AWI Stock Fair Value Calculator – ARMSTRONG WORLD INDUSTRIES Reports Improved Earnings Despite Lower Revenue

April 27, 2023

Trending News ☀️

Despite a decrease in revenue, the company reported improved earnings that surpassed expectations. ARMSTRONG reported Non-GAAP earnings per share of $1.12, surpassing expectations by $0.02. Revenue of $310.2M, however, fell short by $0.66M. Investors have responded positively to the news of ARMSTRONG’S improved earnings despite lower revenue. The company has seen a rise in its share price and is now traded at a higher price than it was before the earnings report was released.

Overall, ARMSTRONG WORLD INDUSTRIES ($NYSE:AWI) has managed to report improved earnings despite lower revenue. This is indicative of the company’s ability to remain resilient and to capitalize on opportunities despite challenging market conditions. As such, investors have responded positively to the news and the company’s share price has increased as a result.

Share Price

On Tuesday, the company’s stock opened at $73.3 and ended the day at $68.2, down from its prior closing price of 72.9. Despite this decline, the company was able to increase its earnings thanks to a focus on cost-cutting initiatives and portfolio adjustments. ARMSTRONG WORLD INDUSTRIES is continuing to take steps to improve its financial performance, including working to reduce debt and implementing strategic initiatives such as expanding international sales and investing in research and development. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AWI. More…

| Total Revenues | Net Income | Net Margin |

| 1.26k | 205.9 | 16.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AWI. More…

| Operations | Investing | Financing |

| 191.9 | 26.5 | -197.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AWI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.69k | 1.14k | 12.05 |

Key Ratios Snapshot

Some of the financial key ratios for AWI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.5% | -3.6% | 23.2% |

| FCF Margin | ROE | ROA |

| 8.5% | 33.9% | 10.8% |

Analysis – AWI Stock Fair Value Calculator

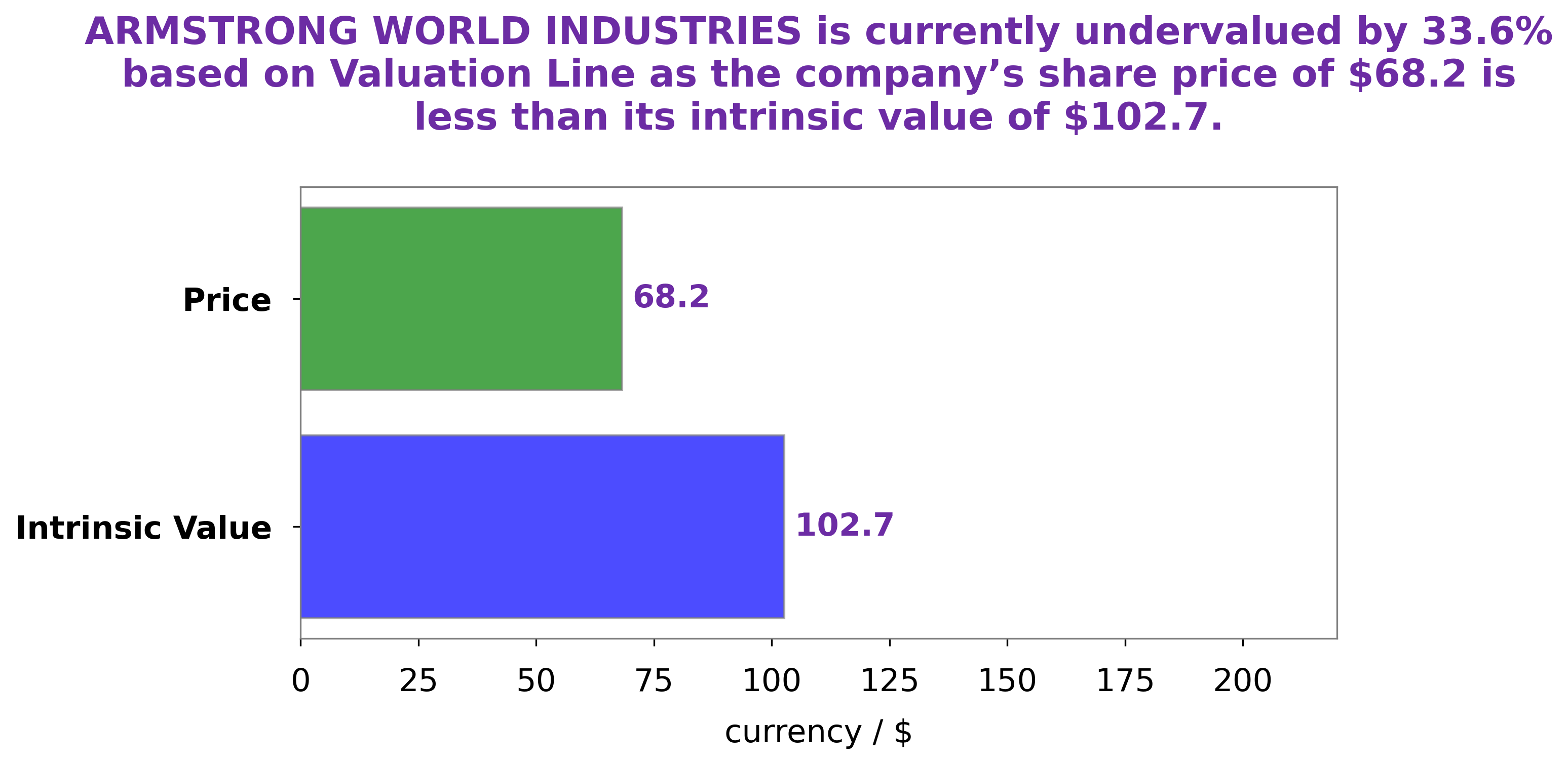

At GoodWhale, we analyze the financials of ARMSTRONG WORLD INDUSTRIES to determine its fair value. By employing our proprietary Valuation Line, we have calculated that ARMSTRONG WORLD INDUSTRIES share is around $102.7. This implies that its current price of $68.2 is undervalued by 33.6%. We at GoodWhale recommend investors to make informed decisions about their investments based on our analysis, and to take advantage of this potential undervaluation. More…

Peers

In the world of flooring, there are a few major players that compete for market share. Armstrong World Industries Inc is one of those companies. They have been in business for over 150 years and have a strong brand name. Some of their main competitors are Forbo Holding AG, Deceuninck NV, and GMS Inc. All of these companies have their own strengths and weaknesses, but Armstrong seems to be doing well in the market.

– Forbo Holding AG ($LTS:0QKD)

As of 2022, Forbo Holding AG has a market cap of 1.65B and a Return on Equity of 21.17%. The company is involved in the manufacturing of flooring, adhesives, and surface treatment products. It operates in two segments: Flooring Systems and Adhesives. The Flooring Systems segment offers a wide range of linoleum, vinyl, and textile floor coverings. The Adhesives segment provides adhesives for the woodworking, construction, and textile industries.

– Deceuninck NV ($LTS:0MEL)

Deceuninck NV is a company that manufactures and sells building and construction products. Its products include windows, doors, and frames. The company has a market cap of 278.24M as of 2022 and a return on equity of 9.83%. Deceuninck NV is a publicly traded company listed on the Euronext Brussels stock exchange.

– GMS Inc ($NYSE:GMS)

GMS Inc is a leading provider of construction and distribution services to the construction industry. It has a market cap of 1.85B as of 2022 and a ROE of 26.33%. The company has a strong presence in the United States, Canada, and Mexico. It offers a wide range of products and services to its customers, including construction materials, distribution, and installation services.

Summary

Armstrong World Industries (AWI) recently reported their non-GAAP earnings per share (EPS) of $1.12, which beat analyst estimates by $0.02. Revenues of $310.2M fell short of expectations, missing by $0.66M. On the same day, the stock price dropped significantly. Investing analysis suggests that despiteAWI’s strong EPS results, investors were not impressed with the revenue miss.

This may be an indication that the company is not seeing the growth in sales that investors had been expecting. Ultimately, potential investors should take a closer look at the company’s fundamentals before deciding whether or not to invest in AWI.

Recent Posts