JANUS INTERNATIONAL Sees 7.5% Increase in Short Interest During December

January 8, 2023

Trending News ☀️

Janus International ($NYSE:JBI) is a leading global asset manager with a long-standing track record of delivering superior long-term performance for its investors. Janus International has a diversified investment approach across stocks, fixed income, alternative and multi-asset solutions. The company is headquartered in Denver, Colorado, and has offices in London, Tokyo, and Singapore. This is an indication of strong investor sentiment and an expectation of future price appreciation. The 7.5% increase in short interest was driven by institutional investors seeking to capitalize on the potential upside of Janus International’s stock.

This reflects the increasing confidence of investors in the company’s ability to deliver strong returns in the long-term. The increase in short interest also indicates that investors are expecting the stock to outperform the broader market over the coming months. With the company’s long-term track record of delivering superior returns, investors are clearly expecting the stock to deliver further gains in the coming months.

Price History

Currently, news sentiment around the company is mostly positive. On Wednesday, JANUS INTERNATIONAL opened at $9.8 and closed at the same price, up by 1.9% from its last closing price of $9.6. This increase in short interest indicates that investors are expecting the stock to go down in the near future.

However, due to the positive news sentiment and the stock’s performance, investors remain optimistic. This could be attributed to the company’s recent financial performance and strategic decisions, which have been well received by the market. The company’s financials have been improving over the past few months. Its strategic decisions and collaborations with key partners have also been paying off. This has resulted in an increase in revenue and profits, which has been well-received by investors.

In addition, JANUS INTERNATIONAL has also made several moves to expand its product portfolio and enter new markets. It has acquired several companies and invested heavily in research and development to stay ahead of the competition. As a result, it is seeing strong growth in sales and profitability as well as customer loyalty. Overall, JANUS INTERNATIONAL’s performance has been impressive in recent months, which has resulted in increased investor confidence and a rise in short interest. With its strong financials, strategic moves, and expanding product portfolio, the company looks well-positioned to continue its success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Janus International. More…

| Total Revenues | Net Income | Net Margin |

| 975.13 | 90.17 | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Janus International. More…

| Operations | Investing | Financing |

| 77.74 | -2.11 | -29.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Janus International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.25k | 911.89 | 2.3 |

Key Ratios Snapshot

Some of the financial key ratios for Janus International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 15.8% |

| FCF Margin | ROE | ROA |

| 6.8% | 29.9% | 7.7% |

VI Analysis

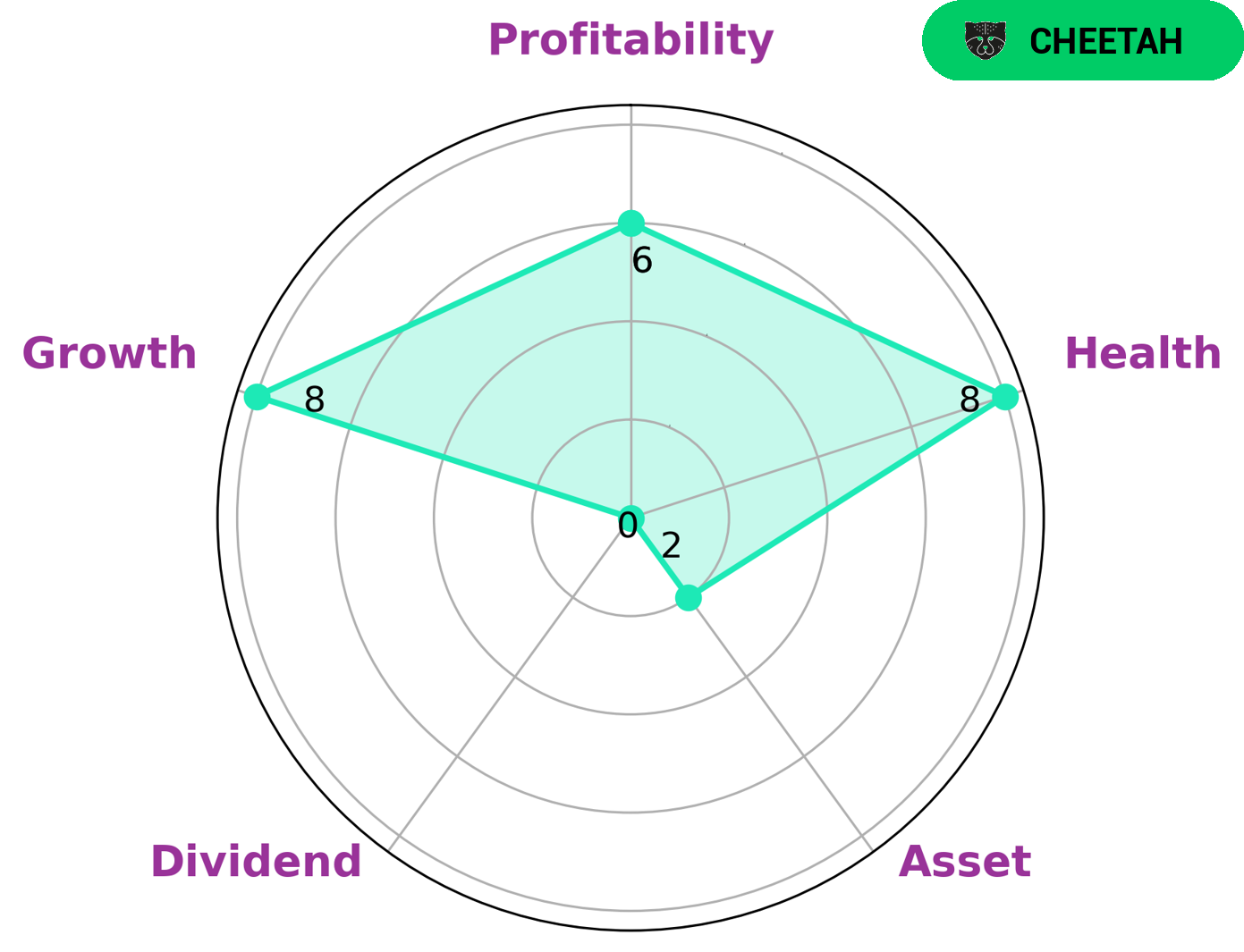

JANUS INTERNATIONAL is a strong growth company, with a high health score of 8/10 based on VI Star Chart. This means that despite its current debt, the company is capable of sustaining future operations in times of crisis. However, it is also classified as a ‘cheetah’, meaning that while it may have achieved high revenue or earnings growth, it is considered less stable due to lower profitability. This makes JANUS INTERNATIONAL attractive for investors who are looking for high-growth opportunities and can accept the risk of lower profits. Such investors may include venture capitalists, angel investors and other high-risk, high-reward investors. They may also be suited for traders who can take advantage of short-term price movements. However, JANUS INTERNATIONAL is relatively weak in other areas such as asset and dividend, making it less attractive to investors who are looking for stability or income. As such, it may be best suited for aggressive investors who can handle the risk involved in investing in such a company. More…

VI Peers

Janus International Group Inc. is one of the world’s leading manufacturers of doors, windows, and related products. The company’s products are used in a wide variety of applications, including residential, commercial, and industrial. Janus International Group Inc. has a strong market presence in North America, Europe, and Asia. The company’s main competitors include Tyman PLC, Aro Granite Industries Ltd, and Deceuninck NV.

– Tyman PLC ($LSE:TYMN)

Tyman PLC is a leading global supplier of engineered industrial products. The company has a market capitalization of 416.16 million as of 2022 and a return on equity of 9.35%. Tyman operates in three segments: building products, industrial products, and water management. The building products segment provides products and solutions for the construction and maintenance of buildings, including doors, windows, stairs, and fittings. The industrial products segment offers products and solutions for the construction and maintenance of industrial facilities, such as conveyor systems, lifting equipment, and cranes. The water management segment provides products and solutions for the treatment and distribution of water, including pumps, valves, and pipes.

– Aro Granite Industries Ltd ($BSE:513729)

Aro Granite Industries Ltd is a company that manufactures and exports granite and marble products. The company has a market cap of 699.98M as of 2022 and a Return on Equity of 5.38%. Aro Granite Industries Ltd is a leading player in the granite and marble industry with a strong presence in India and overseas. The company has a diversified product portfolio and a wide distribution network. Aro Granite Industries Ltd is a publicly listed company with a strong track record of profitability and growth.

– Deceuninck NV ($LTS:0MEL)

Deceuninck NV is a Belgian company that manufactures PVC-u profile systems for the construction industry. The company has a market capitalization of 296.69 million as of 2022 and a return on equity of 9.83%. Deceuninck NV’s products are used in a variety of applications, including windows, doors, conservatories, and curtain walling. The company has a strong presence in Europe, with manufacturing facilities in Belgium, France, Germany, Poland, and the United Kingdom.

Summary

Investors have been increasingly bullish on JANUS INTERNATIONAL, as evidenced by a 7.5% increase in short interest during December. Market sentiment towards the company is largely positive, with analysts forecasting potential for continued growth. Investors may want to consider investing in JANUS INTERNATIONAL as it offers a diversified portfolio of investments and a strong track record of delivering solid returns.

The company has also recently unveiled new initiatives to improve its operational efficiency and streamline its processes. While there is always some risk associated with investing, JANUS INTERNATIONAL appears to be well-positioned to capitalize on market opportunities and reward investors with long-term gains.

Recent Posts