Builders FirstSource Sees 2.57% Increase – Is Now the Time to Invest?

April 20, 2023

Trending News ☀️

Builders ($NYSE:BLDR) FirstSource Inc. is an American supplier and manufacturer of building materials, manufactured components, and construction services for professional installers and contractors. The company serves its customers through a network of locations across the United States, primarily in the southern, western, and northeastern parts of the country. On Tuesday, 04/18/23, the company’s stock closed at $96.72, which was a 2.57% increase from its previous day’s closing price. This could signal a buying opportunity for investors looking to capitalize on an undervalued stock.

Analysts have noted that the company’s fundamentals are strong and appear to be improving, indicating that its stock could continue to rise in value. Thus, while it remains to be seen whether Builders FirstSource will continue to experience growth over the long term, investors may wish to consider this stock as part of their portfolios.

Price History

On Wednesday, BUILDERS FIRSTSOURCE Inc. (BFS) stock opened at $96.7 and closed at $94.5, down by 2.3% from the previous closing price of 96.7. Despite the dip in share prices, the company experienced a 2.57% increase in price since the start of the year. With the stock prices at its current level, many investors are asking if now is the time to invest in BFS. Additionally, BFS has announced plans to invest in new and existing projects, which could potentially increase their profits in the future. Furthermore, BFS has a strong management team with years of experience in the industry. Given these positive factors, investing in BFS could be a smart move for investors.

However, all investments come with risks and it is important to do thorough research before investing. Investors should consider the company’s financial performance and prospects, as well as their competitors’ financials, before deciding whether or not to invest in BUILDERS FIRSTSOURCE Inc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Builders Firstsource. More…

| Total Revenues | Net Income | Net Margin |

| 22.73k | 2.75k | 12.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Builders Firstsource. More…

| Operations | Investing | Financing |

| 3.6k | -957.48 | -2.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Builders Firstsource. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.6k | 5.63k | 35.07 |

Key Ratios Snapshot

Some of the financial key ratios for Builders Firstsource are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 46.1% | 112.6% | 16.6% |

| FCF Margin | ROE | ROA |

| 14.3% | 46.3% | 22.2% |

Analysis

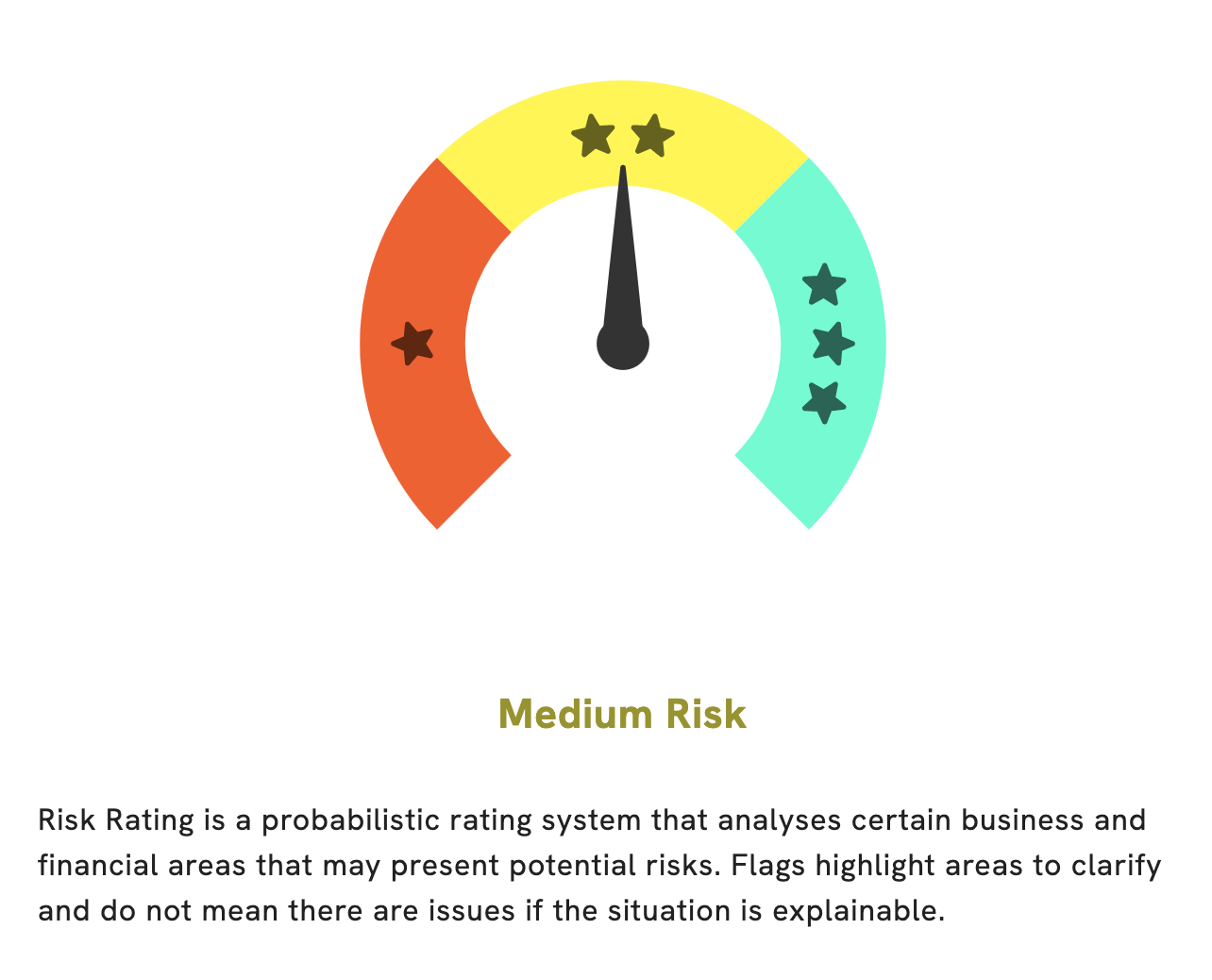

At GoodWhale, we have conducted an analysis of BUILDERS FIRSTSOURCE‘s financials. Based on our Risk Rating, the company is a medium risk investment in terms of financial and business aspects. During our investigation, we detected two risk warnings in their income sheet and balance sheet. If you’re interested in learning more about BUILDERS FIRSTSOURCE, we invite you to register with us so you can get access to our reports and detailed analysis. More…

Peers

The company’s competitors include Noda Corp, Eurocell PLC, and Masco Corp.

– Noda Corp ($TSE:7879)

Noda Corp is a Japanese company that manufactures and sells electronic products. The company has a market cap of 19.66B as of 2022 and a ROE of 17.42%. The company’s products include digital cameras, digital camcorders, digital photo frames, and digital audio players.

– Eurocell PLC ($LSE:ECEL)

Eurocell PLC is a provider of building products and solutions in the United Kingdom. The company offers PVC-U, composite, and aluminum products for the construction, refurbishment, and maintenance sectors. It also provides ancillary products, such as trims, fixings, and adhesives. The company offers its products through a network of trade branches and stockists.

– Masco Corp ($NYSE:MAS)

Masco Corporation is a global leader in the design, manufacture and distribution of branded home improvement and building products. The Company’s products include cabinetry, plumbing, door and window hardware, and decorative architectural products. The Company operates through four segments: Plumbing Products, Decorative Architectural Products, Cabinetry Products and International. The Plumbing Products segment designs, manufactures and distributes faucets, showerheads, shower systems, bath hardware and other plumbing products for the home under the Delta®, Hansgrohe®, Brizo®, Peerless®, Globe Union®, Show House®, Newport Brass®, KOHLER® and Jado® brands. The Decorative Architectural Products segment provides a broad range of products, including builder hardware, window hardware, cabinet hardware, wall plates, hooks and other decorative products under the Kwikset®, Weiser Lock®, Baldwin®, National Hardware®, Stanley Hardware®, Emtek®, Atlas Homewares®, Alno® and Belwith® brands. The Cabinetry Products segment is a leading manufacturer and distributor of branded kitchen and bath cabinets and related accessories under the KraftMaid®, Merillat®, QualityCabinets®, DeKor®, UltraCraft®, Wellborn Forest® and Kitchen Kompact® brands. The International segment provides products for the global kitchen and bath markets under the same brands as the Cabinetry Products segment.

Summary

Builders FirstSource Inc. is a building materials supplier that has recently seen an increase of 2.57%. This could be an attractive buying opportunity for investors looking for solid returns on their investments. Looking at the company’s fundamentals, it is important to analyze the company’s financial statements, profitability, management, competitive position, and industry trends. Investors should look for signals of growth, such as growth in revenues, profits, and return on investment, as well as consistency in earnings and cash flow. It is also important to assess how the company is positioned in its industry, as well as how well it is executing its strategy.

Additionally, investors should keep an eye on any potential risks, such as changes in the competitive landscape and government regulations. Ultimately, it is important to understand the company and its industry before making any investment decisions.

Recent Posts