Beacon Roofing Supply’s Stock Soars: Is Financial Strength Behind the Climb?

February 2, 2023

Trending News ☀️

Beacon Roofing Supply ($NASDAQ:BECN), Inc. (BECN) is one of the largest distributors of residential and commercial roofing products in North America. The company trades on the NASDAQ Global Select Market and is headquartered in Herndon, Virginia. Over the past month, BECN stock has seen a 2.6% increase, leading investors to ask: Is financial strength behind the climb? The company is known for its strong financials. These factors suggest that Beacon Roofing Supply is well-positioned to weather any economic downturns. In addition to its strong financials, Beacon Roofing Supply has been expanding its operations in recent years.

The company has acquired several smaller roofing suppliers in order to expand its reach and increase its market share. Overall, Beacon Roofing Supply’s stock appears to be in a strong position. The company’s financials are solid and its strategic acquisitions have been successful. Therefore, it is likely that the stock’s recent climb is being driven by strong fundamentals rather than speculation.

Stock Price

Beacon Roofing Supply’s stock has been on a steady incline in recent weeks, with the stock opening at $54.8 on Tuesday and closing at $56.9, up by 5.0% from its previous closing price of 54.2. The stock has caught the attention of many investors and so far media coverage has been mostly positive. The reasons behind the climb are being debated in the investment community. Many are attributing it to the company’s financial strength, evidenced by its strong balance sheet and cash flow statement. Beacon Roofing Supply has consistently maintained a healthy financial position, and this is likely one of the factors driving its stock price up.

The company has also made several strategic acquisitions in recent years, giving it an edge over its competitors. This includes the acquisition of Allied Building Products last year, which has allowed them to increase their product range and gain access to new markets. Investors must carefully analyze the company’s financials and consider the potential risks before investing in this stock. In the meantime, investors should continue to monitor the company’s performance to stay updated on any changes in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BECN. More…

| Total Revenues | Net Income | Net Margin |

| 6.82k | 219 | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BECN. More…

| Operations | Investing | Financing |

| 166.7 | 716.4 | -1.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BECN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.85k | 3.7k | 31.22 |

Key Ratios Snapshot

Some of the financial key ratios for BECN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.9% | 36.3% | 6.0% |

| FCF Margin | ROE | ROA |

| 1.4% | 11.7% | 4.6% |

VI Analysis

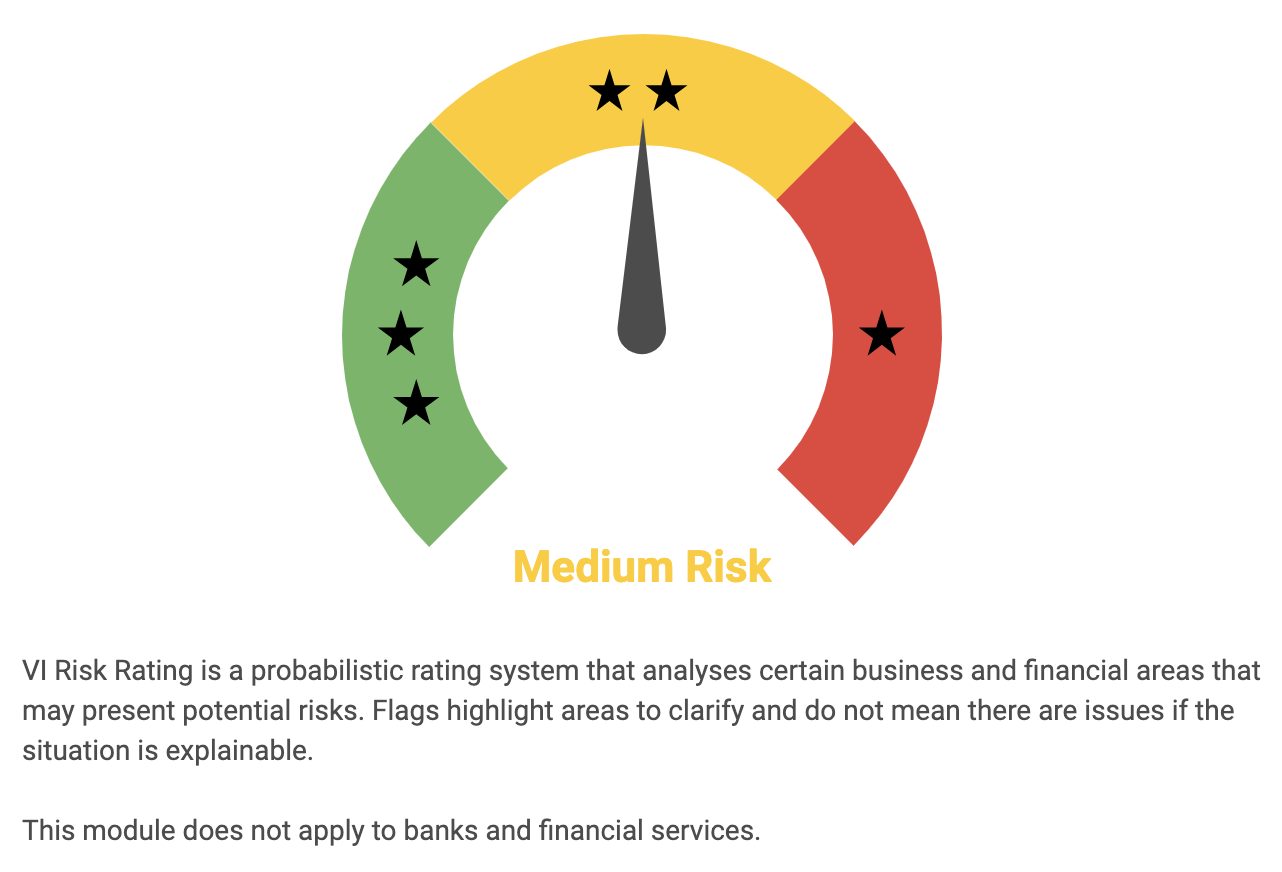

Financial analysis can be a complex process, making it difficult to assess the long-term potential of an investment. The VI app simplifies the analysis of BEACON ROOFING SUPPLY’s fundamentals and can provide a quick assessment of the company’s risk profile. Based on the VI Risk Rating, BEACON ROOFING SUPPLY is categorised as a medium risk investment in terms of both financial and business aspects. This is calculated from a range of factors, including the company’s cash flow, profitability, debt and liquidity. The app has also detected two risk warnings in the balance sheet, which are non-financial in nature.

These may indicate potential areas of risk or concern for investors and should be thoroughly investigated. To gain access to further information, users can register on vi.app. All in all, the VI app provides a useful tool for assessing the financial health of BEACON ROOFING SUPPLY and making an informed decision when investing in the company.

Peers

Beacon Roofing Supply Inc is one of the largest roofing distributors in North America. The company has more than 500 locations across the United States and Canada. The company was founded in 1928 and is headquartered in Herndon, Virginia. Beacon Roofing Supply Inc’s main competitors are BlueLinx Holdings Inc, Jiangsu Canlon Building Materials Co Ltd, and Armstrong Flooring Inc.

– BlueLinx Holdings Inc ($NYSE:BXC)

BlueLinx Holdings Inc is a holding company. Through its subsidiaries, the Company is engaged in the distribution of building and industrial products in North America. It offers its products to customers in the United States and Canada. The Company’s segments include Wholesale and Retail. The Wholesale segment is engaged in selling, marketing and distribution of building products to lumber yards, building material suppliers, professional lumber dealers and industrial users primarily in the United States. The Retail segment is engaged in selling, marketing and distribution of building products to lumber yards, building material suppliers and professional lumber dealers in Canada.

– Jiangsu Canlon Building Materials Co Ltd ($SZSE:300715)

Jiangsu Canlon Building Materials Co Ltd is a Chinese company that produces building materials. The company has a market cap of 5.15B as of 2022 and a Return on Equity of -0.94%. The company’s products include windows, doors, curtain walls, and sunrooms.

Summary

Beacon Roofing Supply has seen a recent surge in its stock price, making it a popular investment option. Financial strength is believed to be a major factor behind the climb, as analysts have noted that the company has been able to maintain a relatively healthy balance sheet and debt-to-equity ratio. Media coverage of the company has been mostly positive, and the stock price moved up the same day as the news was released. Investors looking for an opportunity may want to consider Beacon Roofing Supply as a potential investment, though due diligence is always recommended when investing.

Recent Posts