CARLISLE COMPANIES Reports 36.0% Increase in Total Revenue for Fourth Quarter of FY2022

March 29, 2023

Earnings Overview

CARLISLE COMPANIES ($NYSE:CSL) disclosed their fourth-quarter FY2022 financial results on February 7, 2023, reporting total revenue of USD 174.2 million and net income of USD 1454.6 million. This marked a 36.0% growth in revenue and a 5.7% increase in net income compared to the same quarter in 2021, ending December 31, 2022.

Transcripts Simplified

Carlisle reported record fourth quarter and full year sales in 2022. CEO commended the entire Carlisle team on their success, despite the challenges of the past few years, including navigating the pandemic. The record results are due to the clarity of mission provided by Vision 2025, their strong balance sheet and flexible cash flow, and their portfolio reshaping to pivot to higher returning building products. The pillars of Vision 2025 remain core to their strategy going forward, which includes driving mid-single-digit organic revenue growth, optimizing capital deployment to drive long-term shareholder value, and delivering sustained profitability and cash flow.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Carlisle Companies. More…

| Total Revenues | Net Income | Net Margin |

| 6.59k | 921.8 | 14.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Carlisle Companies. More…

| Operations | Investing | Financing |

| 1k | -61.1 | -862 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Carlisle Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.22k | 4.2k | 59.42 |

Key Ratios Snapshot

Some of the financial key ratios for Carlisle Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.1% | 24.9% | 19.4% |

| FCF Margin | ROE | ROA |

| 12.4% | 26.4% | 11.1% |

Share Price

On Tuesday, CARLISLE COMPANIES reported a 36.0% increase in total revenue for its fourth quarter of FY2022. This positive report sent shares up 1.6% from their closing price of 246.7 to a new closing price of 250.7. The company’s strong fourth quarter was fueled by increased demand for their products and services, as well as strategic acquisitions and partnerships.

Additionally, the company has made a series of investments in the past year which are expected to yield high returns in the future quarters. CARLISLE COMPANIES’ impressive fourth quarter performance builds upon their track record of success, which has seen their stock rise steadily over the past few years. Their fourth quarter FY2022 report serves as a testament to their consistent growth and ability to identify and capitalize on trends within the industry. Live Quote…

Analysis

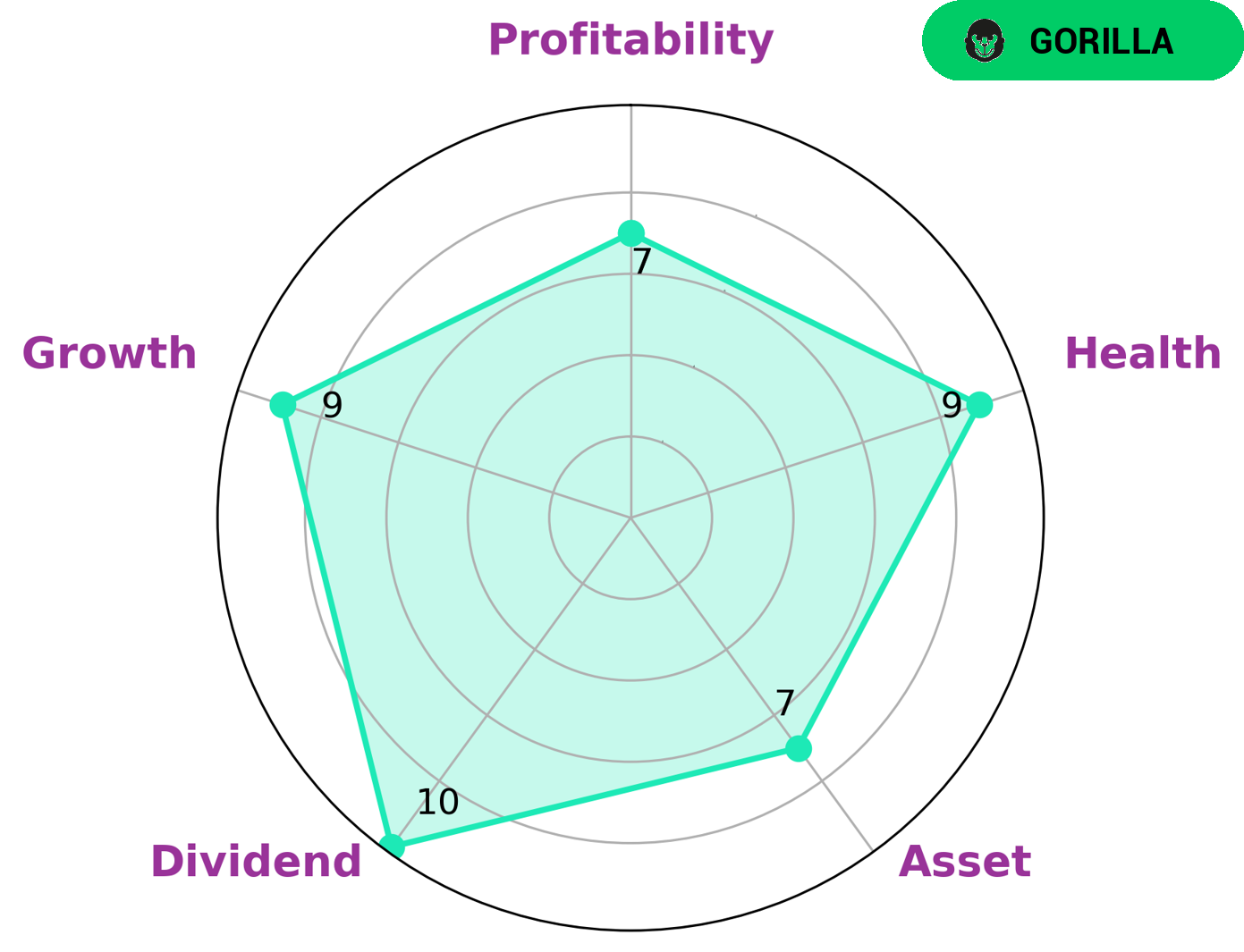

As a financial analyst, I used GoodWhale to analyze CARLISLE COMPANIES‘ financials. The Star Chart classified the company as a ‘gorilla,’ indicating that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. This type of company is likely to be attractive to investors seeking long-term returns. Moreover, CARLISLE COMPANIES scored 9/10 on the health scale, suggesting that the company has strong cashflows and debt capacity to ride out any crisis without the risk of bankruptcy. CARLISLE COMPANIES further demonstrated strong performance in terms of dividend, growth, profitability, and assets. These factors make CARLISLE COMPANIES an attractive investment for many investors. More…

Peers

The company operates in three segments: Carlisle Construction Materials, Carlisle Interconnect Technologies, and Carlisle Brake & Friction. Schweiter Technologies AG, Forbo Holding AG, and Sankyo Tateyama Inc. are all competitors of Carlisle Companies Inc.

– Schweiter Technologies AG ($OTCPK:SCWTF)

Schweiter Technologies AG is a publicly traded company with a market capitalization of 1.03 billion as of 2022. The company has a return on equity of 7.24%. Schweiter Technologies AG is engaged in the development, manufacture and marketing of textile machines, precision tools and related services. The company’s products are used in the textile, automotive, aerospace and other industries.

– Forbo Holding AG ($LTS:0QKD)

Forbo Holding AG is a Swiss manufacturer of floor coverings, adhesives and other specialty products. The company has a market capitalization of 1.77 billion as of 2022 and a return on equity of 21.17%. Forbo produces a wide range of products for both commercial and residential applications, including vinyl and linoleum flooring, carpet tiles, adhesives, sealants and coatings. The company has a strong presence in Europe and Asia, and is expanding its operations in North America and South America.

– Sankyo Tateyama Inc ($TSE:5932)

Sankyo Tateyama Inc is a Japanese company that manufactures and sells pharmaceuticals and medical devices. The company has a market cap of 17.4 billion as of 2022 and a return on equity of 0.94%. The company’s products include drugs for the treatment of hypertension, diabetes, and dyslipidemia, as well as medical devices such as blood pressure monitors and glucose meters.

Summary

CARLISLE COMPANIES has reported strong financial results for the fourth quarter of FY2022 with total revenue of USD 174.2 million and net income of USD 1454.6 million, representing year over year increases of 36.0% and 5.7%, respectively. These numbers demonstrate the company’s sound financial health and show that it has the potential for continued growth. For investors, this presents an excellent opportunity to capitalize on a well-established and reliable business model that has proven itself to be capable of delivering consistent results.

Recent Posts