Carlisle Companies’ Vision 2030 Leaves Some Baffled

December 15, 2023

☀️Trending News

Carlisle Companies ($NYSE:CSL), Inc. is a leading diversified global manufacturer and marketer of highly engineered products for commercial roofing, specialty polyurethane, electronic technologies, and off-highway powertrain applications.

However, its recent announcement of Vision 2030 has left many scratching their heads. At first glance, Carlisle’s Vision 2030 appears to be a sweeping statement of ambition and commitment to shareholders. It includes goals such as becoming the “best customer-centric manufacturing and marketing company in the world” and achieving “sustained mid-teens return on invested capital.” However, upon further inspection, some are perplexed by the guidance of Vision 2030. For one, it does not provide many details on how these goals are to be achieved and does not offer a timeline for when they should be accomplished.

Additionally, there is no indication of how the company will measure its success or how it will reward employees for doing so. It appears that Carlisle must provide more details if they hope to meet their stated goals and ensure the success of their shareholders.

Stock Price

On Thursday, CARLISLE COMPANIES stock opened at $300.0 and closed at $309.1, up by 3.8% from last closing price of 297.7. This increase is likely due to the company’s announcement of their Vision 2030, their long-term sustainability plan. While the plan has been praised by some for its ambitious goals, others are left scratching their heads and wondering what it all means. The plan includes ambitious goals such as a zero-carbon future, a commitment to sustainable and responsible sourcing, and a focus on providing timely customer service.

These goals are ambitious, and some have questioned how the company intends to achieve them in such a short timeframe. Only time will tell if Carlisle’s Vision 2030 will be successful, and if it will have a positive impact on the company’s bottom line. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Carlisle Companies. More…

| Total Revenues | Net Income | Net Margin |

| 5.75k | 734.3 | 13.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Carlisle Companies. More…

| Operations | Investing | Financing |

| 1.22k | -137.1 | -1.58k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Carlisle Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.82k | 3.89k | 60.06 |

Key Ratios Snapshot

Some of the financial key ratios for Carlisle Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | 25.3% | 17.9% |

| FCF Margin | ROE | ROA |

| 18.5% | 21.6% | 9.5% |

Analysis

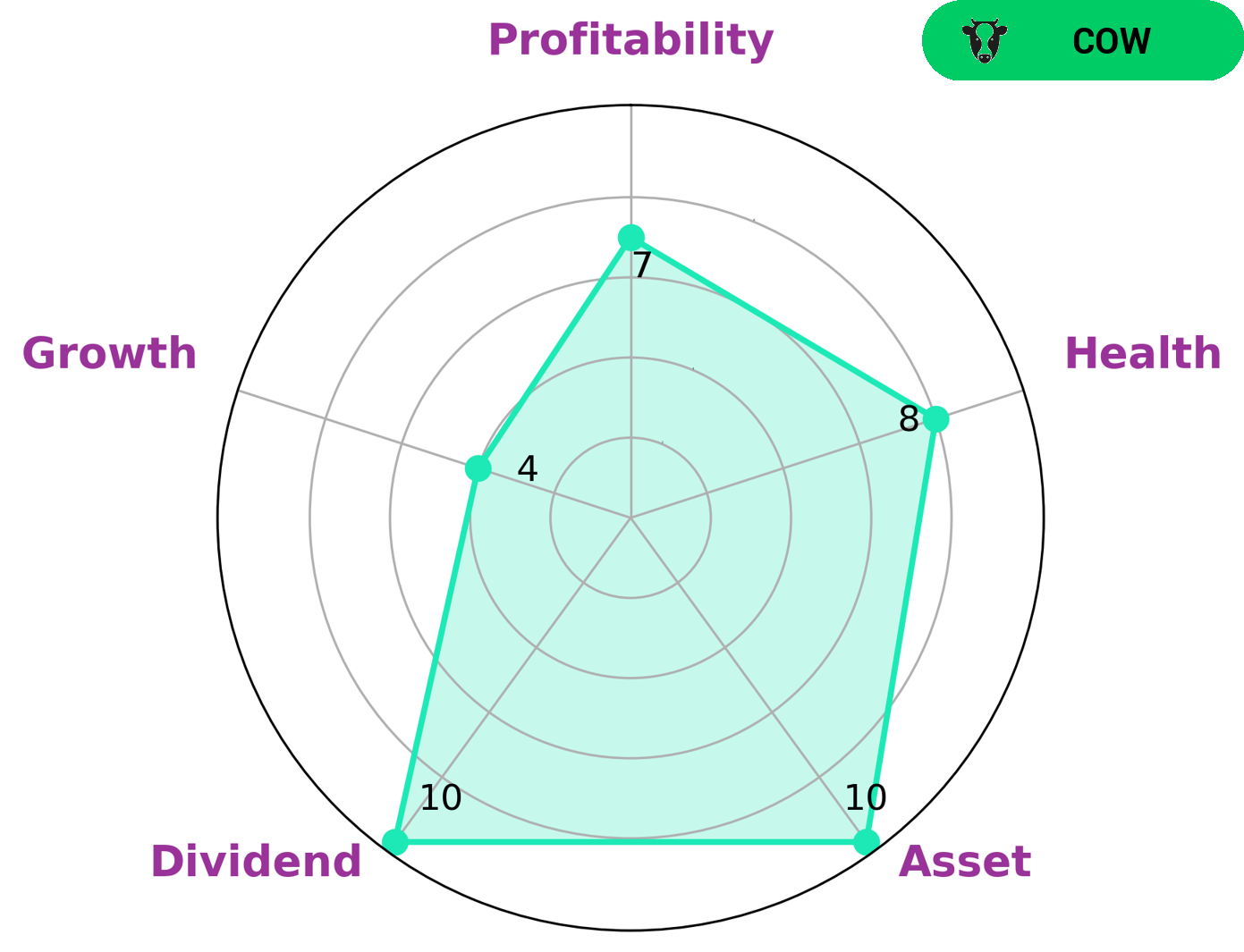

As GoodWhale analyzed the financials of CARLISLE COMPANIES, we could see that according to Star Chart, CARLISLE COMPANIES is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This type of company may appeal to investors who are interested in companies that have established a strong foundation and are likely to generate consistent returns. In terms of CARLISLE COMPANIES’ financials, we can see that it is strong in assets, dividends, and profitability, and is considered medium in terms of growth. CARLISLE COMPANIES also has a high health score of 8/10 considering its cashflows and debt, which shows that it is capable of paying off debt and funding future operations. All together, CARLISLE COMPANIES is an attractive company to investors who are looking for stable returns and companies with a solid financial foundation. More…

Peers

The company operates in three segments: Carlisle Construction Materials, Carlisle Interconnect Technologies, and Carlisle Brake & Friction. Schweiter Technologies AG, Forbo Holding AG, and Sankyo Tateyama Inc. are all competitors of Carlisle Companies Inc.

– Schweiter Technologies AG ($OTCPK:SCWTF)

Schweiter Technologies AG is a publicly traded company with a market capitalization of 1.03 billion as of 2022. The company has a return on equity of 7.24%. Schweiter Technologies AG is engaged in the development, manufacture and marketing of textile machines, precision tools and related services. The company’s products are used in the textile, automotive, aerospace and other industries.

– Forbo Holding AG ($LTS:0QKD)

Forbo Holding AG is a Swiss manufacturer of floor coverings, adhesives and other specialty products. The company has a market capitalization of 1.77 billion as of 2022 and a return on equity of 21.17%. Forbo produces a wide range of products for both commercial and residential applications, including vinyl and linoleum flooring, carpet tiles, adhesives, sealants and coatings. The company has a strong presence in Europe and Asia, and is expanding its operations in North America and South America.

– Sankyo Tateyama Inc ($TSE:5932)

Sankyo Tateyama Inc is a Japanese company that manufactures and sells pharmaceuticals and medical devices. The company has a market cap of 17.4 billion as of 2022 and a return on equity of 0.94%. The company’s products include drugs for the treatment of hypertension, diabetes, and dyslipidemia, as well as medical devices such as blood pressure monitors and glucose meters.

Summary

Carlisle Companies Inc., a diversified industrial company, recently released its long-term guidance for its Vision 2030. The plan outlines its goal to double its operating income by 2030.

However, the guidance leaves investors with many questions regarding the path to achieving this goal. Despite the uncertainty, the stock price of Carlisle rose on the same day, showing some investor optimism. Investors are likely interested in analyzing the company’s current performance and potential outlook as they assess the feasibility of Carlisle’s long-term vision. Factors such as product diversification, operational efficiency, and financial management will be important to consider when evaluating Carlisle’s long-term investment opportunities.

Additionally, investors should also factor in the industry landscape and macroeconomic conditions when assessing the company’s future performance.

Recent Posts