Janus International Stock Fair Value – Janus International Reports Record Revenue and Earnings, Beating Estimates by Wide Margin

May 12, 2023

Trending News 🌧️

Non-GAAP earnings per share (EPS) of $0.18 exceeded expectations by $0.01, with revenue of $251.9M surpassing estimates by $9.24M. Janus International ($NYSE:JBI) is a U.S.-based company that designs and manufactures industrial doors, rolling steel doors, access control systems, and related products for commercial, industrial and residential customers worldwide. The company also provides installation, repair and maintenance services for its products. The company’s innovative product offerings and commitment to customer service have enabled it to gain new business, resulting in record revenue and earnings growth. Going forward, Janus International is well positioned to capitalize on the growth prospects in the industrial door market and continue to deliver strong results for its shareholders.

Earnings

In the latest earning report for the fourth quarter of 2022, as of December 31, JANUS INTERNATIONAL reported record revenue and earnings, beating estimates by a wide margin. The total revenue earned was 279.73 Million USD, with a net income of 32.71 Million USD. Compared to the previous year, total revenue showed an increase of 18.9%, while the net income increased by 218.2%.

In the last three years, JANUS INTERNATIONAL’s total revenue increased from 148.59M USD to 279.73M USD. This impressive growth is a testament to JANUS INTERNATIONAL’s success and puts them in a good position for future growth and profitability.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Janus International. More…

| Total Revenues | Net Income | Net Margin |

| 1.02k | 107.65 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Janus International. More…

| Operations | Investing | Financing |

| 88.47 | -8.69 | -14.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Janus International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.27k | 895.33 | 2.3 |

Key Ratios Snapshot

Some of the financial key ratios for Janus International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 18.4% |

| FCF Margin | ROE | ROA |

| 7.8% | 32.8% | 9.2% |

Market Price

The company saw its stock open at $9.6 and close at $9.3, representing a 2.3% decrease from its last closing price of $9.6. This marks an overall increase in both revenue and earnings for JANUS INTERNATIONAL and further cements the company’s position as one of the strongest in the industry. Live Quote…

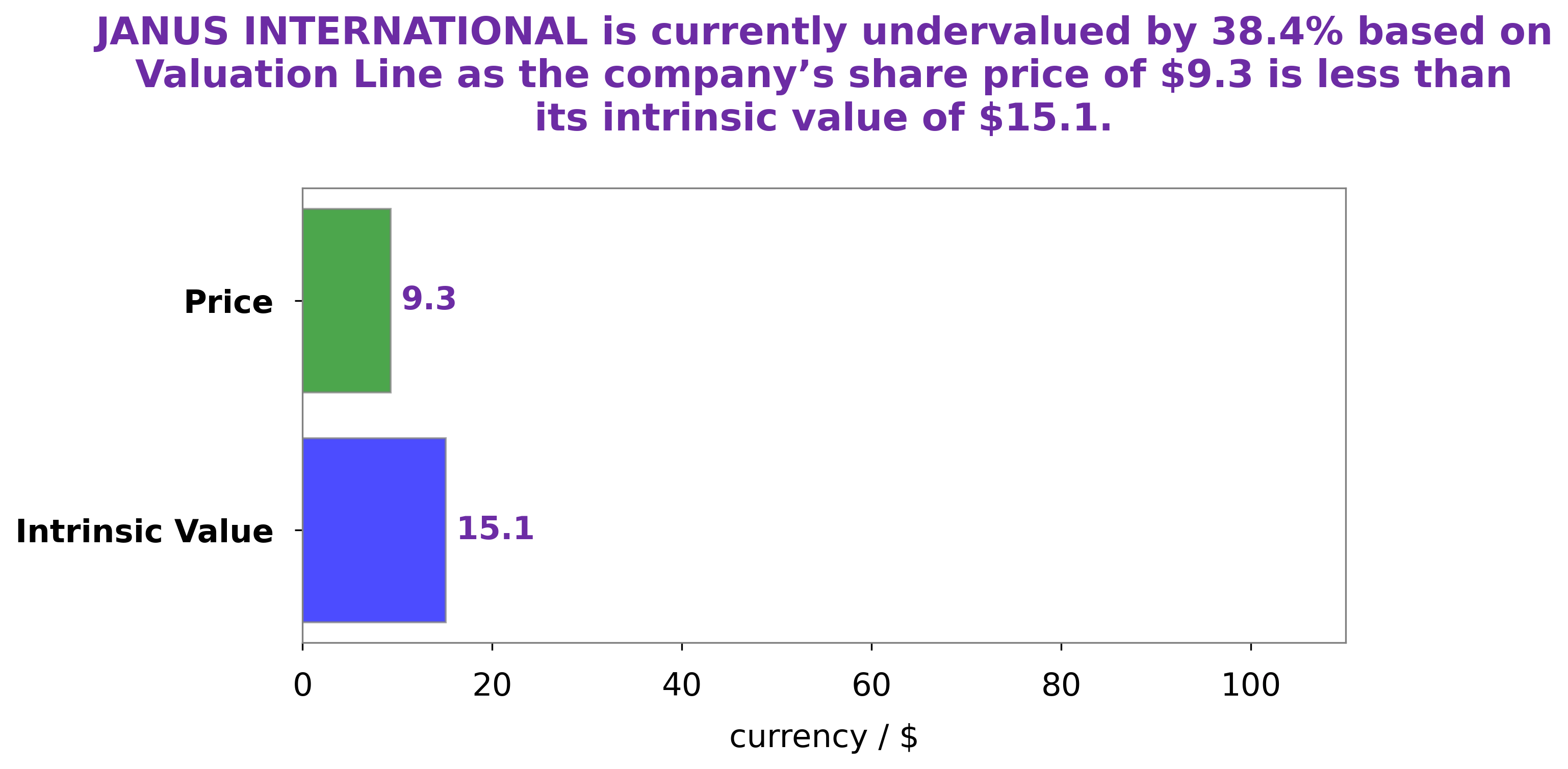

Analysis – Janus International Stock Fair Value

At GoodWhale, we believe that analyzing a company’s financials is the key to making sure you make the best investment decisions. That’s why we’ve recently completed an analysis of JANUS INTERNATIONAL‘s financials to help our users make informed decisions. Our proprietary Valuation Line allowed us to accurately calculate the fair value of JANUS INTERNATIONAL’s shares to be around $15.1. Unfortunately, JANUS INTERNATIONAL’s stock is currently trading at $9.3 which means that it is undervalued by 38.2%. For savvy investors, this presents an excellent opportunity to take advantage of this discrepancy and purchase the stock at a discounted rate. More…

Peers

Janus International Group Inc. is one of the world’s leading manufacturers of doors, windows, and related products. The company’s products are used in a wide variety of applications, including residential, commercial, and industrial. Janus International Group Inc. has a strong market presence in North America, Europe, and Asia. The company’s main competitors include Tyman PLC, Aro Granite Industries Ltd, and Deceuninck NV.

– Tyman PLC ($LSE:TYMN)

Tyman PLC is a leading global supplier of engineered industrial products. The company has a market capitalization of 416.16 million as of 2022 and a return on equity of 9.35%. Tyman operates in three segments: building products, industrial products, and water management. The building products segment provides products and solutions for the construction and maintenance of buildings, including doors, windows, stairs, and fittings. The industrial products segment offers products and solutions for the construction and maintenance of industrial facilities, such as conveyor systems, lifting equipment, and cranes. The water management segment provides products and solutions for the treatment and distribution of water, including pumps, valves, and pipes.

– Aro Granite Industries Ltd ($BSE:513729)

Aro Granite Industries Ltd is a company that manufactures and exports granite and marble products. The company has a market cap of 699.98M as of 2022 and a Return on Equity of 5.38%. Aro Granite Industries Ltd is a leading player in the granite and marble industry with a strong presence in India and overseas. The company has a diversified product portfolio and a wide distribution network. Aro Granite Industries Ltd is a publicly listed company with a strong track record of profitability and growth.

– Deceuninck NV ($LTS:0MEL)

Deceuninck NV is a Belgian company that manufactures PVC-u profile systems for the construction industry. The company has a market capitalization of 296.69 million as of 2022 and a return on equity of 9.83%. Deceuninck NV’s products are used in a variety of applications, including windows, doors, conservatories, and curtain walling. The company has a strong presence in Europe, with manufacturing facilities in Belgium, France, Germany, Poland, and the United Kingdom.

Summary

The company attributed the strong performance to higher sales in all regions, particularly Europe and the Middle East, along with improved operational efficiency. The company also noted that its gross margin was up year-over-year due to reduced costs and better pricing. Looking forward, Janus is confident that its strong performance will continue and expects to see continued growth in all regions. Investors should take note of this positive financial report and consider adding Janus International Group LLC to their portfolios.

Recent Posts