B Analysts Forecast Q1 2024 Earnings of Per Share for Aspen Aerogels,

May 9, 2023

Trending News ☀️

Aspen Aerogels ($NYSE:ASPN), Inc. is a global leader in the development and manufacture of aerogel insulation products. The company has developed innovative insulation solutions to provide superior thermal performance, energy savings, and a better overall building envelope. Bancorp analysts have predicted that Aspen Aerogels, Inc. will report earnings per share of for the first quarter of 2024. The company’s aerogel insulation products have been used in a variety of applications ranging from HVAC systems to industrial structures as well as residential and commercial buildings. Bancorp has recognized Aspen Aerogels, Inc. for its innovation and commitment to providing high-performance insulation solutions.

Analyst at Bancorp have conducted extensive research on the company and its future prospects, predicting that it will report earnings per share of for the first quarter of 2024. Aspen Aerogels, Inc. is supported by a number of strategic partnerships with leading companies in the HVAC and insulation market. These relationships have allowed the company to remain competitive in the ever-changing market, while continuing to offer superior product performance and customer service.

Earnings

Compared to the same quarter of the previous year, this represents an 18.7% increase in total revenue. Over the last 3 years, ASPEN AEROGELS‘s total revenue has risen from 28.1M USD to 45.59M USD. This steady growth makes future earnings look promising, and analysts are looking ahead to the next quarter with optimism.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aspen Aerogels. More…

| Total Revenues | Net Income | Net Margin |

| 187.54 | -80.05 | -42.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aspen Aerogels. More…

| Operations | Investing | Financing |

| -96.22 | -212.85 | 312.06 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aspen Aerogels. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 620.73 | 188.19 | 6.39 |

Key Ratios Snapshot

Some of the financial key ratios for Aspen Aerogels are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | – | -40.3% |

| FCF Margin | ROE | ROA |

| -138.5% | -10.5% | -7.6% |

Share Price

On Monday, Aspen Aerogels, Inc. saw a significant rise in its stock price, opening at $7.6 and closing at $7.9 – a 6.2% increase from the previous day’s closing price of $7.4. Analysts have provided an optimistic outlook for the company’s earnings per share for Q1 2024, with many believing that the company will be able to capitalize on its impressive growth over the past year. Aspen Aerogels, Inc. has made a name for itself through its innovative aerogel technology, and the company have shown no signs of slowing down. The upcoming quarter is sure to be an exciting time for investors as the company looks to capitalize on its current momentum. Live Quote…

Analysis

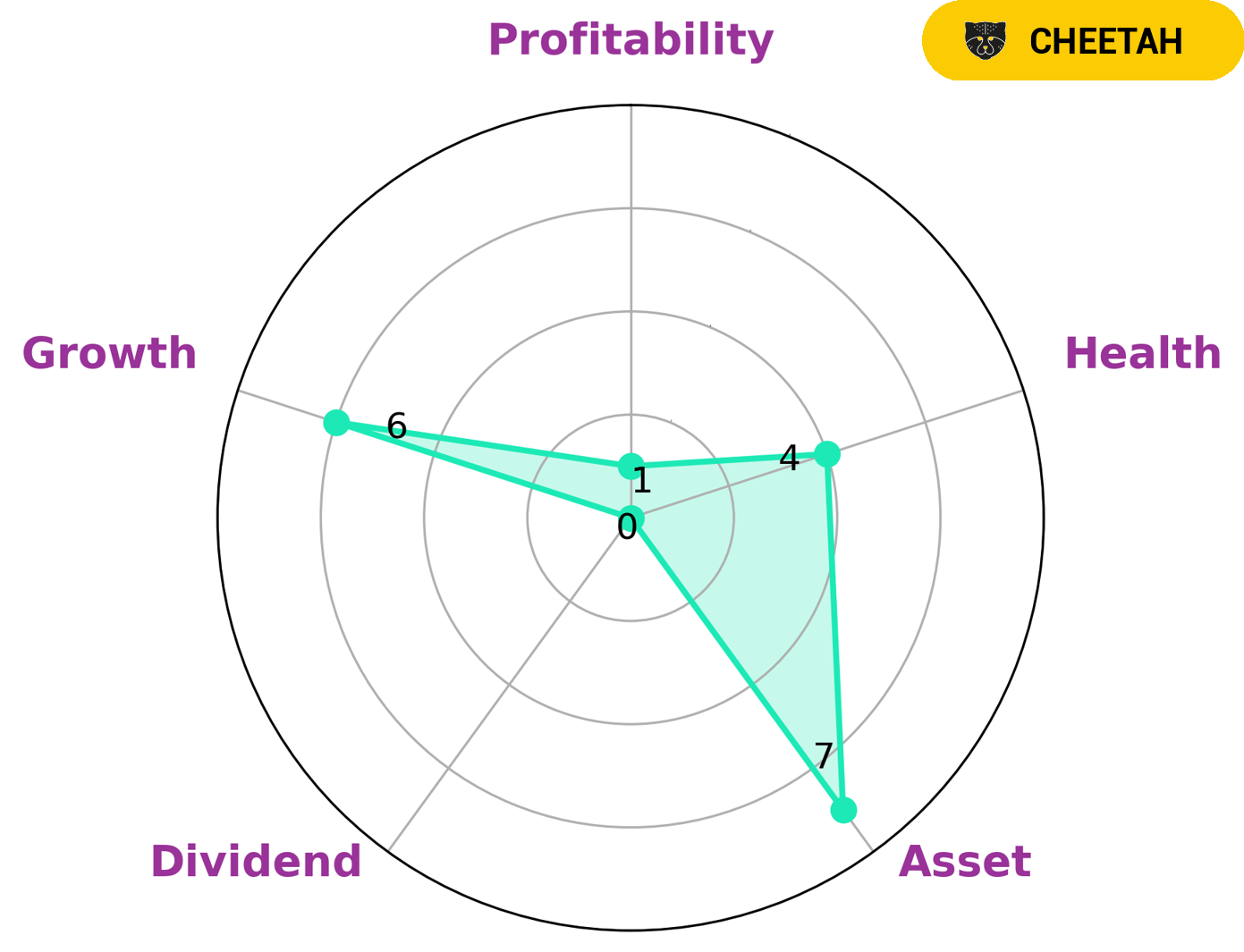

GoodWhale conducted an analysis of ASPEN AEROGELS‘s fundamentals, and based on our Star Chart, ASPEN AEROGELS has an intermediate health score of 4/10. This score indicates that ASPEN AEROGELS may be able to safely ride out any crisis without the risk of bankruptcy. We classified ASPEN AEROGELS as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who are seeking rapid growth and are willing to accept the associated risks. Looking at the breakdown of ASPEN AEROGELS’s fundamentals, we can see that it is strong in assets, medium in growth, and weak in dividend and profitability. These are all factors that interested investors should consider before investing in such a company. More…

Peers

Its main competitors are Goodtech ASA, LifeSafe Holdings PLC, and Jiangsu Jingxue Insulation Technology Co Ltd.

– Goodtech ASA ($LTS:0ELH)

Goodtech ASA is a Norwegian engineering and technology company. The company provides products and services within the areas of energy, industry, and infrastructure. Goodtech ASA has a market cap of 211.8M as of 2022 and a Return on Equity of -3.23%.

– LifeSafe Holdings PLC ($LSE:LIFS)

LifeSafe Holdings PLC is a provider of health and safety products and services. The company has a market cap of 8.62M as of 2022 and a return on equity of 252.02%. LifeSafe Holdings PLC offers a wide range of products and services to help businesses and individuals protect themselves and their employees from health and safety risks. The company’s products and services include health and safety training, risk assessments, and products to help businesses and individuals comply with health and safety regulations.

– Jiangsu Jingxue Insulation Technology Co Ltd ($SZSE:301010)

Jiangsu Jingxue Insulation Technology Co Ltd is a Chinese company that manufactures insulation products. The company has a market cap of 2.23B as of 2022 and a Return on Equity of 5.98%. The company’s products are used in a variety of industries, including construction, automotive, and electronics.

Summary

Aspen Aerogels, Inc. is an innovative company that manufactures and sells aerogel insulation products for industrial and commercial applications. Recently, analysts at B have forecasted that the company will post Q1 2024 earnings of per share, which led to a surge in their stock price. Investors who are looking to add Aspen Aerogels to their portfolio should consider the impact of the company’s expected earnings and the possibility that the stock may continue its recent success. Analyzing the company’s financial history and current standings is important in order to gain an understanding of the company’s potential future growth.

Furthermore, investors should pay attention to the competitive landscape, trends in the industry, and any news regarding the company. By understanding all of the factors that influence Aspen Aerogels’ stock price, investors can make informed decisions about whether to buy or sell shares.

Recent Posts