Carrier Global Passes on $10B Bid for Germany’s Viessmann

April 25, 2023

Trending News 🌥️

Carrier Global ($NYSE:CARR), a NYSE-listed company, has recently made the decision to reject a $10B bid for Germany’s Viessmann. Carrier Global is a world leader in developing and delivering high-performance heating, ventilating, air-conditioning and refrigeration (HVACR) solutions with operations across Europe, the Middle East, India and Africa. The substantial offer from one of Europe’s leading heating technology companies was ultimately deemed too risky for Carrier Global to pursue.

The company stated that the potential deal did not fit their criteria for investments and that it was not in their best interest to pursue it. While Carrier Global will not be investing in Viessman, they remain committed to their core mission of providing service and products that help people stay comfortable while also saving energy.

Stock Price

On Monday, CARRIER GLOBAL passed on a bid for Germany’s Viessmann, one of the largest producers of heating systems and refrigeration technology worldwide. The reported $10 billion bid was not accepted and the stock suffered from the news. CARRIER GLOBAL opened at $45.4 and closed at $41.9, a drop of 7.3% from the prior closing price of $45.2. This drop reflected the disappointment of investors at the missed opportunity to acquire one of the world’s foremost names in heating technology, though CARRIER GLOBAL did not comment on the failed bid. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Carrier Global. More…

| Total Revenues | Net Income | Net Margin |

| 20.42k | 3.53k | 17.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Carrier Global. More…

| Operations | Investing | Financing |

| 1.74k | 1.75k | -2.93k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Carrier Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 26.09k | 18.01k | 8.55 |

Key Ratios Snapshot

Some of the financial key ratios for Carrier Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.1% | 2.3% | 22.5% |

| FCF Margin | ROE | ROA |

| 6.8% | 38.5% | 11.0% |

Analysis

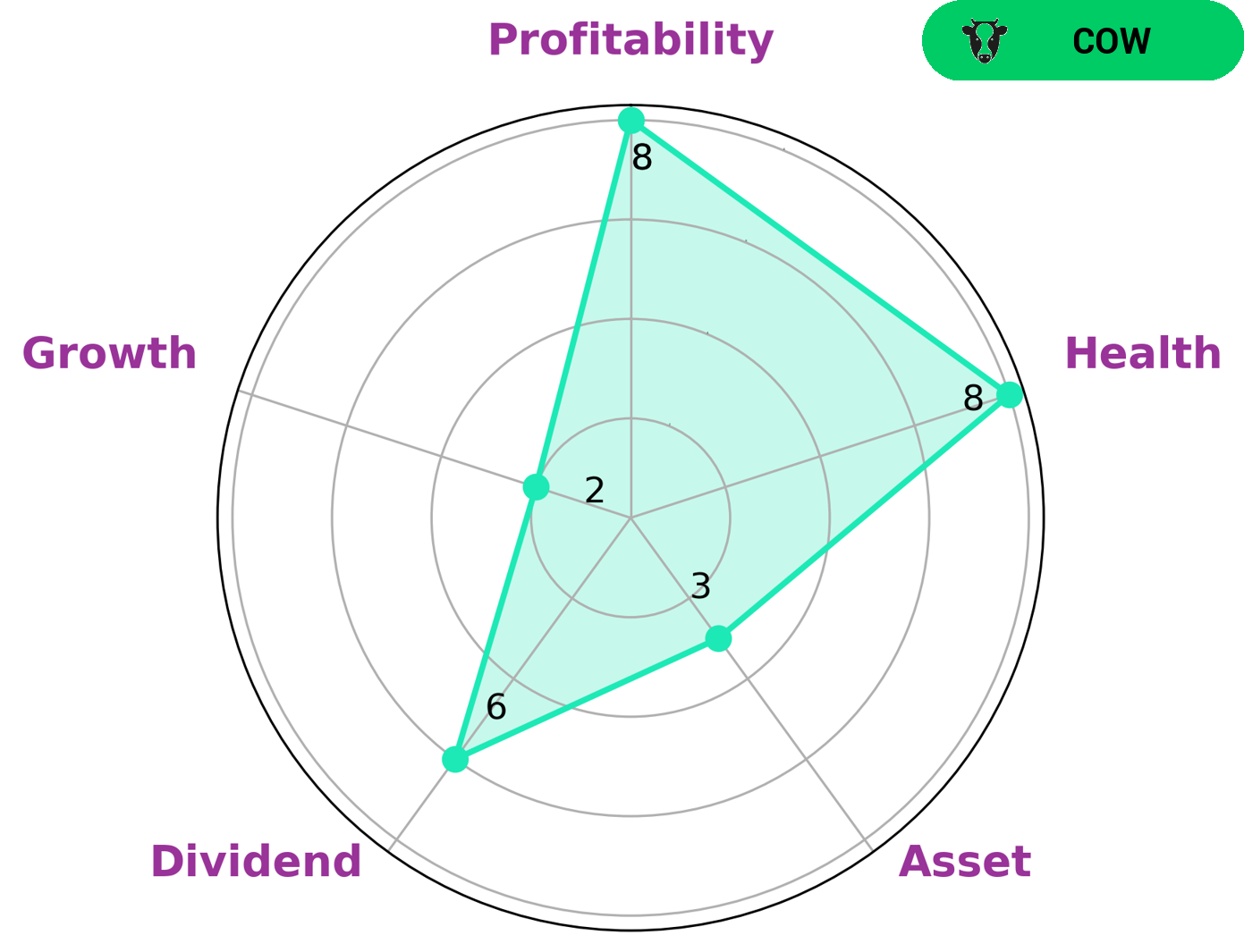

We at GoodWhale recently conducted an analysis of CARRIER GLOBAL‘s wellbeing, and based on our Star Chart we classified the company as a ‘cow’, which we consider to be one that has a track record of paying out consistent and sustainable dividends. We believe this type of company would be of interest to investors seeking a reliable stream of income. CARRIER GLOBAL earned a high health score of 8/10 due to its strong cashflows and debt structure, allowing for the company to pay off debt and fund future operations. Moreover, CARRIER GLOBAL scored highly in profitability, moderately in dividend sustainability and weakly in asset and growth. This presents a promising picture of the company’s financial health and provides investors with a good indicator of its future prospects. More…

Peers

The competition between Carrier Global Corp and its competitors is fierce. Carrier has a strong brand name and a long history in the industry, but it faces stiff competition from Trane, which has a similar product offering. Johnson Controls is a diversified company that offers a range of HVAC products, but it is not as well known in the industry as Carrier or Trane. Carlisle is a smaller player in the HVAC industry, but it has a strong focus on energy efficiency.

– Johnson Controls International PLC ($NYSE:JCI)

Johnson Controls International PLC is a technology and industrial leader with a market cap of 45.72B as of 2022. The company has a Return on Equity of 7.45%. Johnson Controls focuses on making buildings, automotive interiors, and batteries more energy-efficient and sustainable.

– Trane Technologies PLC ($NYSE:TT)

Trane Technologies PLC is a publicly traded company with a market capitalization of $40.55 billion as of 2022. The company has a return on equity of 24.48%. Trane Technologies is a provider of products, services and solutions to improve the quality and comfort of air in homes and buildings, transport and protect food and perishables, and increase industrial productivity and efficiency. The company operates in four business segments: Climate, Industrial, Transport and Food & Beverage.

– Carlisle Companies Inc ($NYSE:CSL)

The company’s market cap is $12.28B as of 2022 with a ROE of 26.49%. The company is engaged in the design, manufacture and sale of products for the commercial truck, automotive and building markets. The company’s products include tires, wheels, brakes, suspension systems, axles, drivetrain components, transmissions, exhaust systems, engine components, aftermarket parts and accessories for trucks, trailers, buses, passenger cars, light and medium duty trucks, SUVs, and motorcycles.

Summary

Investing in Carrier Global could be risky business. On the heels of reports that the company received a $10 billion bid for its German subsidiary, Viessmann, the company’s stock moved downward the same day. This raises concerns about the company’s future prospects and is indicative of investors’ apprehension about a potential acquisition.

The future of Carrier Global may depend on how the company manages this situation, and how it responds to potential buyers. Investors should closely monitor the company’s activities to make sure they are comfortable with their decisions when investing in this stock.

Recent Posts