Janus International Stock Fair Value Calculator – JANUS INTERNATIONAL Reports First Quarter Earnings Results for FY2023

June 22, 2023

🌥️Earnings Overview

On May 11 2023, JANUS INTERNATIONAL ($NYSE:JBI) reported its financial results for the quarter ending March 31 2023, which saw total revenue of USD 251.9 million, a 9.8% increase from the same period in FY2022. The company also saw a 31.9% increase in net income, reaching USD 26.0 million.

Share Price

On Thursday, JANUS INTERNATIONAL took the stock market by surprise when it reported its first quarter earnings results for fiscal year 2023. The company opened the day at $9.6 per share, before closing the day at $9.3, a 2.3% drop from the prior day’s closing price of $9.6. This marked the second consecutive day of declining prices for JANUS INTERNATIONAL. The latest earnings report revealed that the company had seen a steady decline in profits over the course of the first quarter. The company cited increased operating expenses as one of the main causes of their decline in profitability. Despite this, JANUS INTERNATIONAL remains confident in its ability to turn things around in the coming quarters. Their management team has implemented a number of cost-cutting measures which are expected to help improve their financial performance in the future.

Additionally, JANUS INTERNATIONAL is optimistic about their pipeline of new products and services, which they believe will bring in increased revenue and profits in the near future. While there were signs of a decline in their profitability, the company remains confident in their ability to turn things around. Investors should keep an eye on JANUS INTERNATIONAL as they look to regain their footing and return to profitability. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Janus International. More…

| Total Revenues | Net Income | Net Margin |

| 1.04k | 113.93 | 10.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Janus International. More…

| Operations | Investing | Financing |

| 113.94 | -12.87 | -58.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Janus International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.24k | 838.3 | 2.75 |

Key Ratios Snapshot

Some of the financial key ratios for Janus International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 19.5% |

| FCF Margin | ROE | ROA |

| 9.8% | 32.6% | 10.2% |

Analysis – Janus International Stock Fair Value Calculator

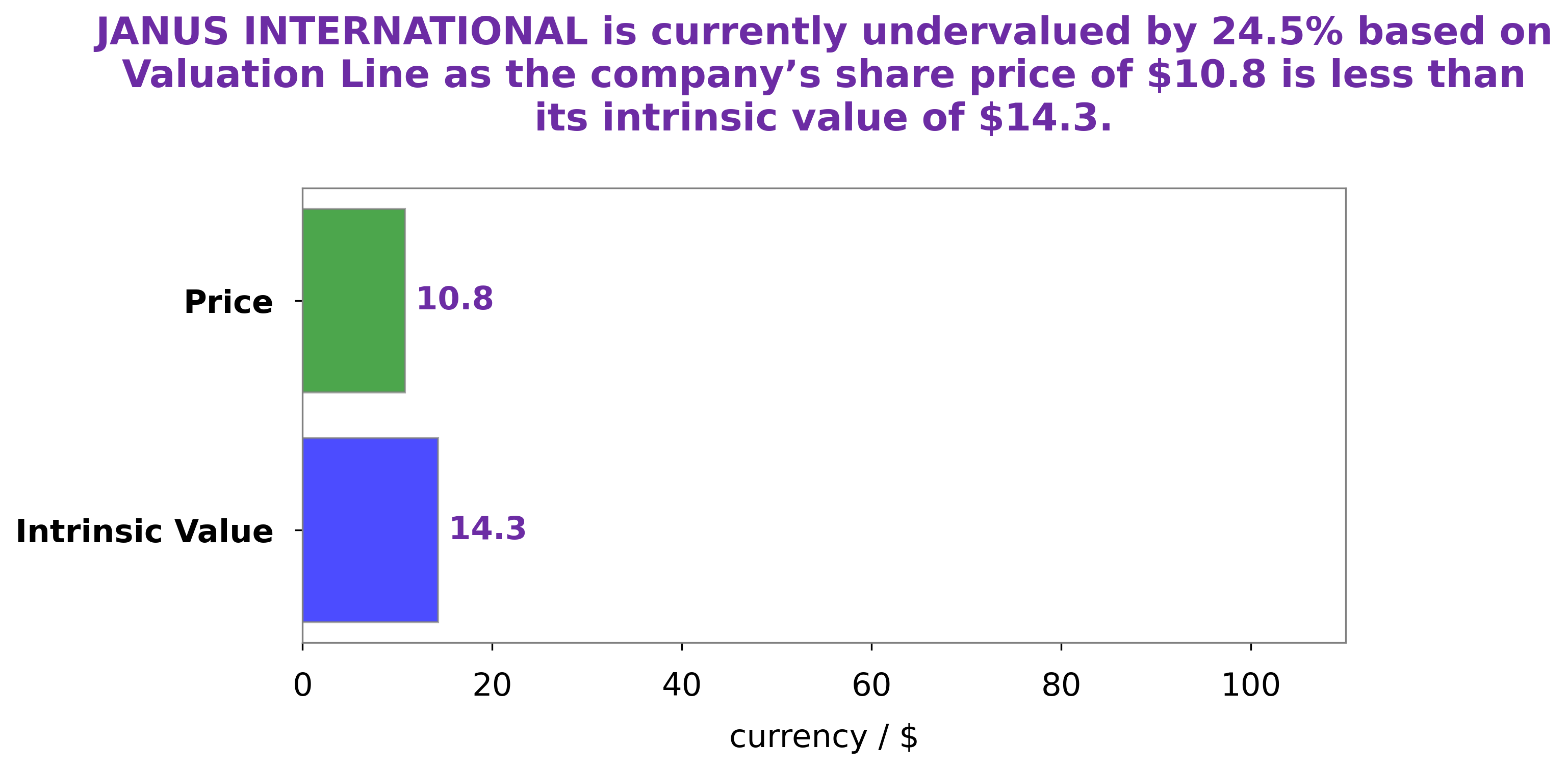

GoodWhale has conducted an analysis of JANUS INTERNATIONAL‘s fundamentals and concluded that the fair value of JANUS INTERNATIONAL’s share is around $15.3. This was calculated by our proprietary Valuation Line, which uses a combination of traditional and innovative valuation techniques. Currently, JANUS INTERNATIONAL stock is traded at $9.3, meaning that it is undervalued by 39.0%. This creates a great opportunity for potential investors to purchase JANUS INTERNATIONAL stock at a discounted price. We believe that this could be excellent long-term value for savvy investors. More…

Peers

Janus International Group Inc. is one of the world’s leading manufacturers of doors, windows, and related products. The company’s products are used in a wide variety of applications, including residential, commercial, and industrial. Janus International Group Inc. has a strong market presence in North America, Europe, and Asia. The company’s main competitors include Tyman PLC, Aro Granite Industries Ltd, and Deceuninck NV.

– Tyman PLC ($LSE:TYMN)

Tyman PLC is a leading global supplier of engineered industrial products. The company has a market capitalization of 416.16 million as of 2022 and a return on equity of 9.35%. Tyman operates in three segments: building products, industrial products, and water management. The building products segment provides products and solutions for the construction and maintenance of buildings, including doors, windows, stairs, and fittings. The industrial products segment offers products and solutions for the construction and maintenance of industrial facilities, such as conveyor systems, lifting equipment, and cranes. The water management segment provides products and solutions for the treatment and distribution of water, including pumps, valves, and pipes.

– Aro Granite Industries Ltd ($BSE:513729)

Aro Granite Industries Ltd is a company that manufactures and exports granite and marble products. The company has a market cap of 699.98M as of 2022 and a Return on Equity of 5.38%. Aro Granite Industries Ltd is a leading player in the granite and marble industry with a strong presence in India and overseas. The company has a diversified product portfolio and a wide distribution network. Aro Granite Industries Ltd is a publicly listed company with a strong track record of profitability and growth.

– Deceuninck NV ($LTS:0MEL)

Deceuninck NV is a Belgian company that manufactures PVC-u profile systems for the construction industry. The company has a market capitalization of 296.69 million as of 2022 and a return on equity of 9.83%. Deceuninck NV’s products are used in a variety of applications, including windows, doors, conservatories, and curtain walling. The company has a strong presence in Europe, with manufacturing facilities in Belgium, France, Germany, Poland, and the United Kingdom.

Summary

JANUS INTERNATIONAL reported its earnings results for Q1 FY2023, showing a strong performance. Total revenue increased by 9.8%, reaching USD 251.9 million, while net income increased by 31.9%, reaching USD 26.0 million. This is positive news for investors, as JANUS INTERNATIONAL is showing positive financial growth and returns over the period. Investors may consider investing in JANUS INTERNATIONAL as it is a strong performer with proven success and consistent returns.

Additionally, its financial health is solid, and the company is well-positioned to continue bringing value to its shareholders.

Recent Posts