Azek Company Intrinsic Stock Value – AZEK Company’s Poor Financial Performance Raises Red Flags

April 14, 2023

Trending News 🌧️

The AZEK ($NYSE:AZEK) Company, a provider of sustainable building products, has been struggling with its financial performance as of late. This has raised red flags for many investors considering the AZEK Company for their portfolios. By looking at the company’s financial performance, it is clear why many investors are hesitant. The company’s losses have been increasing over the past few quarters, resulting in a negative bottom line. This means that the company is losing more than it is making, creating a risky investment opportunity. The AZEK Company has seen a decrease in both sales and profits over the past few years.

This decrease has resulted in a negative bottom line, creating an unsustainable business model. Without a turnaround in the company’s financial performance, the AZEK Company poses too much of a risk to be considered a viable investment opportunity. Overall, the AZEK Company’s poor financial performance raises red flags for potential investors. Investors must be aware of the company’s negative bottom line and take caution when investing in the company. With no signs of improvement in the near future, the AZEK Company is not a recommended investment opportunity.

Price History

On Thursday, AZEK COMPANY‘s stock opened at $25.5 and closed at $25.3, down by 0.4% from its previous closing price of 25.4. This has caused some concern as it could suggest that the company is not doing as well as previously thought. This is concerning, especially as competitors in the same industry have seen their stocks rise over the same period. It appears as though investors are becoming increasingly wary of AZEK COMPANY’s financial performance, and it will be important for the company to address these issues in order to restore confidence in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Azek Company. More…

| Total Revenues | Net Income | Net Margin |

| 1.31k | 32.68 | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Azek Company. More…

| Operations | Investing | Financing |

| 142.86 | -153.83 | 31.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Azek Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.35k | 935.93 | 9.35 |

Key Ratios Snapshot

Some of the financial key ratios for Azek Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.8% | 3.8% | 5.4% |

| FCF Margin | ROE | ROA |

| 0.4% | 3.1% | 1.9% |

Analysis – Azek Company Intrinsic Stock Value

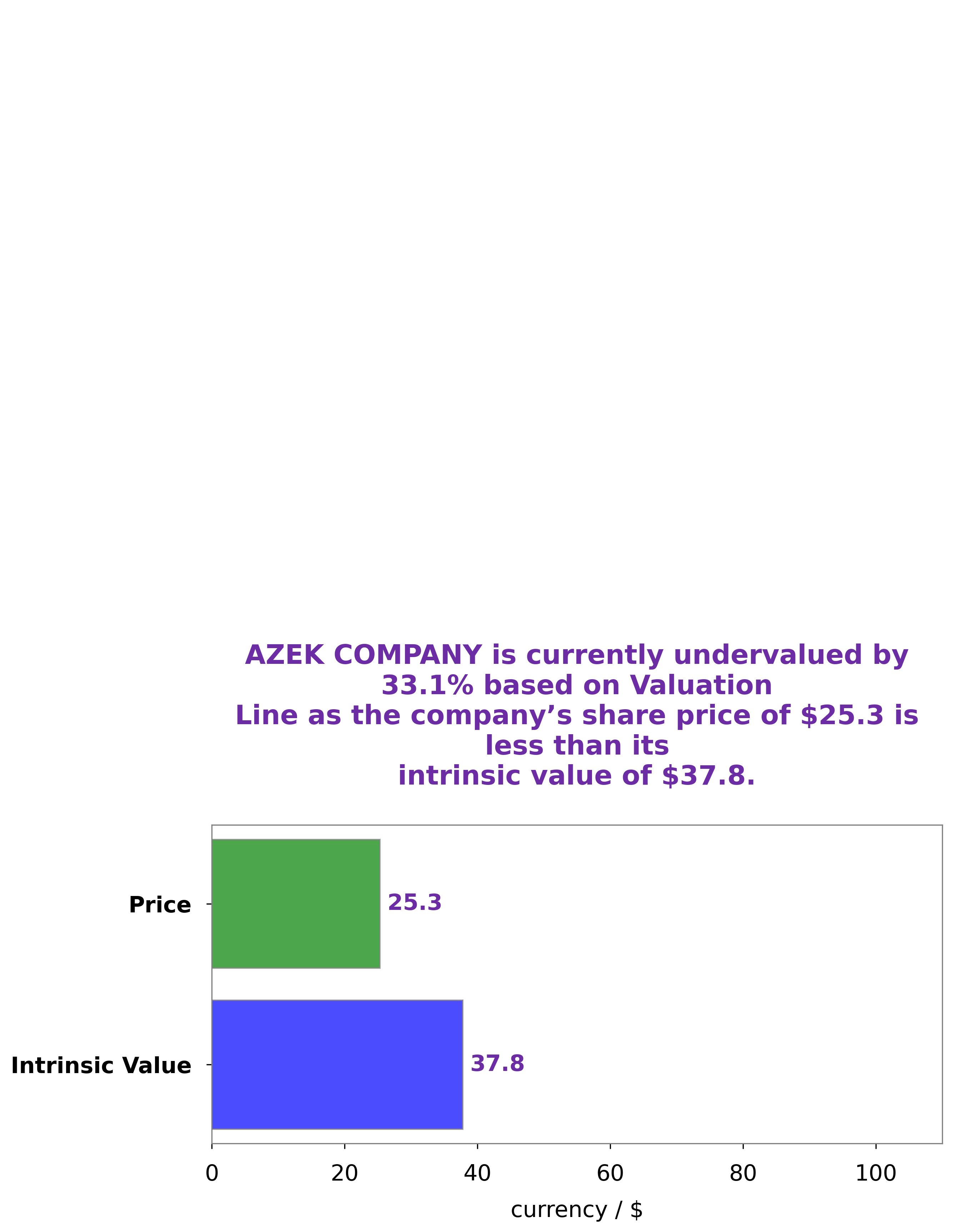

At GoodWhale, we have conducted an analysis of AZEK COMPANY‘s fundamentals. Our proprietary Valuation Line indicates that the fair value of AZEK COMPANY share is around $37.8. However, currently AZEK COMPANY stock is trading at $25.3, meaning it is undervalued by 33.1%. This presents a great opportunity for investors looking to capitalize on the current market conditions. We recommend investors to take advantage of this opportunity and consider investing in AZEK COMPANY when making their portfolio decisions. More…

Peers

The AZEK Co Inc competes with Louisiana-Pacific Corp, Byggma ASA, and Masco Corp in the market for wood-based building products. These companies all produce similar products, but AZEK has a competitive advantage in terms of product quality and customer service.

– Louisiana-Pacific Corp ($NYSE:LPX)

Louisiana-Pacific Corp is a publicly traded company with a market capitalization of $3.71 billion as of March 2022. The company has a return on equity of 63.05%. Louisiana-Pacific Corp is a leading manufacturer of building products and engineered wood products. The company’s products are used in a variety of applications, including residential construction, commercial construction, and industrial applications. Louisiana-Pacific Corp operates manufacturing facilities in the United States, Canada, and Chile.

– Byggma ASA ($LTS:0DVM)

Byggma ASA is a trusted provider of construction and building materials in Norway. The company has a market capitalization of 2.06 billion as of 2022 and a return on equity of 29.21%. Byggma ASA is committed to providing quality products and services to its customers, and its strong financial performance is a testament to its success. The company’s products and services are in high demand, and its customer base is growing. Byggma ASA is well-positioned to continue its growth and expansion in the Norwegian construction market.

– Masco Corp ($NYSE:MAS)

Masco Corporation is a global leader in the design, manufacture and distribution of branded home improvement and building products. Our products include faucets, cabinets, windows, doors, plumbing fixtures, architectural hardware, lumber and other building materials. We operate more than 60 manufacturing facilities in the United States, Canada, Europe and Asia. Our products are sold under a variety of brand names including Delta®, Hansgrohe®, Brizo®, Axor®, InSinkErator®, KraftMaid®, Merillat®, QualityCabinets®, Masco Cabinetry®, Kichler®, Simonswerk® and many other regional brands. Our products are distributed through a variety of channels including home centers, mass merchants, Showrooms, International distributors, OEMs and other specialty retailers.

Summary

Investing in The AZEK Company is a risky move, as the company is currently reporting a negative bottom line. It is important to fully assess the risks associated with investing in the company, including making sure to understand the financial statements and evaluating the current market conditions. Additionally, investors should be aware of potential changes in the company’s prospects that could have a detrimental effect on profits. A thorough understanding of the company’s position is necessary before making any investment decisions.

Recent Posts