Jeld-wen Holding Intrinsic Value Calculator – JELD-WEN HOLDING Announces Positive Q3 Earnings for FY2023

December 2, 2023

☀️Earnings Overview

JELD-WEN HOLDING ($NYSE:JELD) released its fiscal year 2023 Q3 earnings results on November 6 2023. These figures reflected the company’s financial performance from July 1 to September 30 2023. The total revenue for the quarter was USD 1077.0 million, a decrease of 16.9% year-on-year. Despite this, net income was reported at USD 43.8 million, which is an improvement from the -33.2 million posted in the third quarter of FY2022.

Share Price

On Monday, JELD-WEN HOLDING, a leading producer of windows and doors, announced its positive third quarter earnings for the fiscal year ending 2023. The stock opened at $12.6 and closed at $12.3, which was 2.7% lower than last closing price of 12.7. This indicates that the company is becoming more efficient with its operations. This announcement was welcomed by investors who have been closely monitoring JELD-WEN HOLDING’s performance in recent months.

The positive earnings report is an indication that the company is on track for a successful end to the fiscal year. Analysts are expecting the company’s stock to rebound in the coming weeks as investors gain more confidence in their performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jeld-wen Holding. More…

| Total Revenues | Net Income | Net Margin |

| 5.05k | 130.82 | 2.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jeld-wen Holding. More…

| Operations | Investing | Financing |

| 376.75 | 274.54 | -622.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jeld-wen Holding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.01k | 2.17k | 9.82 |

Key Ratios Snapshot

Some of the financial key ratios for Jeld-wen Holding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | 9.1% | 4.6% |

| FCF Margin | ROE | ROA |

| 5.2% | 18.0% | 4.8% |

Analysis – Jeld-wen Holding Intrinsic Value Calculator

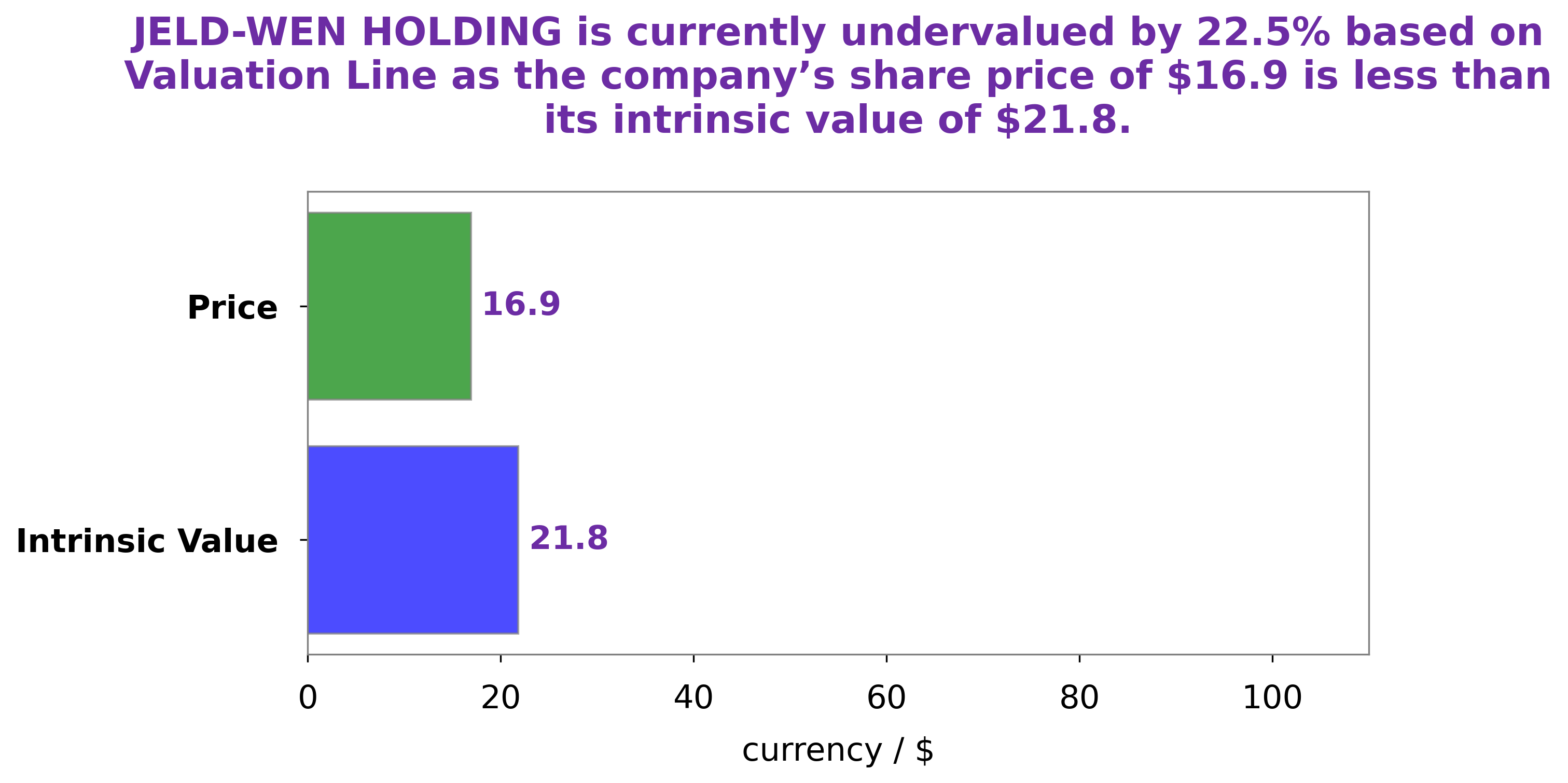

At GoodWhale, we analyze JELD-WEN HOLDING‘s financials and provide an intrinsic value for the stock. Our proprietary Valuation Line shows that JELD-WEN HOLDING is worth around $21.9 per share. Right now, JELD-WEN HOLDING is trading at $12.3, which means a 43.8% discount to its intrinsic value. This provides an opportunity to buy the stock at a deep discount. More…

Peers

JELD-WEN Holding Inc is one of the world’s largest manufacturers of doors and windows. The company operates in three segments: North America, Europe, and Asia Pacific. JELD-WEN has a diversified product mix that includes wood, steel, aluminum, and vinyl products. The company’s primary competitors are Masonite International Corp, Tyman PLC, and Sanwa Holdings Corp.

– Masonite International Corp ($NYSE:DOOR)

Masonite International Corp is a leading manufacturer and marketer of interior and exterior doors for the residential and commercial construction markets. Its products are sold under the Masonite, Marsh, and Beaver brands. The company has a market cap of 1.57B as of 2022 and a Return on Equity of 24.2%. Masonite International Corp is headquartered in Tampa, Florida.

– Tyman PLC ($LSE:TYMN)

Tyman PLC is a United Kingdom-based company, engaged in the design, manufacture and distribution of door and window products. The Company’s segments include Europe, North America and Asia Pacific. The Company’s brands include AmesburyGroup, Deceuninck, Schuco, KBE, REHAU, Trocal, VEKA, comadur and Roto. The Company offers a range of products, including composite and uPVC doors, aluminium doors, timber doors, security products and glass products.

– Sanwa Holdings Corp ($TSE:5929)

Sanwa Holdings Corp is a Japanese holding company that provides financial services through its subsidiaries. The company’s market cap as of 2022 is 279.49B. Its return on equity is 10.49%. Sanwa Holdings Corp’s subsidiaries include Sanwa Bank, Ltd., a commercial bank; Sanwa Lease Corporation, a leasing company; and Sanwa Factoring Corporation, a factoring company.

Summary

JELD-WEN Holding Inc. reported their FY2023 Q3 earnings results on November 6 2023. The results for the quarter showed total revenue of USD 1077.0 million, a 16.9% drop from the third quarter of the previous year. Net income was USD 43.8 million, a positive turnaround from last year’s -33.2 million. Investors should consider these numbers when analyzing JELD-WEN Holding Inc.’s performance, as well as their financial position, as it could affect their future investments.

Furthermore, investors should consider the company’s competitive position in the market as it may affect their overall profitability. Investors should also keep an eye on their future earnings to get a better understanding of how they are performing.

Recent Posts