Builders Firstsource Stock Fair Value Calculator – Builders FirstSource Experiences More Than -32.08% Drop in Value

May 21, 2023

Trending News 🌥️

Builders FirstSource Inc., a leading supplier and manufacturer of building materials and services in the United States, experienced a drop of -32.08% in its stock value on Friday, May 12. The company closed its trading session at $115.84, resulting in a decrease of -1.22% from its closing price on the preceding day. BUILDERS FIRSTSOURCE ($NYSE:BLDR) is a national provider of building products, services, and solutions for professional contractors and homeowners across the United States. The company is also one of the leading manufacturers and distributors of lumber products and building materials used in residential construction. In addition, BUILDERS FIRSTSOURCE offers a wide range of professional services to assist customers with their construction projects.

Analysis – Builders Firstsource Stock Fair Value Calculator

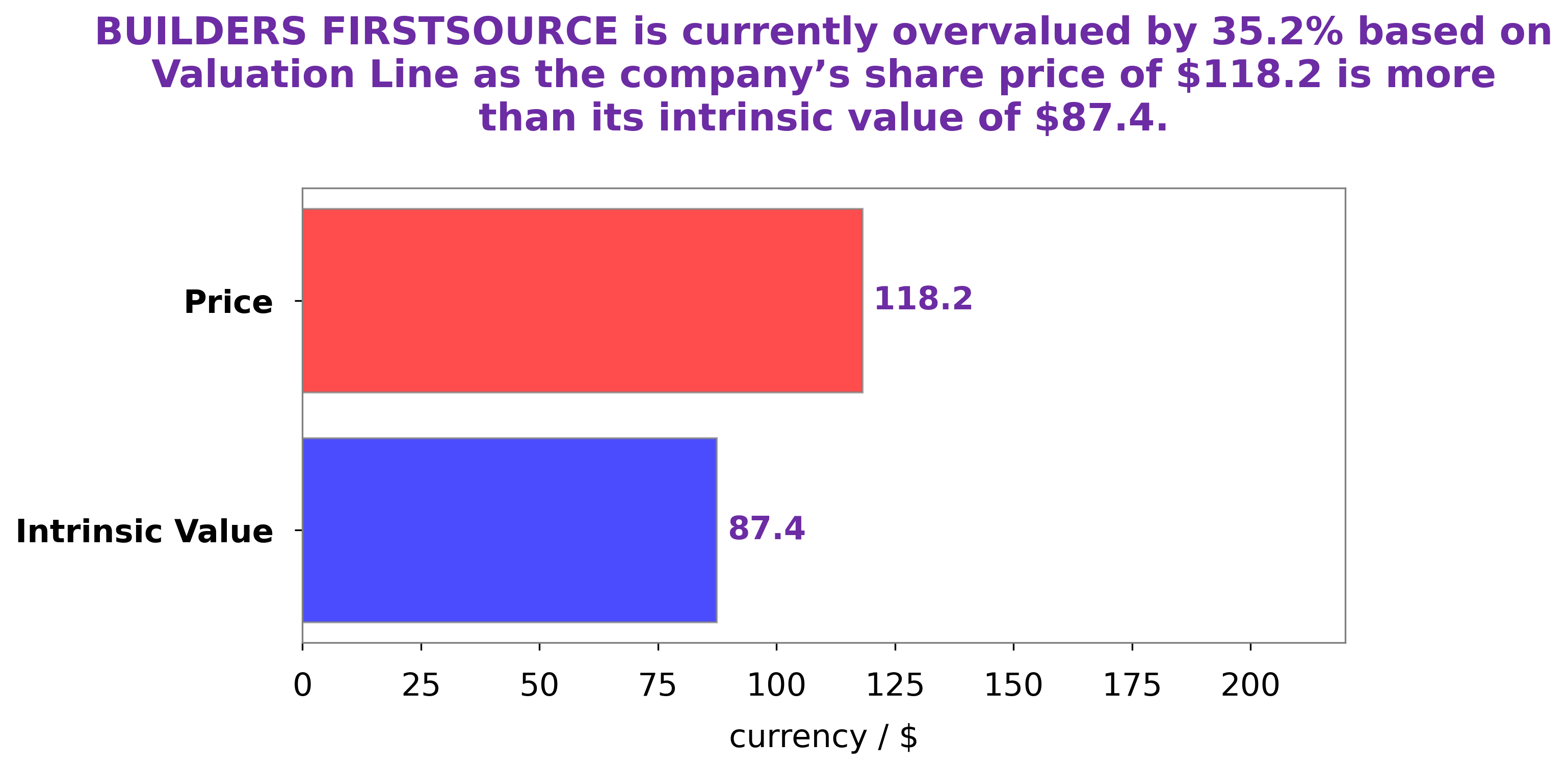

GoodWhale conducted an in-depth analysis of BUILDERS FIRSTSOURCE and its wellbeing. After assessing the company, we developed a proprietary Valuation Line and calculated the fair value of BUILDERS FIRSTSOURCE share to be at around $87.4. However, currently BUILDERS FIRSTSOURCE stock is being traded at $118.2, which is substantially overvalued by 35.2%. Considering such a large difference between the fair valuation and market price, investors should be aware of the potential risks when investing in BUILDERS FIRSTSOURCE stock. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Builders Firstsource. More…

| Total Revenues | Net Income | Net Margin |

| 20.93k | 2.44k | 11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Builders Firstsource. More…

| Operations | Investing | Financing |

| 4.07k | -1.09k | -3.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Builders Firstsource. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.48k | 5.82k | 35.98 |

Key Ratios Snapshot

Some of the financial key ratios for Builders Firstsource are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 41.2% | 106.8% | 16.1% |

| FCF Margin | ROE | ROA |

| 17.6% | 43.8% | 20.1% |

Peers

The company’s competitors include Noda Corp, Eurocell PLC, and Masco Corp.

– Noda Corp ($TSE:7879)

Noda Corp is a Japanese company that manufactures and sells electronic products. The company has a market cap of 19.66B as of 2022 and a ROE of 17.42%. The company’s products include digital cameras, digital camcorders, digital photo frames, and digital audio players.

– Eurocell PLC ($LSE:ECEL)

Eurocell PLC is a provider of building products and solutions in the United Kingdom. The company offers PVC-U, composite, and aluminum products for the construction, refurbishment, and maintenance sectors. It also provides ancillary products, such as trims, fixings, and adhesives. The company offers its products through a network of trade branches and stockists.

– Masco Corp ($NYSE:MAS)

Masco Corporation is a global leader in the design, manufacture and distribution of branded home improvement and building products. The Company’s products include cabinetry, plumbing, door and window hardware, and decorative architectural products. The Company operates through four segments: Plumbing Products, Decorative Architectural Products, Cabinetry Products and International. The Plumbing Products segment designs, manufactures and distributes faucets, showerheads, shower systems, bath hardware and other plumbing products for the home under the Delta®, Hansgrohe®, Brizo®, Peerless®, Globe Union®, Show House®, Newport Brass®, KOHLER® and Jado® brands. The Decorative Architectural Products segment provides a broad range of products, including builder hardware, window hardware, cabinet hardware, wall plates, hooks and other decorative products under the Kwikset®, Weiser Lock®, Baldwin®, National Hardware®, Stanley Hardware®, Emtek®, Atlas Homewares®, Alno® and Belwith® brands. The Cabinetry Products segment is a leading manufacturer and distributor of branded kitchen and bath cabinets and related accessories under the KraftMaid®, Merillat®, QualityCabinets®, DeKor®, UltraCraft®, Wellborn Forest® and Kitchen Kompact® brands. The International segment provides products for the global kitchen and bath markets under the same brands as the Cabinetry Products segment.

Summary

Builders FirstSource Inc. (BFS) has had a significant upside in the past few months, with the stock price increasing by more than 32%. Recently, the stock price declined by 1.22% to $115.84 on Friday, May 12th. Analysts are expecting the stock to remain volatile in the short-term as investors continue to monitor the company’s performance and overall market sentiment. Investors may want to study BFS’s fundamentals closely, such as its financial health, competitive advantage, and operational efficiency, before making an investment decision.

They should also keep an eye on industry trends and external factors affecting the company’s performance. Overall, BFS looks poised for further growth in the long-term and is worth considering for investing.

Recent Posts