Carrier Global Stock Intrinsic Value – , a Carrier Global Company

April 22, 2023

Trending News ☀️

Carrier Global ($NYSE:CARR) Corporation, a wholly-owned subsidiary of United Technologies Corporation, is pleased to announce that its wholly-owned subsidiary NORESCO has been awarded a $130M contract by the EPA’s National Vehicle and Fuel Emissions Laboratory. The five-year contract includes the delivery and installation of lab equipment and the management of data collection, analysis, and reporting. CARRIER GLOBAL is a leading global provider of heating, ventilation, air conditioning, and refrigeration products and services. From residential to commercial to industrial applications, CARRIER GLOBAL offers superior products and services, delivered by highly trained professionals, to ensure reliable and efficient operation with maximum comfort and cost savings. CARRIER GLOBAL is dedicated to creating quality products with cutting edge technology for a better tomorrow.

Price History

CARRIER GLOBAL, a leader in energy efficient heating, cooling and refrigeration solutions, announced on Thursday the awarding of a $130 million contract from the Environmental Protection Agency (EPA) for a Vehicle and Fuel Emissions Laboratory to its subsidiary NORESCO. This laboratory will provide research and analysis of automotive engine and fuel emissions and will be located in Ann Arbor, Michigan. CARRIER GLOBAL stock opened at $44.8 and closed at $45.4 on Thursday, up by 0.9% from the prior closing price of 45.0. This latest news has spurred investor confidence in the company and its prospects for continued growth. The Vehicle and Fuel Emissions Laboratory will be a state-of-the-art facility, utilizing cutting-edge technology to aid in the investigation of emissions from various sources.

It is expected to provide valuable insight into how to reduce emissions in order to create a cleaner environment. This project is part of CARRIER GLOBAL’s commitment to environmental stewardship and sustainability. CARRIER GLOBAL is proud to be the provider of this cutting-edge laboratory and looks forward to working with the EPA to provide valuable research that will benefit the world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Carrier Global. More…

| Total Revenues | Net Income | Net Margin |

| 20.42k | 3.53k | 17.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Carrier Global. More…

| Operations | Investing | Financing |

| 1.74k | 1.75k | -2.93k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Carrier Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 26.09k | 18.01k | 8.55 |

Key Ratios Snapshot

Some of the financial key ratios for Carrier Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.1% | 2.3% | 22.5% |

| FCF Margin | ROE | ROA |

| 6.8% | 38.5% | 11.0% |

Analysis – Carrier Global Stock Intrinsic Value

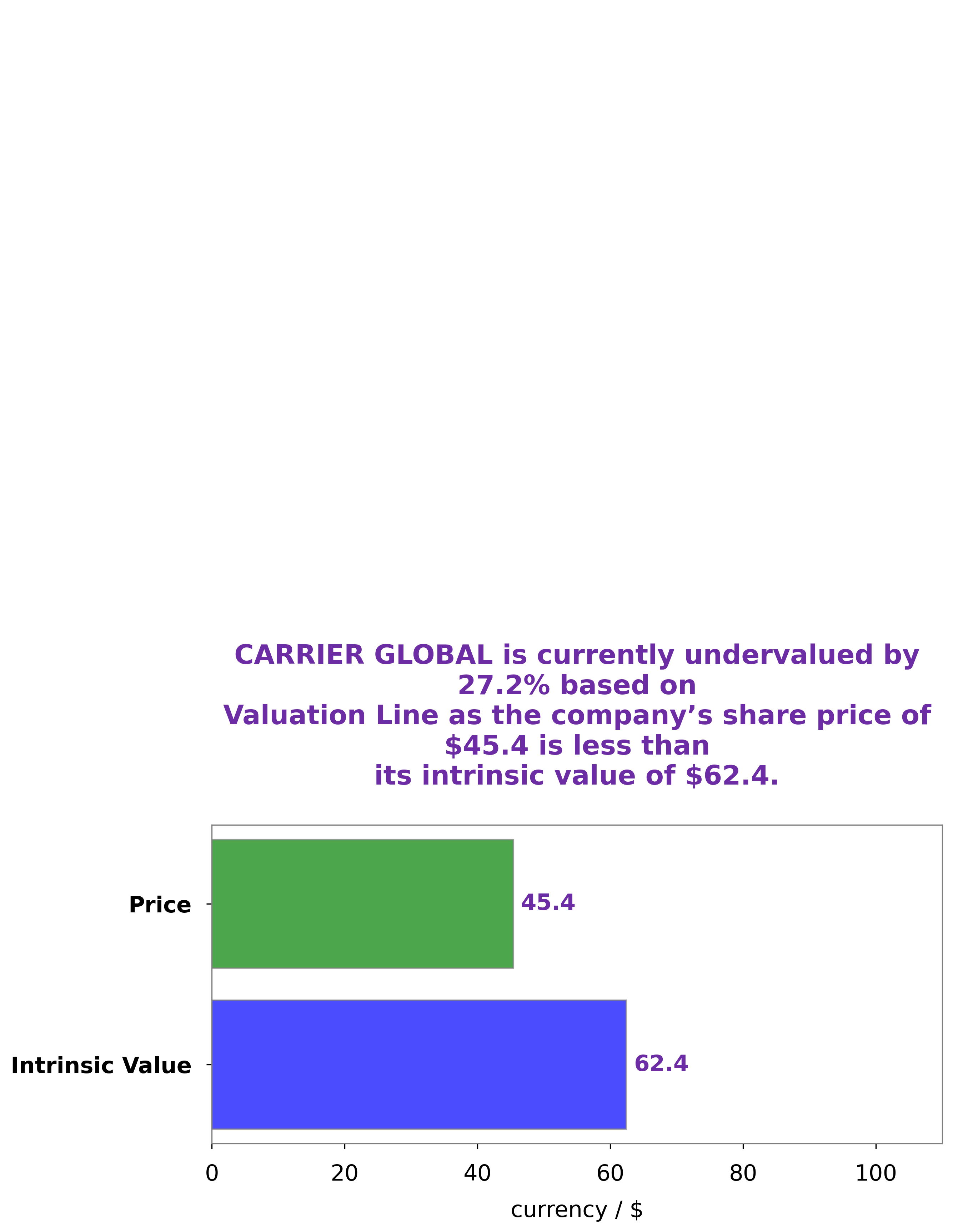

GoodWhale has completed an analysis of CARRIER GLOBAL‘s financials and concluded that the fair value of the company’s share is around $62.4. This number was calculated through our proprietary Valuation Line, which is based on various metrics such as the company’s profit margin, debt to equity ratio, and revenue. Currently, CARRIER GLOBAL’s stock is trading at $45.4, which implies that it is undervalued by 27.3%. This suggests that investors could potentially benefit from investing in the company’s stock before its value increases. More…

Peers

The competition between Carrier Global Corp and its competitors is fierce. Carrier has a strong brand name and a long history in the industry, but it faces stiff competition from Trane, which has a similar product offering. Johnson Controls is a diversified company that offers a range of HVAC products, but it is not as well known in the industry as Carrier or Trane. Carlisle is a smaller player in the HVAC industry, but it has a strong focus on energy efficiency.

– Johnson Controls International PLC ($NYSE:JCI)

Johnson Controls International PLC is a technology and industrial leader with a market cap of 45.72B as of 2022. The company has a Return on Equity of 7.45%. Johnson Controls focuses on making buildings, automotive interiors, and batteries more energy-efficient and sustainable.

– Trane Technologies PLC ($NYSE:TT)

Trane Technologies PLC is a publicly traded company with a market capitalization of $40.55 billion as of 2022. The company has a return on equity of 24.48%. Trane Technologies is a provider of products, services and solutions to improve the quality and comfort of air in homes and buildings, transport and protect food and perishables, and increase industrial productivity and efficiency. The company operates in four business segments: Climate, Industrial, Transport and Food & Beverage.

– Carlisle Companies Inc ($NYSE:CSL)

The company’s market cap is $12.28B as of 2022 with a ROE of 26.49%. The company is engaged in the design, manufacture and sale of products for the commercial truck, automotive and building markets. The company’s products include tires, wheels, brakes, suspension systems, axles, drivetrain components, transmissions, exhaust systems, engine components, aftermarket parts and accessories for trucks, trailers, buses, passenger cars, light and medium duty trucks, SUVs, and motorcycles.

Summary

Carrier Global Corporation (CARR) is a leading provider of heating, cooling, and ventilation systems and services. The company’s stock has seen an increase in investor attention recently due to their $130M contract awarded by the EPA National Vehicle and Fuel Emissions Laboratory to NORESCO, a leading energy efficiency and infrastructure modernization firm. This contract indicates that CARR is continuing to invest in energy efficiency, which could indicate future profits.

CARR has also been able to maintain strong financials throughout the pandemic, with cash balances increasing and debt levels decreasing. With superior financial health and a commitment to energy efficiency, investing in CARR presents a great opportunity for long-term gains.

Recent Posts