of 211.8M as of 2022 and a Return on Equity of -3.23%.

– LifeSafe Holdings PLC ($LSE:LIFS)

LifeSafe Holdings PLC is a provider of health and safety products and services. The company has a market cap of 8.62M as of 2022 and a return on equity of 252.02%. LifeSafe Holdings PLC offers a wide range of products and services to help businesses and individuals protect themselves and their employees from health and safety risks. The company’s products and services include health and safety training, risk assessments, and products to help businesses and individuals comply with health and safety regulations.

– Jiangsu Jingxue Insulation Technology Co Ltd ($SZSE:301010)

Jiangsu Jingxue Insulation Technology Co Ltd is a Chinese company that manufactures insulation products. The company has a market cap of 2.23B as of 2022 and a Return on Equity of 5.98%. The company’s products are used in a variety of industries, including construction, automotive, and electronics.

Summary

The New York State Common Retirement Fund has been increasing its investments in Aspen Aerogels, Inc. in response to the growing interest in ESG (Environmental, Social, and Governance) investing. Aspen Aerogels is a company that produces innovative insulation materials that have numerous sustainability benefits. The rising popularity of ESG investments has benefited Aspen Aerogels, as investors are attracted to the company’s commitment to sustainability and its potential for long-term financial returns. With this recent uptick in investments from institutional investors, Aspen Aerogels is set to make a strong impact on the market in the coming years.

Recent Posts